- Litecoin’s price is squeezing below major resistance at $87.36, primed for a big move.

- Technical indicators and high open interest suggest a bullish setup, though volume remains muted.

- A breakout to $92+ is in sight — but failure to push through might trigger a sharp pullback.

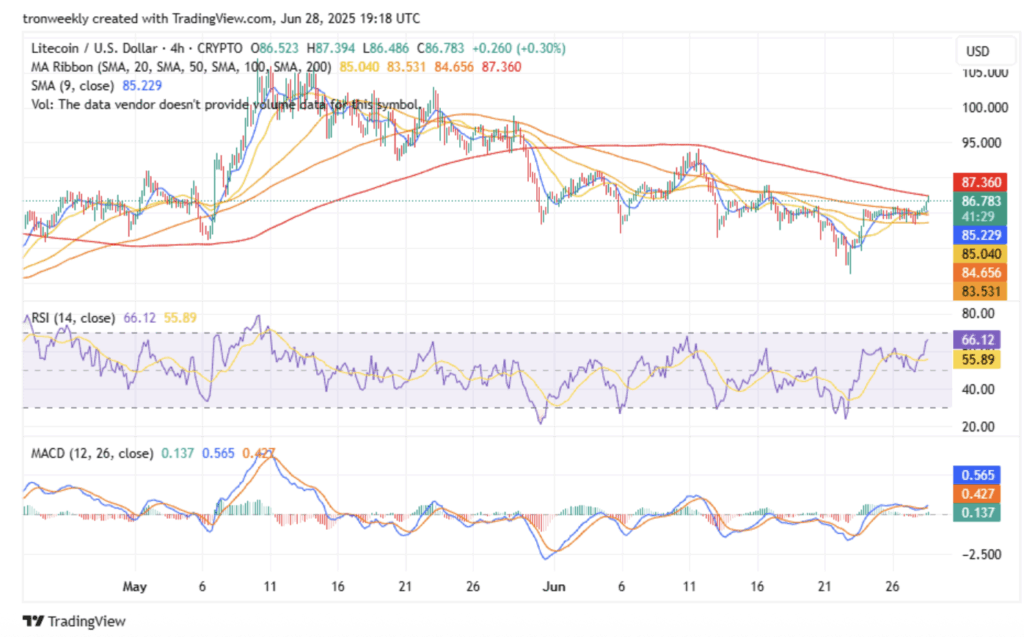

Litecoin’s been creeping its way back up the charts, and now it’s sitting right at a pretty interesting spot. At $86.78, it’s hovering just under a long-standing resistance line that’s been tough to crack. The setup? Classic pre-breakout tension. And with the 200-period simple moving average hanging around $87.36, there’s a sense that something’s gotta give soon.

The past week’s been kind to LTC, with steady gains inching it closer to that big threshold. Traders have their eyes locked in, and momentum is slowly starting to build — not loud, but definitely there.

Support Stacks Up, Momentum Tilting Upward

Litecoin’s price action is now resting on a pretty firm technical floor. It’s finding support from the 9, 20, and 50-period SMAs — all clustered tightly around the $85 range. That bunching up below the current price is like a safety net in case of a pullback. And deeper down, the 100 SMA at $83.53 offers another buffer if things turn sour.

Meanwhile, momentum’s starting to lean bullish. The RSI’s creeping up around 66 — not overbought, but definitely not cold. And MACD? It just printed a bullish crossover. The histogram’s widening too, hinting at strengthening buyer interest. Doesn’t scream breakout, but it whispers, “watch this space.”

Derivatives Market Loaded With Speculation

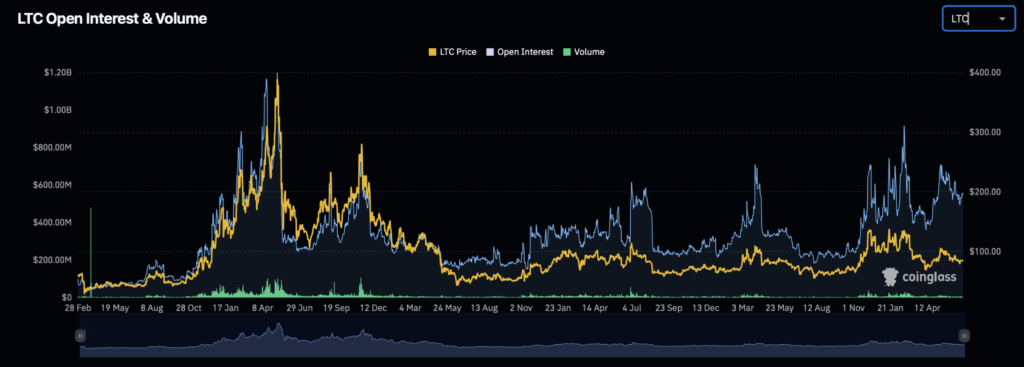

What’s really caught attention, though, is what’s happening in the derivatives arena. Open interest has ballooned past $1.03 billion — that’s a whole lot of folks betting on something big. It tells us traders aren’t just watching… they’re positioning.

Yet volume’s kinda… meh. Just $128.5 million, which suggests most people are just setting their traps and waiting. That kind of tension — rising leverage, flat volume — usually doesn’t last long. When one moves, the rest tend to follow, fast.

Make or Break in the Next 48 Hours?

So here we are. Litecoin’s basically on a coiled spring. If it manages to close solidly above that 200 SMA, especially with volume finally showing up, we could see a run toward $92–$95. That range isn’t just a price zone — it’s a psychological marker and an old supply wall, which means it won’t go down easy.

But if LTC stumbles at the line? A retreat to $85 or even $83.50 isn’t out of the question, especially with so much leverage already stacked in. Liquidations could snowball if things don’t go the bulls’ way.