- LINK breakdown stressed a major support zone, but accumulation trends remain strong.

- Exchange outflows, rising Taker Buy CVD, and long-heavy positioning support a rebound case.

- Reclaiming $16.64 is the key trigger for momentum toward $19.13 and potentially higher.

Chainlink’s drop under that big $16 support level definitely shook things up, putting around 53.8 million accumulated LINK under pressure and shifting the whole psychology of the chart. Traders had expected continuation, not rejection, so the breakdown felt heavier than usual and the zone flipped straight into resistance. Still, LINK continues hovering around a dense activity cluster — one of those areas where patient holders dig in their heels and wait for a recovery spark. Even though sentiment dipped, the market structure hasn’t fully collapsed, which leaves room for a bounce if conditions line up right.

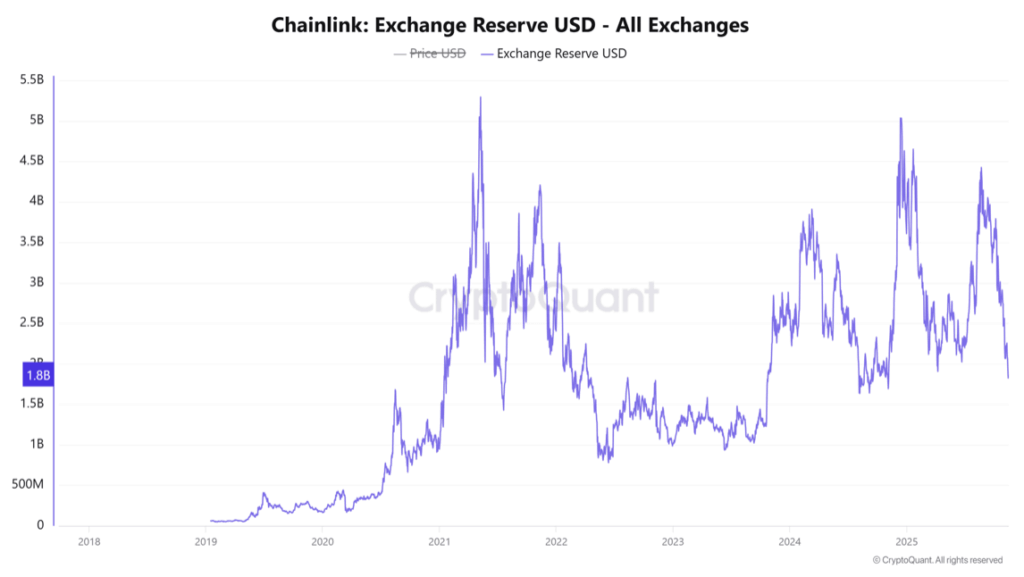

Exchange Reserves Continue Falling, Hinting at Quiet Accumulation

One of the more interesting signals here: LINK exchange reserves keep slipping. Another 2.26% drop — taking the total toward 1.8 billion — leans bullish rather than bearish, since it suggests holders are removing tokens from exchanges instead of prepping to sell them. Less sell-side liquidity means that, whenever buyers return, upside can move faster. Outflows like these often show up before stabilization phases too, because shrinking supply pressure makes the next push smoother. Even so, the break below $16 still weighs on short-term confidence; traders want a firmer base before leaning too hard into the bullish narrative.

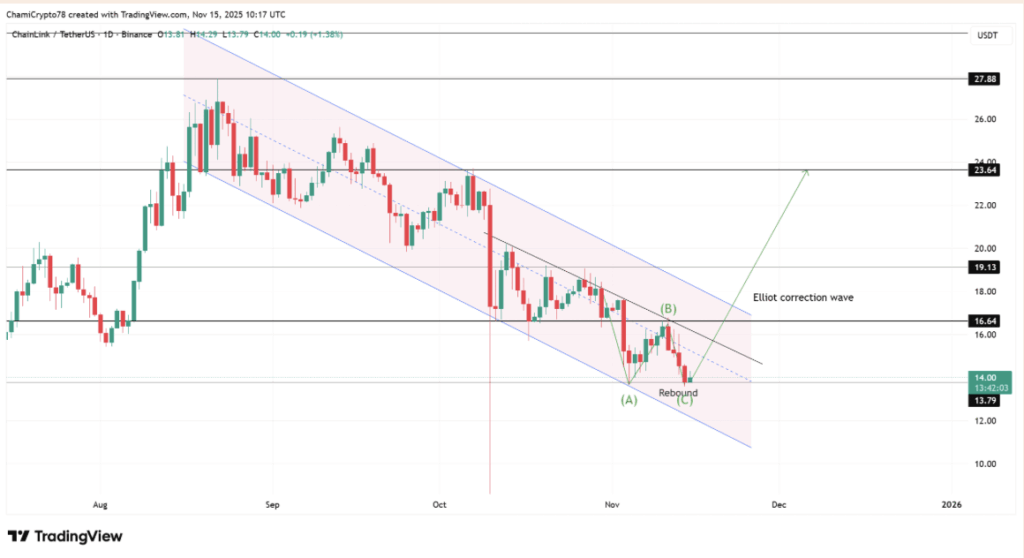

A Rebound Forms Inside the Descending Channel

LINK has been moving inside a descending channel since early September, shaping its corrective trend. The price now sits near the lower edge of that channel, where buyers stepped in after completing a full Elliott A-B-C correction. The reaction from the “C” leg hints that the market still respects that lower boundary as support. But for sentiment to really shift, LINK needs to reclaim the mid-channel region. A clean break above that area opens room toward $16.64 — which lines up with a previous supply block. If bulls hold that level afterward, $19.13 becomes the next target, with a more optimistic projection stretching toward $23.64. If price rejects at the midpoint again though, the setup weakens and lower lows come back into play.

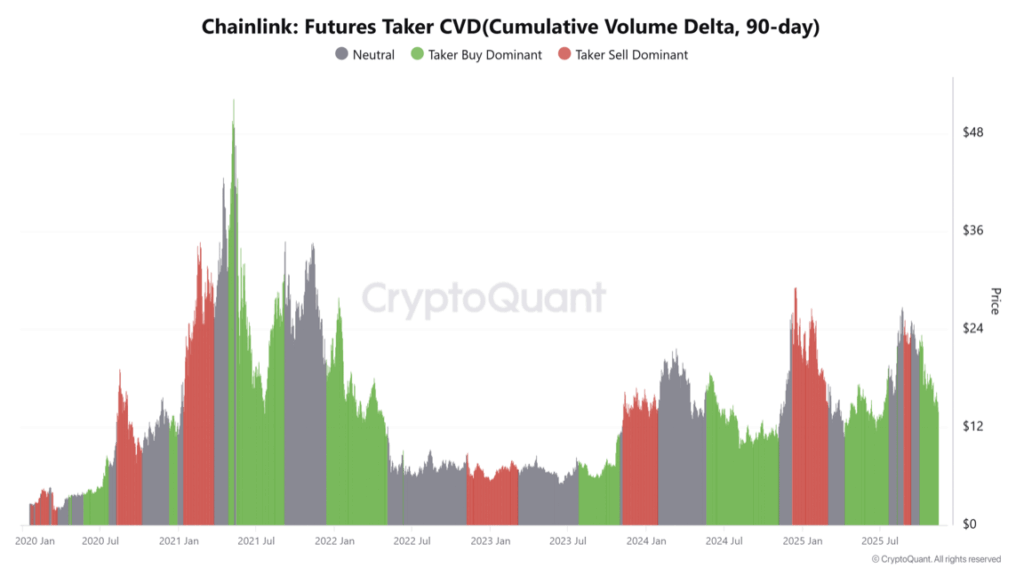

Taker Buy Dominance Jumps as Top Traders Lean Long

Futures data adds another layer to the story: Taker Buy CVD has been climbing steadily, showing aggressive buyers stepping in during the correction instead of sitting on the sidelines. The rising curve matches the “C” leg rebound on the charts, which gives the move some extra credibility — it’s not just a passive bounce. At the same time, Binance’s top-trader positioning shows 74.32% of positions leaning long, compared to only 25.68% short. That 2.89 ratio suggests experienced traders are anticipating a mid-channel reclaim and a possible trend shift. Still, all this futures strength needs Spot confirmation to carry any real weight. Without that, momentum can fade fast.

Will LINK Reclaim $16.64 and Reverse?

All signs point toward early stabilization: exchange reserves falling, Taker Buy dominance rising, and top traders stacking long exposure. Combine that with the Elliott rebound and channel support, and the technical backdrop looks… cautiously constructive. But the real test sits at $16.64. If buyers push LINK back above that level and hold it, the path toward $19.13 becomes very realistic. The next few sessions should reveal whether accumulation pressure outweighs the lingering bearish mood or if LINK needs more time before a full reversal.