- Bitcoin slumps near $90K after the Fed’s rate cut triggers another classic “sell the news” drop instead of a relief rally.

- Liquidity across crypto has thinned dramatically, with spot volume down 66% since January and ETFs seeing billions in outflows.

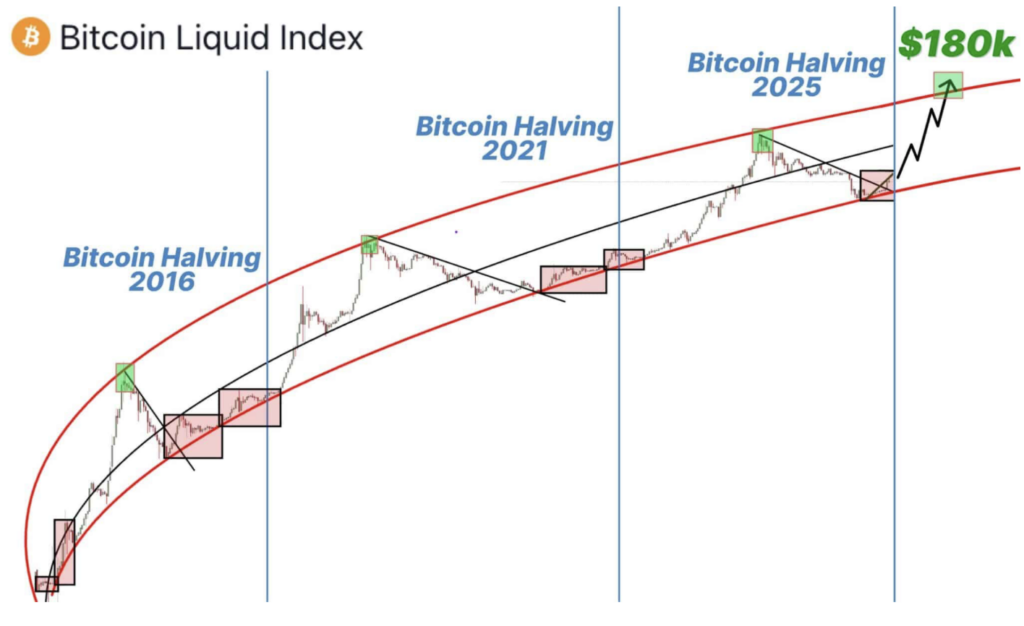

- BTC now tests key support at $90K, with downside risk toward $83K–$86K, though long-term patterns still point to late-cycle exhaustion rather than a full breakdown.

The crypto market slid into the red today, with Bitcoin drifting around $90K, down roughly 2.8% in 24 hours. A lot of people expected a relief rally after the Fed cut rates yesterday… but nope, not even close. Instead we got a classic “sell the news” dump. It’s one of those days where everything should be bullish, yet price action says otherwise — and that disconnect is exactly what’s throwing traders off.

The Federal Reserve cut by 25 bps, but Jerome Powell’s tone stayed cautious. Inflation still a concern, future cuts likely slower — definitely not the dovish vibe markets were hoping for. BTC spiked above $94K right after the announcement, then flipped hard and slid back down.

And honestly, this isn’t new. Look at how Bitcoin behaved during recent FOMC meetings:

- June 18: Pause → -6.36%

- July 30: Pause → -5.62%

- Sept 17: 25 bps cut → -8.10%

- Oct 29: 25 bps cut → -12.04%

Every single one triggered short-term downside. But here’s the twist: after the September meeting, Bitcoin went on to break its all-time high. Short-term pain, long-term strength — the pattern keeps repeating.

Why Crypto Is Down Today… and Why It Could Still Go Lower

Crypto is moving more and more like tech stocks these days, and Nasdaq is slightly red today too. On top of that, AI stocks are being questioned for bubble-like valuations, which drags capital out of high-risk assets — including crypto.

Then add in the macro overhang:

- Trump’s tariff threats wiped out $19B in leveraged positions back in October.

- Year-end deleveraging is hitting full force.

- Spot trading volume has tanked 66% since January (Kaiko).

- Market depth is down 30% — meaning barely any liquidity.

- BTC/ETH ETFs have seen $7.2B in net outflows since October.

- Retail interest by Google Trends = basically on life support.

When liquidity dries up like this, even small sell-offs snowball into ugly candles. That’s exactly what’s happening.

MicroStrategy even cut its 2025 BTC target down to $85K–$110K, which rattled some holders. Yes, the biggest corporate Bitcoiner just got a little nervous too.

Bitcoin Chart: Nasty, Choppy, and Testing Support

Over the last week, BTC has been stuck in a sloppy downtrend, now testing the $90K support — right around the 20-day EMA. The structure almost looks like a bear flag, which isn’t great if you’re hoping for a clean bounce.

BTC and ETH options expire today, which usually leads to choppy, slow, directionless price action until after U.S. markets close.

If $90K breaks convincingly, the next support sits around $83K–$86K.

So Is Crypto Finished? Is This the End?

Short answer: no. Longer answer: absolutely not — but the market is exhausted.

December has been brutal, marking Bitcoin’s worst month since 2021, dropping roughly $18K in November alone. But historically, December actually averages +9.7% gains for BTC. And analysts still expect stabilization heading into a potential 2026 bull phase.

This looks less like a structural crash and more like late-cycle fatigue — a tired market shaking out anybody overleveraged or overconfident.

Altcoins? Also wrecked. The Altcoin Season Index is sitting at 17, which basically screams “oversold.”

If you’re holding long-term, focus on the bigger cycle rather than the short-term noise. But as always, DYOR — markets flip fast, and usually when people stop expecting it.