- Kaspa spiked more than 20 percent as whales accumulated heavily through the recent downturn.

- Improving macro sentiment and rising odds of a December rate cut added fuel to the move.

- Despite momentum, post-holiday volatility could trigger a short-term correction.

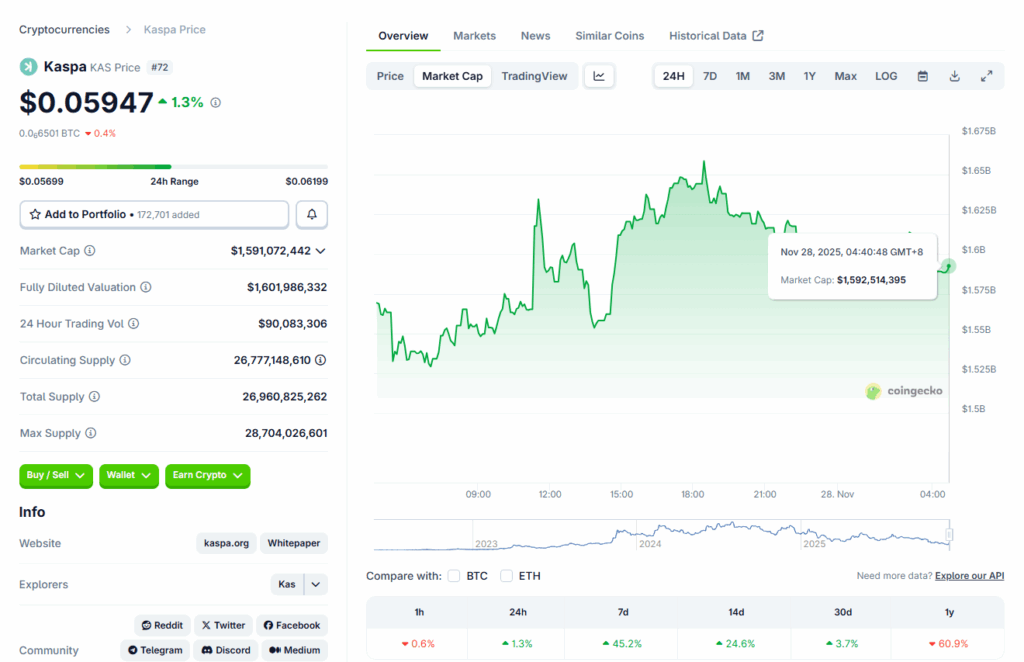

Kaspa has suddenly become one of the strongest movers in the market, jumping more than 20 percent in the past 24 hours and extending solid gains from earlier in the week. The token is now up more than 43 percent over seven days, even though it’s still far below the levels it held late last year. Traders watching the move say the uptick feels different from earlier relief bounces, mostly because the volume behind it has picked up and the rally isn’t happening in isolation. Bitcoin has been grinding back toward the $92,000 mark, and that broader strength appears to be giving smaller proof-of-work projects like Kaspa a lift.

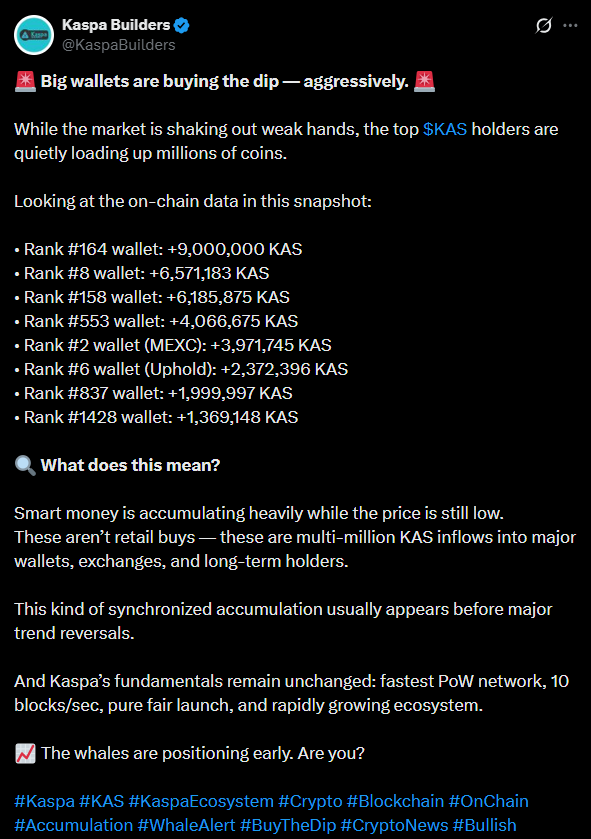

Whale Accumulation Sparks Momentum

One of the big catalysts came from whale activity. Kaspa community accounts have flagged aggressive buying from top holders throughout the recent market dip. According to them, these whales quietly scooped up millions of tokens while retail investors were still panicking, and that buying pressure often shows up in price action a few days later. With the wider crypto market stabilizing from its early-November slide, those whale buys may have finally pushed KAS into a cleaner breakout. Combined with stronger sentiment around altcoins this week, the setup created the kind of move that smaller caps thrive on.

Macro Tailwinds Add Fuel to the Move

Kaspa’s run may also be riding on shifting expectations around the Federal Reserve’s next move. Rate-cut odds for December climbed to roughly 85 percent based on CME FedWatch data, giving risk assets a noticeable boost. There’s growing chatter about Kevin Hassett potentially replacing Jerome Powell as Fed chair, and Hassett has openly supported deeper rate cuts. A softer policy stance tends to help high-volatility assets like crypto, and if the Fed delivers another cut in early 2026, coins in the mid-cap range could benefit the most. With confidence creeping back in and BTC recovering from its lows, traders see enough macro support to justify short-term upside in Kaspa.

Can the Rally Actually Hold?

Even with the strong push, there’s still a chance Kaspa cools off again. Holiday weeks in the U.S. often bring thin trading conditions, and the market could easily whip around once activity returns. The token has been highly sensitive to Bitcoin’s direction, so any pullback in BTC could drag KAS down with it. For now, the trend is leaning bullish, but the next few sessions will determine whether this is the start of a bigger rebound or just another sharp but temporary bounce.