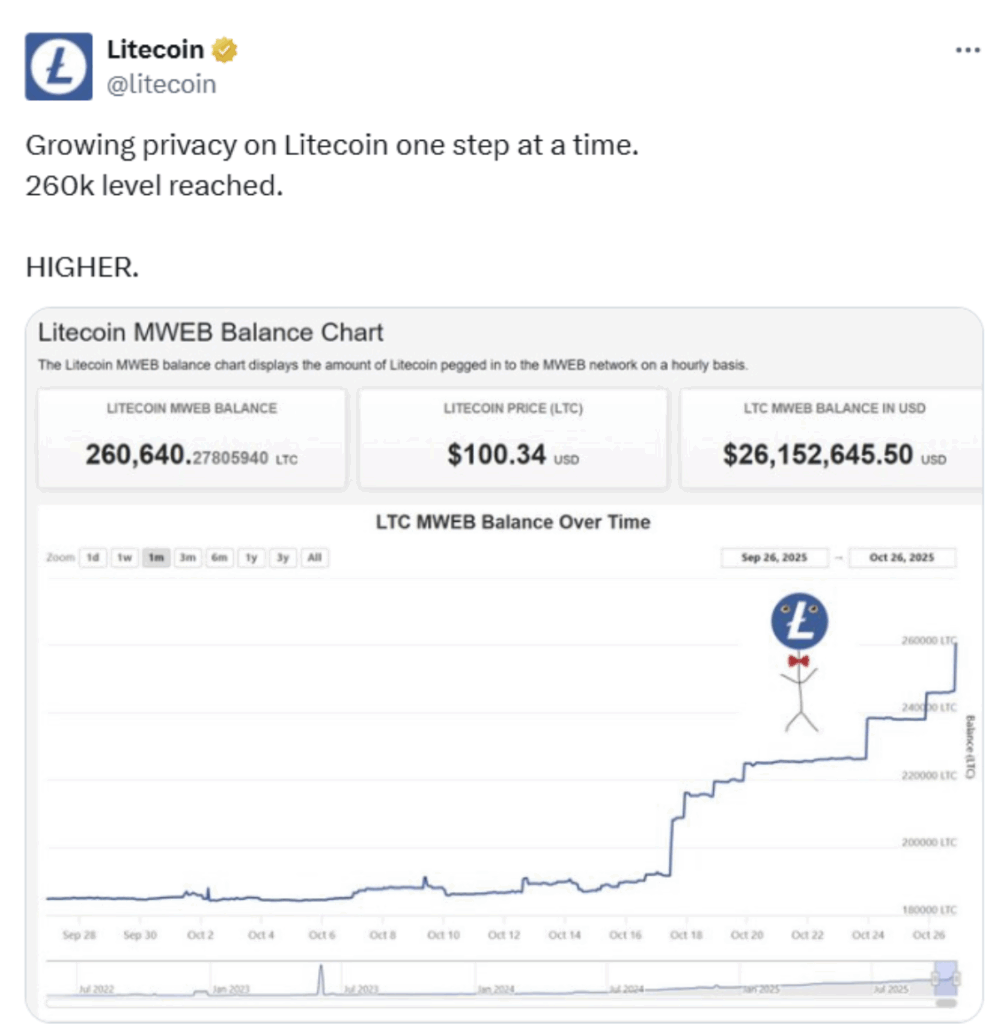

- MWEB privacy balances have surpassed 260K LTC, signaling steady on-chain growth.

- Litecoin is forming a long-term bullish pennant pattern around the $99 zone.

- ETF rumors add speculation as traders watch for a breakout above key resistance.

Litecoin is quietly gaining attention again, not for hype or wild price moves, but for something more organic — growing usage. More holders are locking their coins into the network’s MWEB (MimbleWimble Extension Blocks) feature, a privacy upgrade that lets users send transactions without publicly revealing the amounts. It’s not flashy, but it shows people are still using Litecoin for what it was built for — everyday payments with a touch of privacy.

MWEB Balances Keep Rising

Over time, the balance of coins held in MWEB has climbed steadily, now sitting above 260,000 LTC — worth roughly $26 million at current prices near $100. The chart doesn’t show big spikes; it rises gradually, like people have been quietly adding to their MWEB balances month after month.

This slow, consistent growth says a lot. It means holders are using Litecoin for more than just trading — they’re valuing its privacy and utility. Even during quieter stretches in the market, when prices aren’t doing much, activity within MWEB has stayed strong. It’s almost like a background heartbeat that keeps the network alive, especially for users who want to move or store coins without drawing attention.

Litecoin’s always been known for low fees and simplicity, and MWEB adds another layer — privacy. Together, those traits keep it relevant in a crypto world full of complex, expensive, and sometimes risky alternatives.

Price Chart Forms Long-Term Bullish Pennant

Meanwhile, the price chart tells its own story. Litecoin has been moving within what analysts call a bullish pennant — a long-term pattern that forms after a big rally, followed by consolidation in a tightening range. The top trendline slopes downward, the bottom one slopes upward, and they’re now meeting right around $99.

If you zoom out, this pattern stretches all the way back to 2017, when LTC rocketed from under $5 to over $400. Since then, it’s been years of sideways action — over 1,200 trading bars, according to some analysts — but the structure is tightening. The theory is simple: once price breaks above the top line with strong volume, momentum could build fast.

Traders watching this setup say buying interest tends to reappear under $120, suggesting long-term believers are still quietly accumulating. If that breakout happens, the next targets would be projected by adding the height of the previous rally to the breakout point — a method that’s guided many bullish predictions over the years.

Will a Litecoin ETF Bring More Fuel?

Adding to the intrigue, there’s growing speculation about a potential Litecoin ETF. If approved, it would let traditional investors gain exposure through regulated channels — no wallets, no private keys, just a ticker symbol.

The success of Bitcoin’s spot ETFs earlier this year has reignited talk that Litecoin, as one of the oldest and most stable networks, could be next in line. Still, nothing official has been confirmed. For now, traders are simply watching and waiting.

With privacy use climbing, a massive long-term pattern nearing completion, and the faint buzz of ETF speculation in the background — Litecoin seems to be quietly gearing up for its next chapter. Whether it breaks out or keeps coiling, the pieces are falling into place for something big down the road.