- Chainlink exchange reserves have fallen to a yearly low as accumulation continues

- LINK price remains weak despite ETF inflows and reduced sell-side supply

- Short-term sentiment is bearish, but long-term accumulation signals persist

Chainlink has quietly stayed on the radar for whales, institutions, and retail traders, even while the broader market continues to drag. On-chain data points to heavy accumulation happening in the background, yet LINK’s price hasn’t followed through. That disconnect is starting to raise eyebrows.

Despite persistent weakness across crypto, interest in LINK hasn’t disappeared. Instead, it’s shifted into quieter behavior, more cold storage, less trading. The question now is whether that’s enough to counter the wider market pressure pressing down on price.

Exchange Reserves Sink to a Yearly Low

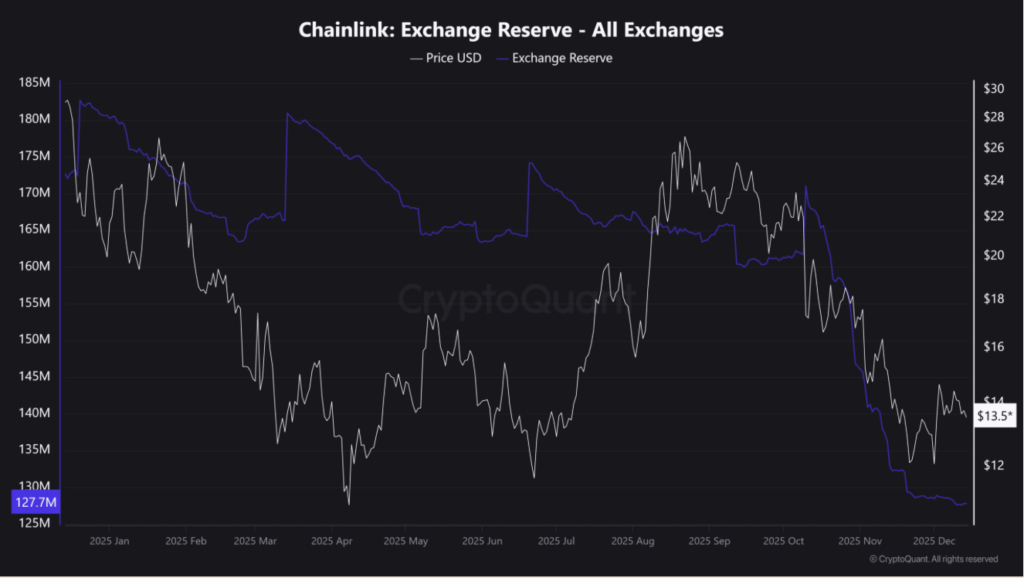

According to CryptoQuant, more than 44.9 million LINK tokens have left exchanges over the past year. That steady outflow pushed Chainlink’s exchange reserves to their lowest level in twelve months. In crypto, that usually signals accumulation, with investors opting for self-custody instead of keeping assets ready to sell.

Lower reserves often mean reduced sell-side pressure. But this time, price action told a different story. Over the same stretch, LINK slid hard, falling from nearly $29 to around $13.60. That divergence between accumulation and price has left traders wondering whether macro weakness is simply overpowering everything else.

ETF Inflows Haven’t Sparked a Bounce Yet

Institutional interest has also shown up through U.S. spot Chainlink ETFs. Data from SoSoValue shows these products have seen inflows since launching on December 2. Normally, that kind of Wall Street demand adds steady buying pressure under the hood.

So far though, LINK hasn’t responded. Price continued trending lower, moving in line with the broader market downturn that set in after momentum faded around mid-October. Even with fresh capital entering through ETFs, the wider risk-off environment appears to be winning, at least for now.

Volume Dries Up as LINK Hugs Support

At the time of writing, LINK was trading near $13.65, down about 2.25% on the day. Trading activity thinned out sharply alongside the price drop. Spot volume fell more than 48% to roughly $295 million, signaling hesitation from both buyers and sellers.

On the daily chart, LINK has been stuck in a consolidation range between $13.19 and $14.70 since early December. Price is hovering close to the lower boundary of that range, right near the $13.20 support zone. A clean break below that level could open the door to another leg down, potentially around 16%, given the lack of strong support underneath.

Trend strength remains weak as well. The Average Directional Index sits near 20.9, below the 25 threshold that typically signals a strong trend. In other words, momentum is muted, and conviction is low.

Leverage Data Tilts Bearish in the Short Term

Derivatives data paints a cautious picture. CoinGlass shows traders are heavily positioned around $13.45 on the downside and $13.99 on the upside. At those levels, roughly $2.01 million in long leverage and $3.04 million in short leverage have built up.

That imbalance suggests short-term sentiment leans bearish, with traders expecting downside continuation. Still, the steady drain of LINK from exchanges and consistent ETF inflows hint that longer-term accumulation is happening quietly beneath the surface, even if price hasn’t caught on yet.