- LTC rises 4% but fundamentals and ETF demand remain weak.

- Negative funding rates show shorts gaining control in derivatives.

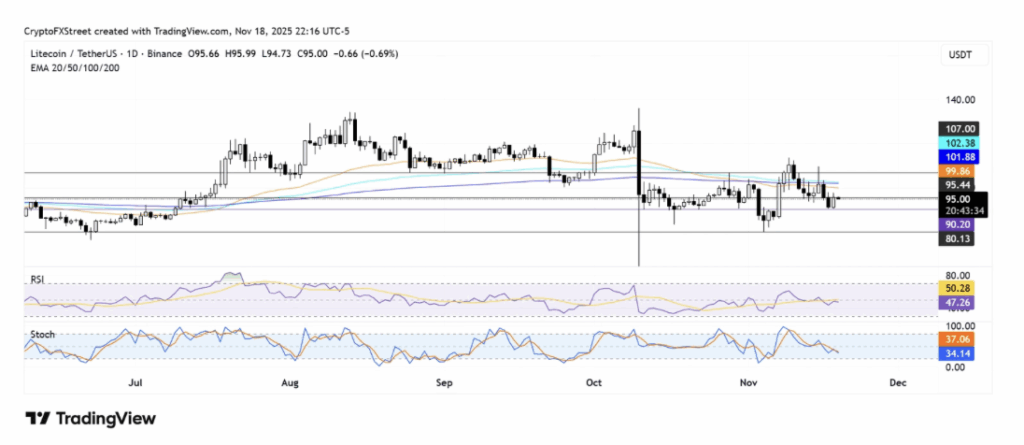

- Litecoin must break $95.4 and multiple EMAs to flip bullish; losing $90 risks a drop to $80.

Litecoin is up around 4% during the early Asian session on Wednesday, bouncing along with the broader crypto market after three straight red days. It’s a decent recovery, though nothing dramatic, and the fundamentals behind the Bitcoin fork still look… well, cautious at best. Santiment data shows that the total supply of LTC in profit fell to 57%, and once that happened, selling pressure ticked up. Investors have been locking in losses and grabbing what profit they can — mostly those who bought within the last two months and are now reshuffling their positions.

Interestingly, when the supply in profit keeps dropping, older coins historically start joining the sell-off. That makes this metric one to watch closely, because it can tell you if long-term holders are getting nervous or if they’re still holding steady.

Litecoin ETF Demand Remains Weak as Derivatives Flash Warning Signs

Weakness isn’t just on-chain — you can see it in the ETF market too. U.S. spot Litecoin ETFs have failed to gather meaningful traction since launching last October. According to SoSoValue, they’ve attracted just $7.26 million in cumulative net inflow. For context, that’s extremely low, and Canary’s LTCC is still the only LTC spot ETF available in the U.S. The lack of demand hints that traditional investors aren’t rushing toward Litecoin the way they have with Bitcoin or even Solana.

Derivatives tell a similar story. Litecoin funding rates turned negative twice in the past two days, meaning short traders are slowly gaining control in the futures market. Negative funding rates mean shorts are paying longs — a sign that bearish pressure isn’t going anywhere just yet. Open interest has recovered a bit to 5.57 million LTC, but it’s still miles below the 8.80 million LTC seen before the October 10 leverage flush.

LTC Struggles With Major Resistance as Momentum Weakens

On the price chart, Litecoin bounced cleanly off support at $90.2 but is now pressing against resistance at $95.4. If LTC can break above that, it’ll run straight into another challenge — the confluence of the 50-day, 100-day, and 200-day EMAs, all stacked together like a wall. Breaking through that cluster would finally flip momentum bullish, but for now it’s acting as a ceiling that LTC can’t quite crack.

To the downside, losing $90.2 opens the door to a deeper fall toward $80, a level that held during previous corrections. Both the RSI and Stochastic Oscillator sit below neutral territory, signaling that bearish momentum is still the dominant force. Even with the small bounce, Litecoin needs stronger demand — preferably both on-chain and in derivatives — before any meaningful trend reversal can form.