- Larry Fink says tokenized ETFs and digital wallets will define the future of finance.

- He now calls Bitcoin “digital gold” and an “asset of fear” used to hedge currency risk.

- BlackRock’s shift signals broader institutional acceptance of tokenization and crypto.

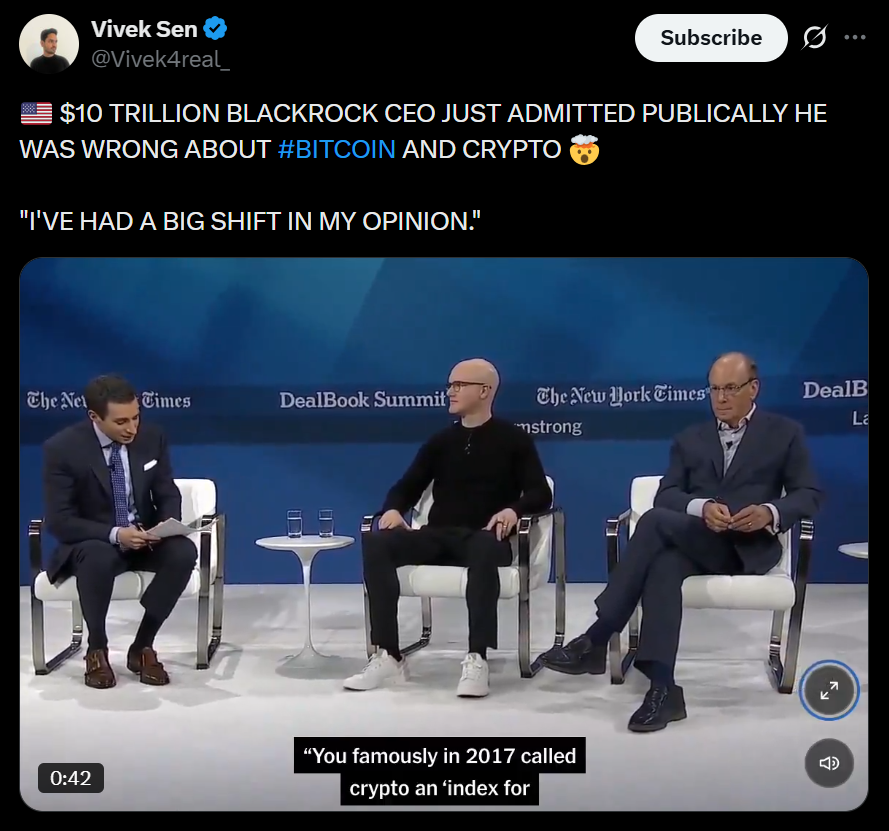

Larry Fink’s stance on Bitcoin has taken one of the biggest U-turns in modern finance. Back in 2017, the BlackRock CEO dismissed BTC as nothing more than an “index of money laundering,” a quip that echoed loudly through Wall Street at the time. Fast-forward to today, and Fink is openly pushing a vision where nearly every major financial asset — from ETFs to bonds — could live inside a digital wallet. The shift is dramatic, maybe even overdue, but it shows how fast crypto is forcing legacy finance to rethink itself.

From Critic to Champion of Tokenization

During a conversation with Citadel CEO Ken Griffin, Fink said something that would’ve sounded wild ten years ago but feels oddly normal now. If he could tokenize every ETF and place them inside a simple digital wallet, he said users could move between stocks, bonds, or cash instantly with practically no fees. That kind of friction-free trading — “from cash to stocks to bonds and back again,” as he put it — is what Fink believes the world is heading toward sooner rather than later.

It’s a vision basically built on blockchain rails, whether traditional institutions admit it or not. And Fink, after years of skepticism, is now saying the quiet part out loud: digital ownership is going mainstream.

Bitcoin as an “Asset of Fear”

At the same event, Fink tried to explain Bitcoin’s role in the current financial landscape. He compared BTC and gold, calling them “assets of fear” — the things people run to when they’re scared of currency debasement, geopolitical risk, or… frankly, governments printing too much money.

“You own it if you have financial insecurities,” he said. Not exactly a glowing compliment, but it reveals how he now sees Bitcoin as a functional hedge rather than a fringe toy. And for the CEO of the world’s biggest asset manager, that’s a pretty big admission.

Reality Has Already Caught Up to His Predictions

Ironically, the future Fink describes — digital wallets, seamless token trades, instant settlement — already exists in crypto apps today. Tons of platforms let users deposit paychecks straight into digital wallets, then buy stocks, stablecoins, or Bitcoin in a couple taps.

Gen Z is already living in that world while traditional finance debates whether it’s possible. In that sense, Fink is less predicting the future and more acknowledging a shift that’s already here, just outside the walls of the institutions he leads.

The Long Road to Acceptance

The BlackRock CEO has been warming up to Bitcoin for years, slowly stepping away from his early criticisms. In 2024, he even admitted he was wrong — calling BTC a “legitimate financial instrument” with uncorrelated returns and real macro value. He went a step further, labeling it “digital gold,” aligning himself with one of the strongest narratives in all of crypto.

His latest comments confirm something deeper: BlackRock isn’t dipping its toe in crypto anymore. It’s preparing for a world where everything — literally everything — becomes tokenized.