- Over 50% of all Litecoin is now held by retail investors, signaling strong community ownership.

- Network hash rate, MWEB usage, and Layer 2 developments are driving growth in 2025.

- Institutional interest from Luxxfolio, MEI Pharma, and T. Rowe Price reinforces Litecoin’s status as a stable long-term asset.

Litecoin is quietly becoming one of 2025’s most adopted cryptocurrencies, gaining traction among both casual users and major institutions. Its appeal lies in its simplicity—fast transactions, low fees, and a decade-long reputation for reliability. As the market shifts toward real-world utility, Litecoin is showing that staying power still matters.

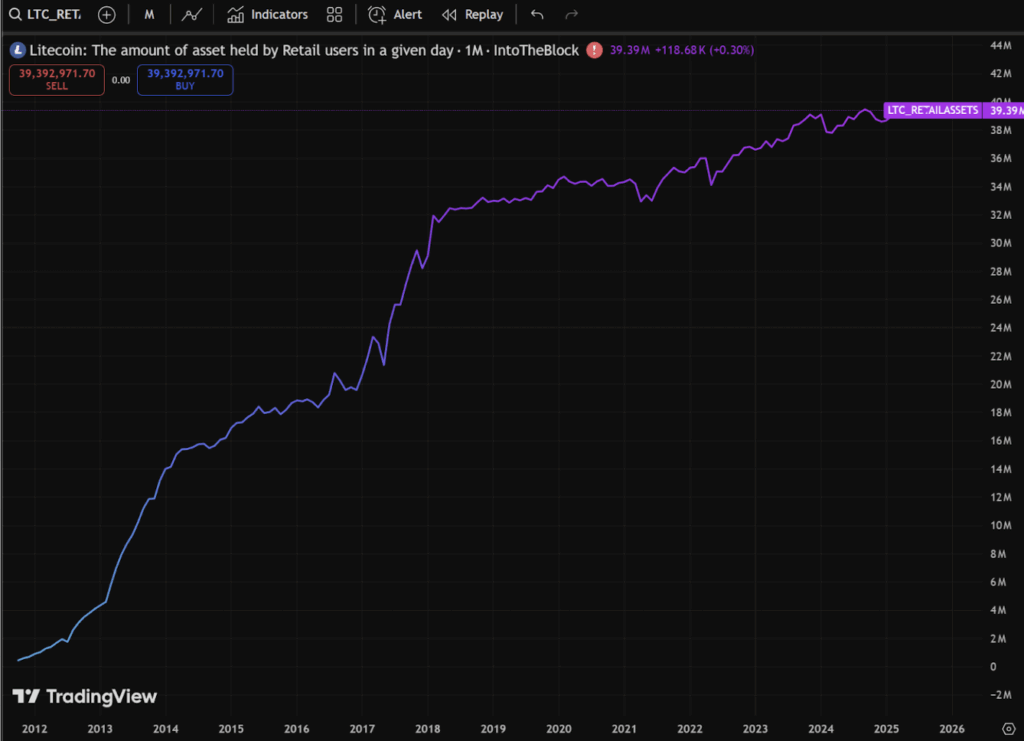

Retail Holders Dominate the Supply

Retail investors now control more than half of all Litecoin in circulation, a remarkable show of decentralization at a time when many other crypto networks are dominated by whales and funds. Even as institutional players have been increasing their exposure, the majority of LTC remains in the hands of everyday users.

Litecoin’s circulating supply sits around 76.44 million coins, trading at roughly $95.45—a modest 1.9% gain in the last day. What’s more impressive is the 8.7 million active retail users, not just wallet addresses. This steady growth shows Litecoin’s expanding global base of people actually holding and using it, not just speculating.

Network Strength and New Tech Developments

2025 has been a powerhouse year for the Litecoin network. The hash rate has reached new all-time highs, reflecting stronger network security and miner confidence. Interestingly, miners have been holding onto more of their coins instead of selling, which often signals long-term optimism.

On the tech side, privacy-focused MWEB (MimbleWimble Extension Block) addresses have nearly tripled in adoption, showing that Litecoin’s privacy layer is gaining serious traction. There’s ongoing development around Layer 2 scaling solutions using ZK Proofs, too. Meanwhile, major payment processors and companies continue to adopt Litecoin for day-to-day transactions, with ETF and ETP approvals still pending but expected to add further legitimacy.

Institutional Accumulation and Corporate Treasuries

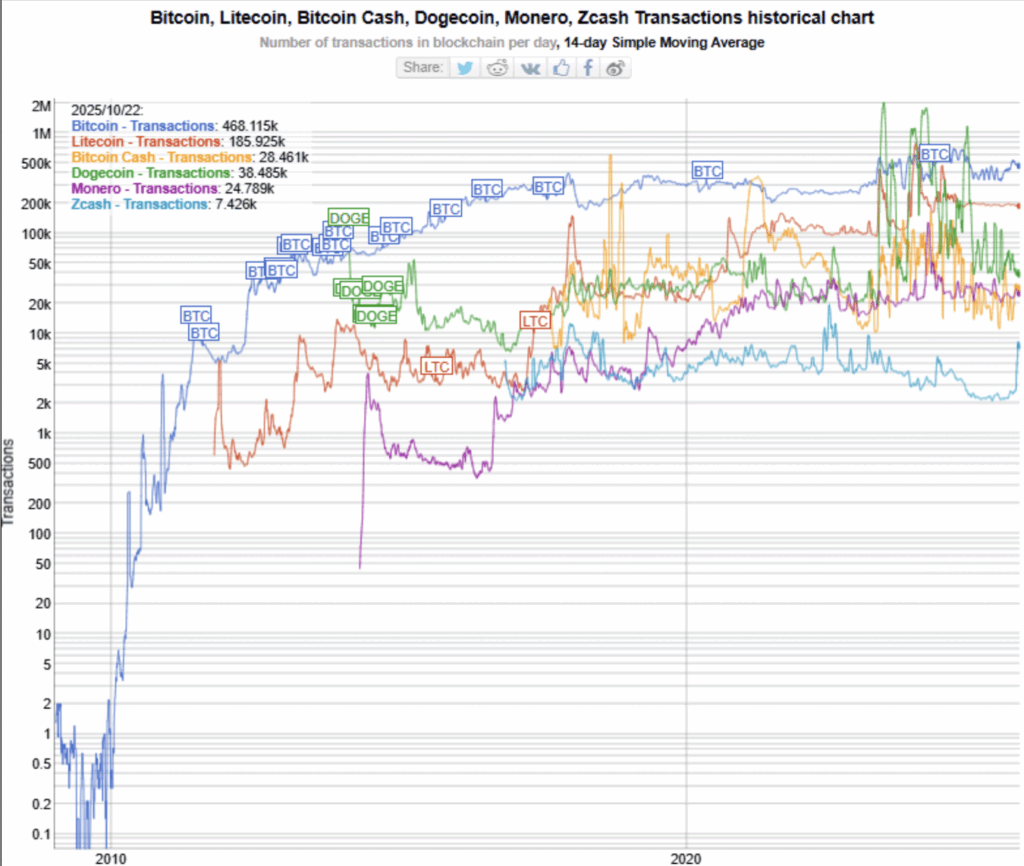

Institutional adoption is picking up momentum. Luxxfolio Holdings, which manages Litecoin reserves, has noted consistently high transaction activity, with Litecoin maintaining around 30–40% of Bitcoin’s daily transaction volume for four straight years. That’s no small feat.

Luxxfolio recently filed to raise $73 million, targeting the acquisition of up to 1 million LTC by 2026. In another big move, MEI Pharma purchased 929,548 Litecoin—valued at over $110 million—cementing a substantial corporate treasury position. And asset management firm T. Rowe Price has jumped in too, filing for a crypto ETF that will hold between 5–15 digital assets, including Litecoin alongside Bitcoin and Ethereum.

All this suggests a turning tide. With everyday users owning the majority, institutions stacking up reserves, and ongoing technical expansion, Litecoin is shaping up as one of 2025’s quiet power players in crypto. It’s not flashy, but it’s solid—and in this market, that might just be what wins long term.