- JPMorgan CEO Jamie Dimon calls Bitcoin a “Ponzi scheme” with no intrinsic value.

- Despite criticism, BTC reached $100,000 in 2024 and could hit $120,000 soon.

- Dimon supports crypto innovation but criticizes Bitcoin for its alleged misuse in crimes.

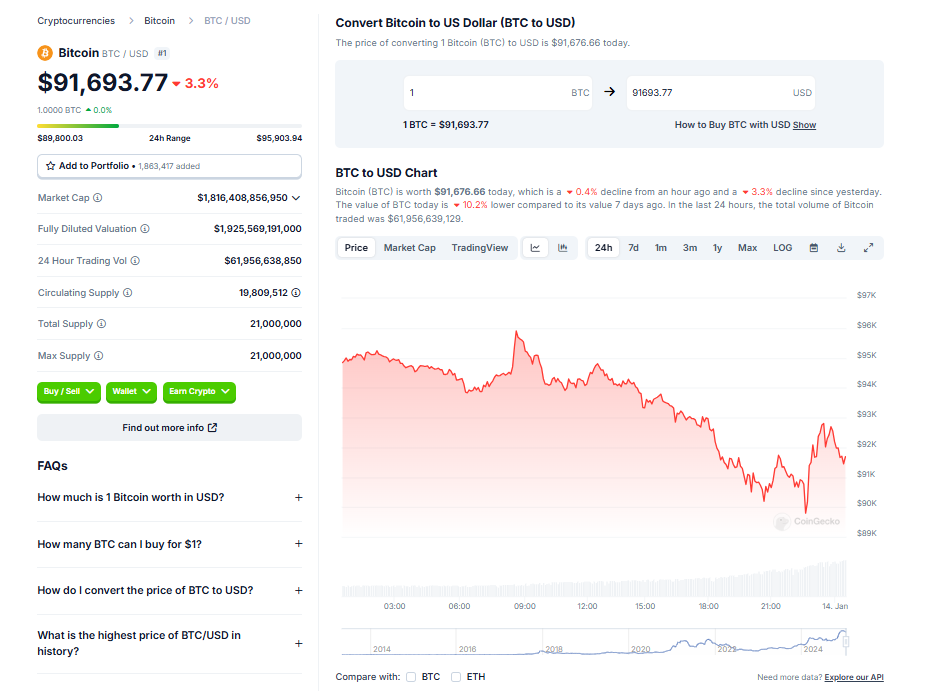

JPMorgan Chase CEO Jamie Dimon has made headlines again with sharp criticism of Bitcoin. In a recent CBS interview, Dimon labeled the world’s largest cryptocurrency a “Ponzi scheme” and claimed it has “no intrinsic value.” This comes at a time when Bitcoin, despite its critics, has achieved remarkable milestones, including breaking the $100,000 mark in 2024, fueled by institutional backing like BlackRock’s Bitcoin ETF.

While Dimon has always been vocal about his doubts regarding Bitcoin, his stance contrasts sharply with the asset’s growing adoption and success. Calling BTC a “pet rock,” Dimon dismisses it as little more than hype, even as its market cap continues to dominate the crypto space.

Mixed Signals: Dimon Supports Crypto, Not Bitcoin

Interestingly, Dimon’s criticism of Bitcoin doesn’t extend to all cryptocurrencies. He’s expressed support for the broader concept of digital currencies, stating, “We are going to have some kind of digital currency at some point. I’m not against crypto.” However, his concerns about Bitcoin’s use in illegal activities, like money laundering and ransomware, overshadow his acknowledgment of blockchain technology’s potential.

Comparing Bitcoin to smoking, Dimon quipped, “I applaud your ability to want to buy or sell it. Just like I think you have the right to smoke, but I don’t think you should smoke.” His harsh words come at a time when BTC’s value is predicted to soar even higher, with projections of $120,000 by the end of January 2025.

Bitcoin’s Success Challenges Dimon’s Narrative

Dimon’s skepticism stands in stark contrast to Bitcoin’s recent milestones. The cryptocurrency reached an all-time high of $100,000 in late 2024, partly thanks to the introduction of a Bitcoin ETF by BlackRock, an $11 trillion asset manager. With Bitcoin now on track to hit $120,000, Dimon’s comments may feel out of sync with the asset’s trajectory.

It’s worth noting that the cryptocurrency market continues to thrive, regardless of critiques from major financial institutions. Whether JPMorgan’s stance will have any significant impact on Bitcoin’s momentum remains to be seen. One thing’s for sure: Bitcoin’s ability to defy expectations makes it a topic that won’t be fading from headlines anytime soon.