- Kevin Hassett says the Fed should cut rates next week and likely will.

- Trump’s recent praise fuels speculation he may nominate Hassett as Fed chair.

- Hassett stayed vague on future cuts, stressing a data-driven approach.

National Economic Council Director Kevin Hassett says the Federal Reserve should move ahead with a 25-basis-point rate cut at next week’s meeting, adding that the latest comments from Fed officials hint they’re leaning that way. Speaking on Fox News, he explained that the tone across governors and regional presidents has shifted, suggesting the committee is preparing to ease policy again. Hassett said the data justifies it, and the Fed appears noticeably more open to cutting than it was even a few weeks ago.

Political Spotlight Grows as Trump Eyes New Fed Chair

The remarks come as President Donald Trump prepares to announce his pick for the next Federal Reserve chair early next year. Trump has been unusually vocal in praising Hassett lately, fueling speculation that he’s the frontrunner to replace Jerome Powell when the current term expires. While Hassett avoided confirming anything, the timing of his comments has already put markets on alert.

Hassett Stays Cautious on Future Cuts

Pressed on how many rate cuts he might support if he ultimately becomes Fed chair, Hassett stayed guarded. He said the job requires being “very data responsive” and weighing the impact of every move on inflation, wages, and employment. Rather than committing to a path, he stressed flexibility — though traders will likely read his tone as more dovish than some on the current committee.

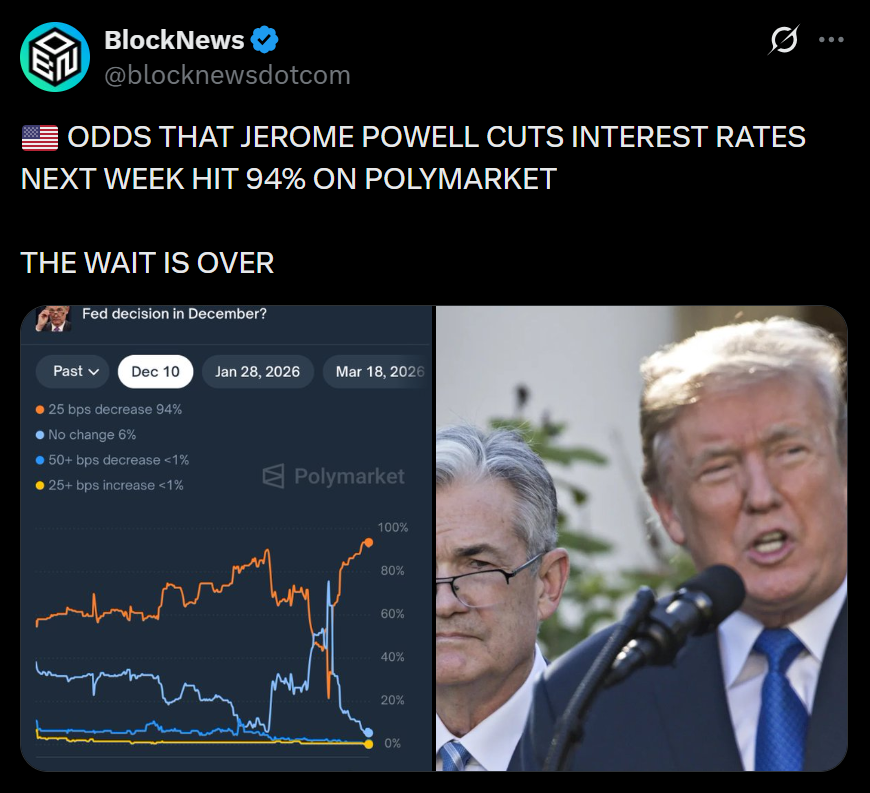

What This Means Ahead of the FOMC Meeting

With expectations already high — markets are pricing in roughly 92% odds of a December rate cut — Hassett’s public stance adds even more momentum to the idea that easing is basically baked in. If the Fed follows through, the cut could reset market sentiment heading into 2026, especially with a potential leadership change on the horizon.