- Litecoin (LTC) surged 15% to $130, reclaiming a $10B market cap as ETF optimism fuels bullish momentum.

- Analysts see potential for a breakout above $140, targeting $200 short-term and up to $750 if a long-term pattern confirms.

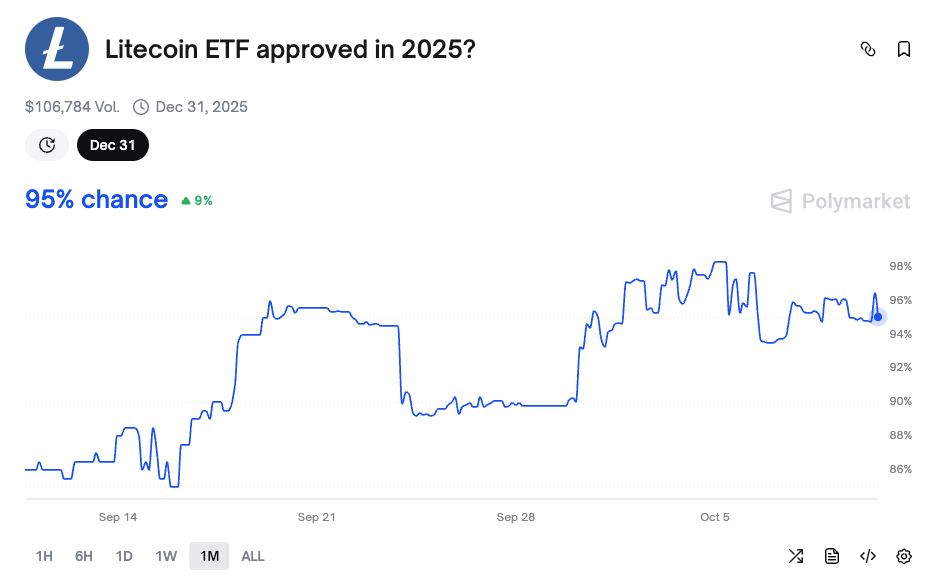

- ETF approval odds have soared to 95%, signaling growing confidence in institutional adoption for Litecoin.

Litecoin is quietly stealing the spotlight again. While most of the crypto market takes a breather, LTC just pulled off a 15% move to hit $130, sliding back into the top 20 coins by market cap with a cool $10 billion valuation. The rally comes as talk of a potential Litecoin ETF approval grows louder, pushing investor optimism to levels not seen in years.

According to market data, Litecoin’s price has been grinding higher for nearly two weeks now, and the chart’s starting to show some serious promise. Traders are eyeing that $135–$140 zone like hawks—it’s been a wall of resistance for months, but if it finally breaks, there’s a clear runway to $200 and beyond.

Bulls Eye $200 Short-Term, $750 Long-Term

Right now, LTC’s price is holding just under key resistance, with momentum indicators flashing green. The shorter-term moving averages have crossed above the long-term ones, a setup that usually screams “bullish shift.” The RSI’s sitting at around 62—still below overbought territory—so there’s room for another leg up before cooling off.

Crypto analyst Captain Faibik pointed out that Litecoin might actually be breaking out from a seven-year symmetrical triangle pattern. Yeah, seven years. If that’s true, the implications could be massive. Analysts say a confirmed breakout could trigger a multi-year rally that sends LTC to $750 or even higher in the long run. That might sound wild—but in crypto, stranger things have happened.

ETF Hype Sparks Fresh Optimism

A big part of this momentum comes down to one thing: ETF fever. The Litecoin ETF deadline is right around the corner, and optimism has gone through the roof. Major players like Grayscale, CoinShares, and Canary Capital have already filed or updated their applications with the SEC. Canary’s recent filing updates have traders convinced that something’s brewing behind the scenes.

On Polymarket, the odds for a Litecoin ETF approval have shot up from 66% in July to a staggering 95% today. That’s almost a done deal in traders’ eyes. If the SEC actually gives the green light, it could open the floodgates for institutional money to pour into Litecoin—similar to what Bitcoin saw when its ETFs launched earlier this year.

What’s Next for Litecoin?

From a technical view, the setup looks clean. If LTC can punch through the $140 resistance level with strong volume, a fast rally toward $200 looks likely. Beyond that, momentum could carry it even further if the ETF hype turns into actual inflows.

Still, traders are cautious. LTC’s been around long enough to know that hype alone doesn’t sustain a rally forever. But with strong fundamentals, a potential ETF approval, and one of the longest consolidation patterns in crypto about to snap—Litecoin might just be gearing up for its biggest run in years.