- LINK taps two major support zones, forming a high-probability bounce setup.

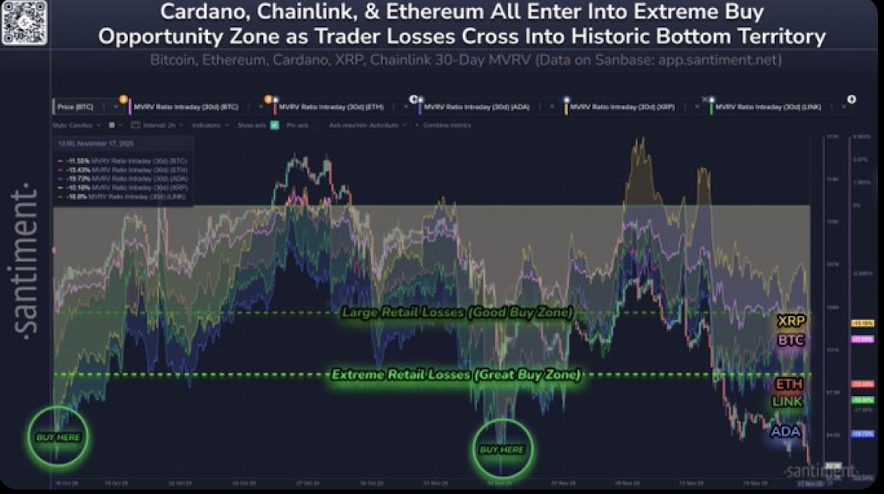

- On-chain MVRV shows Chainlink is in an “Extreme Buy Zone,” hinting at undervaluation.

- A successful breakout may target $30+, while failure risks a deeper support search.

The Chainlink ecosystem is starting to give off that familiar “something’s shifting” kind of energy, with both technical patterns and on-chain metrics lining up in a way we don’t see very often. After weeks of heavy selling pressure, several indicators are hinting that LINK might finally be scraping its bottom. The latest price action tapped directly into a long-standing diagonal support level — almost perfectly — while also landing right inside a key local demand zone. When two major supports converge like that, the odds of a bounce tend to shoot up fast. LINK now sits at a make-or-break moment; a clean rebound here would confirm that the underlying trend structure is still intact.

Falling Wedge Compression Signals a Potential Breakout

Adding to this setup, analysts point out that LINK has been grinding inside a falling wedge — a pattern known for compression, exhaustion, and eventually explosive breakouts. If LINK manages to break above the wedge’s resistance, upside targets stretch beyond $30, possibly marking the first major shift in market control in months. But as always, confirmation is everything. A fake-out here would drag the price right back into the grind, so traders are watching closely for a decisive move.

On-Chain Metrics Suggest LINK Is Deep in an “Extreme Buy Zone”

While charts paint the structure, on-chain data reveals how much pain traders are actually sitting in — and Santiment’s 30-day MVRV ratio shows something big. LINK has entered what the platform classifies as the “Extreme Buy Zone,” a region that historically only appears around major market bottoms. That means most active traders are holding losses so severe that they resemble levels seen in previous accumulation phases. From a valuation standpoint, LINK appears fundamentally undervalued compared to the cost basis of long-term holders. When those two things align — undervaluation and technical support — relief rallies tend to follow.

The Next Resistance Will Decide Everything

What happens next depends entirely on LINK’s ability to break through the first overhead resistance after this bounce attempt. If it pushes through cleanly, the odds dramatically increase for a full structural reversal and a stronger long-term bullish trend. In that case, LINK’s roadmap toward much higher levels becomes far more realistic.

But if the price fails to bounce convincingly and slips back below the demand zone, the entire setup loses validity — forcing analysts to search for the next major support before any recovery can take shape. For now, pressure is heavy, support is strong, and sentiment is quietly shifting… which is often exactly how turning points begin.