- JPMorgan will soon accept Bitcoin and crypto ETFs like IBIT as collateral for loans.

- The bank will count crypto holdings in net worth assessments for wealth clients.

- This marks a major reversal from CEO Jamie Dimon’s earlier anti-crypto stance.

In a major pivot from its traditionally cautious stance on crypto, JPMorgan is preparing to accept Bitcoin and crypto-based ETFs as collateral for loans. This includes products like BlackRock’s iShares Bitcoin Trust (IBIT), marking a huge milestone for the $3.6 trillion banking giant. The decision reflects a growing wave of crypto adoption within traditional finance circles.

Despite JPMorgan CEO Jamie Dimon’s past criticism of Bitcoin—calling it a “Ponzi scheme” just months ago—the bank is now rapidly expanding its crypto exposure. With President Trump’s administration pushing pro-crypto policies, institutions like JPMorgan are being nudged into alignment with the new regulatory climate, making moves that seemed unlikely just a year ago.

A Major Shift in Traditional Finance’s Crypto Strategy

JPMorgan’s latest move sends a powerful message: crypto assets are now being treated on par with traditional financial instruments. The bank is not only accepting Bitcoin ETFs for collateral but will also factor crypto holdings into wealth assessments for clients. This means investors’ BTC and ETF positions could directly influence their borrowing power and net worth calculations.

This policy change is expected to roll out in the coming weeks and marks another big step toward crypto’s institutional mainstreaming. It also adds weight to a broader industry trend where major banks, once skeptical, are now racing to innovate in the space due to changing market conditions and regulatory support.

Crypto Market Gains Further Legitimacy

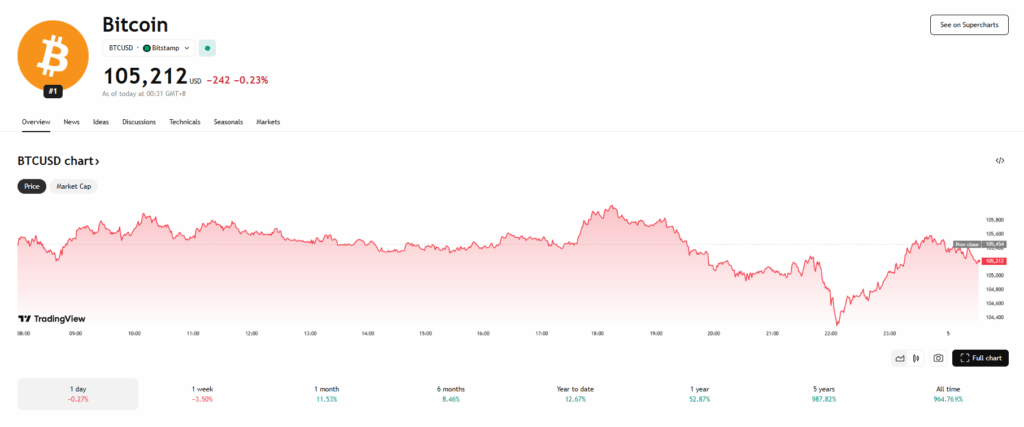

JPMorgan’s decision is especially significant given its CEO’s long-standing opposition to crypto. The stark contrast between Dimon’s public opinions and the bank’s internal moves underscores how powerful the momentum for crypto integration has become. With Bitcoin hitting a new high of $111,000, traditional finance can no longer ignore the market’s impact.

This shift may spark a domino effect among other institutions. As crypto ETFs gain legitimacy and utility, more banks could follow suit—offering clients new ways to leverage their digital assets within legacy systems. It’s no longer a question of if crypto goes mainstream—it’s happening now.