- One popular metric suggests the retail crowd hasn’t arrived yet in the current Bitcoin rally.

- The Korea Premium Index, reflecting retail participation, has been predominantly in the red territory around -0.5%, indicating that retail investors have not actively contributed to the current Bitcoin price rally.

- Google Trends data shows an uptick in Bitcoin searches after Trump’s win, but the levels are still significantly lower than during the 2021 and 2017 bull runs, suggesting there is room for further retail participation which could potentially push Bitcoin to $100,000.

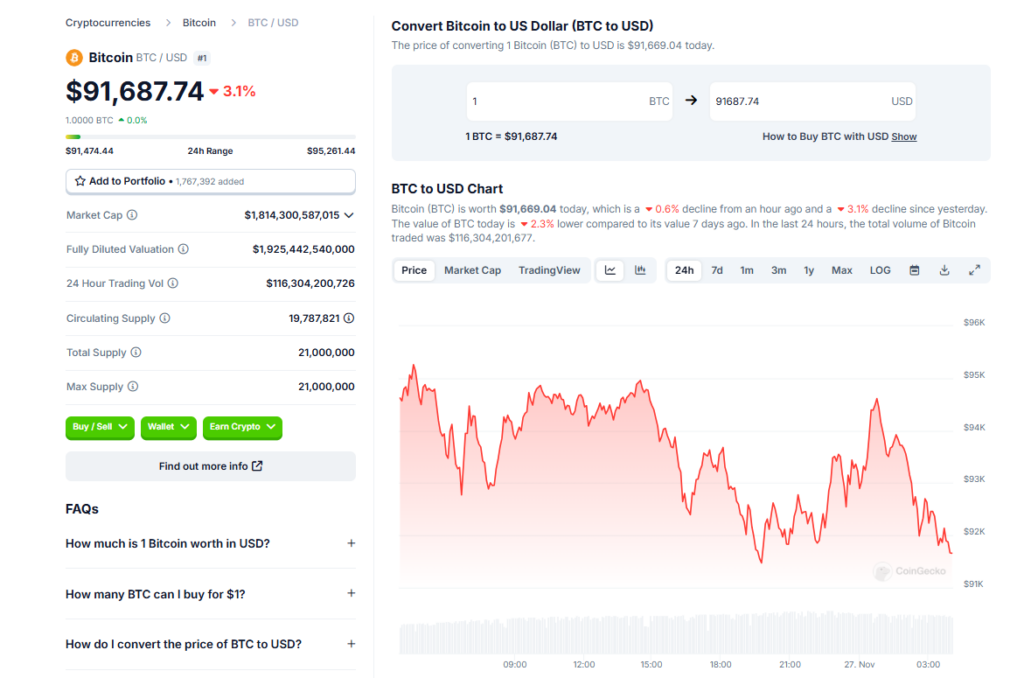

Bitcoin has seen impressive growth since Donald Trump‘s presidential election victory in early November, adding over $30,000 within weeks and surpassing $99,800. Reports indicate this run was driven by US institutions, not retail investors. When will the retail crowd arrive and how might that impact Bitcoin’s price?

Institutional Investors Fuel Bitcoin’s Rally

Bitcoin’s rapid 30% price increase to nearly $100k was primarily driven by US institutions according to most reports. This is evidenced by the incredible inflows into Bitcoin spot ETFs. Massive short term price jumps often attract retail investors, but this doesn’t seem to be happening in Bitcoin’s current rally. The public mania we saw during Bitcoin’s rise to $20k in 2017 and $70k in 2021 is absent.

Data Shows Retail Investors Are Still Absent

The Korea Premium Index from CryptoQuant shows retail investors have yet to arrive. This index reflects the difference between Bitcoin’s price on South Korean and global exchanges, indicating Korean retail involvement. Recently it’s been negative, suggesting retail has not contributed to the rally. Historically, the Korea Premium Index has spiked before Bitcoin tops out. Monitoring it can help identify potential tops.

Google Trends Also Reflects Low Retail Interest

Google search data indicates retail sentiment remains low. While there was an uptick in Bitcoin searches after Trump’s election, levels are far below the 2021 and 2017 bull runs. This suggests ample room for increased retail participation. Some think eventual retail inflows could push Bitcoin to the coveted $100k mark.

The Retail Crowd’s Arrival Could Propel Bitcoin to $100k

If historical patterns hold, Bitcoin may reach its peak when the Korea Premium Index and Google searches spike. While the current rally has been institutionally driven thus far, the eventual arrival of the retail crowd could provide the final push needed for Bitcoin to reach $100k. For now, the market awaits the entrance of the masses.