- Litecoin surged 20% in a week, breaking key resistance and signaling bullish momentum with BBP climbing above 22.5.

- Over $33M in long liquidations sit below $116, making the rally fragile if price dips—though $19M in shorts above could fuel more upside.

- Exchange outflows suggest holders are locking up LTC, reducing sell pressure and keeping the path open toward the $147 target zone.

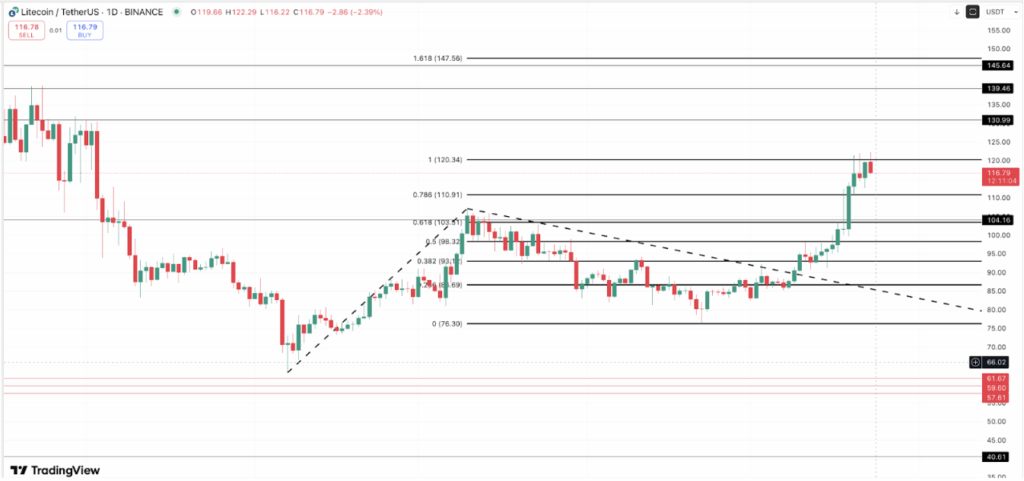

Litecoin kinda came outta nowhere this week. After hovering under $100 for a while, it suddenly shot up more than 20%, cruising past key resistance and landing near $116. Traders are watching it again—and for good reason. Yeah, it’s still way off from its all-time high (over 70% below it), but momentum? It’s building. And if the rally holds, we could be staring down a push toward $147. Not a bad move.

Bulls Are Taking Charge—And The Charts Back It Up

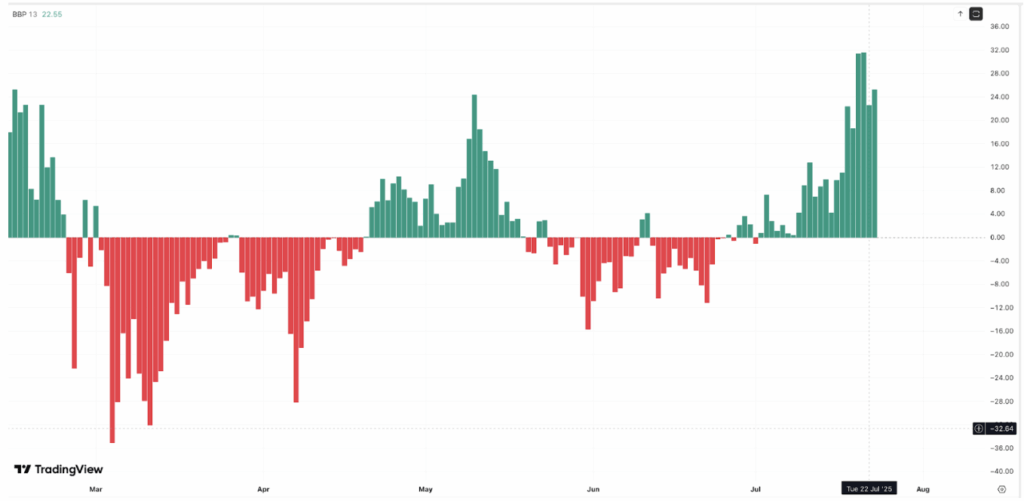

One of the biggest signs that this isn’t just a fluke came from the Bull-Bear Power (BBP) indicator. It basically tells us who’s in the driver’s seat—buyers or sellers. When it’s red, sellers are calling the shots. But once it flips green? That’s bulls showing muscle.

Earlier this month, BBP flipped green and has been climbing steadily ever since. It just passed 22.5—a pretty solid level—which suggests buyers have taken over, and they’re not letting up.

BBP rising with price movement? That’s what you wanna see if you’re hoping for follow-through. It means this isn’t just short-term noise. The strength is real.

$33 Million in Liquidation Risk—Watch Your Step

Here’s where it gets kinda sketchy. The liquidation map is flashing some warning lights. LTC’s got about $33 million in long positions hanging right below the current price. If Litecoin dips even a bit, over-leveraged traders—especially those sitting on 25x or 50x bets—could get wiped.

That triggers a chain reaction. More liquidations, more forced selling… and boom, a long squeeze kicks in.

Still, it’s not all doom. There’s also about $19 million in shorts waiting above the current range. If LTC climbs toward $120 or $125, it could trigger short liquidations—aka a mini rally fuel pump.

Bottom line: market’s bullish, but it’s also kinda heavy with leverage. Smooth climb? Great. Sharp move the wrong way? Could get messy.

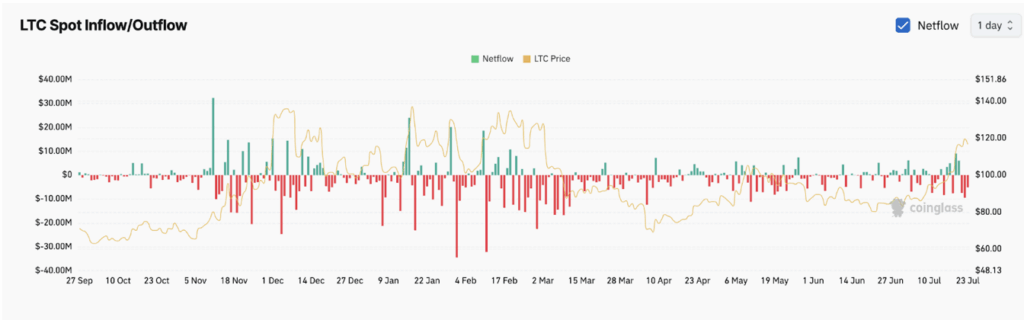

Outflows Are Picking Up—And That’s a Good Thing

Check this—over the last few sessions, Litecoin saw about $5.12 million flow out of exchanges. That’s not people selling, it’s the opposite. When coins leave exchanges, they’re usually headed to cold storage or maybe DeFi apps. It’s a sign that holders aren’t looking to dump anytime soon.

Less LTC sitting on exchanges = less sell pressure. And that’s good for price action. So yeah, netflows turning negative might look bearish on paper—but in reality, it’s a sneaky bullish sign.

Can Litecoin Hit $147 Next?

As of now, LTC’s flirting with the $120 zone. That’s a solid resistance level. But if it breaks through and sticks the landing, the next big target sits up at the $147.56 mark—that’s the 1.618 Fib extension, and it’d be a 27% move from here.

Price already smashed through $110 and cleared the $103 area, which was the Fib 0.786 line. Next levels? $130, $139, and then the $147-$148 region. If momentum stays hot, there’s not a lot of supply overhead to slow it down.

Still, it’s not all clear skies. If LTC drops under $110 again, that’s your first red flag. Below $104? That’s when bulls might start sweating. A dip past that would probably put us right back into correction mode.