- The SEC is unlikely to approve a spot bitcoin ETF soon due to lack of a fully compliant crypto exchange and Gensler’s 18 month term remaining as Chairman.

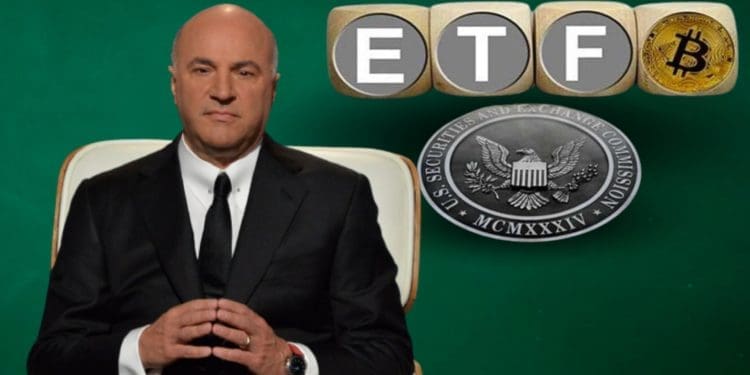

- O’Leary believes a transparent, SEC-compliant crypto exchange is needed before the SEC will approve a spot bitcoin ETF. He predicts no bitcoin ETF until such an exchange exists.

- With Gensler serving another 18 months as Chairman, O’Leary estimates spot bitcoin ETF approval could take over a year and a half. He notes demand for bitcoin will surge when the SEC finally approves a spot ETF.

The US Securities and Exchange Commission (SEC) is unlikely to approve a spot bitcoin exchange-traded fund (ETF) anytime soon according to investor Kevin O’Leary. This is due to the lack of a fully compliant crypto exchange and the SEC Chairman’s term lasting another 18 months.

O’Leary’s Prediction on Spot Bitcoin ETF Approval

O’Leary believes a transparent, SEC-compliant crypto exchange is needed before the SEC will approve a spot bitcoin ETF. He predicts there won’t be a bitcoin ETF until such an exchange exists.

Coinbase’s Bid for SEC Compliance

Coinbase is working to become SEC compliant but is currently in litigation with the regulator. The SEC charged Coinbase with operating illegally as an exchange. Coinbase insists it does not list securities, but the SEC disagrees on all assets besides bitcoin.

Institutional Investor Hurdles

O’Leary says bitcoin’s 24/7 trading poses problems for institutions limited to 5% exposure per asset class. Stocks are easier to rebalance daily since markets close at 4 pm.

Institutions Ready to Invest in Bitcoin

Despite hurdles, O’Leary reveals institutions are ready to invest in bitcoin, seeing it as liquid enough and a store of value. They aren’t interested in altcoins.

Gensler’s Term Means Long Wait

With SEC Chairman Gensler serving another 18 months, O’Leary estimates spot bitcoin ETF approval could take over a year and a half. He notes demand for bitcoin will surge when the SEC finally approves a spot ETF.