- Whale-sized orders are stacking up on both spot and futures markets, signaling serious institutional interest.

- Futures data shows tight concentration between $35–$45, with almost zero support below $30 — a new price floor may be forming.

- If momentum returns and HYPE reclaims $45, a break above the all-time high is very much in play.

With just 12% separating Hyperliquid from its all-time high of $49, the question now is: can HYPE smash through that ceiling and kick off a fresh price discovery run—or is it gearing up for yet another rejection?

Let’s break down what’s actually going on behind the candles. Because, well… numbers don’t lie, but hype sometimes does.

Whale Moves Speak Loud

Forget the noise for a second. If you wanna know where price is headed, watch the big wallets.

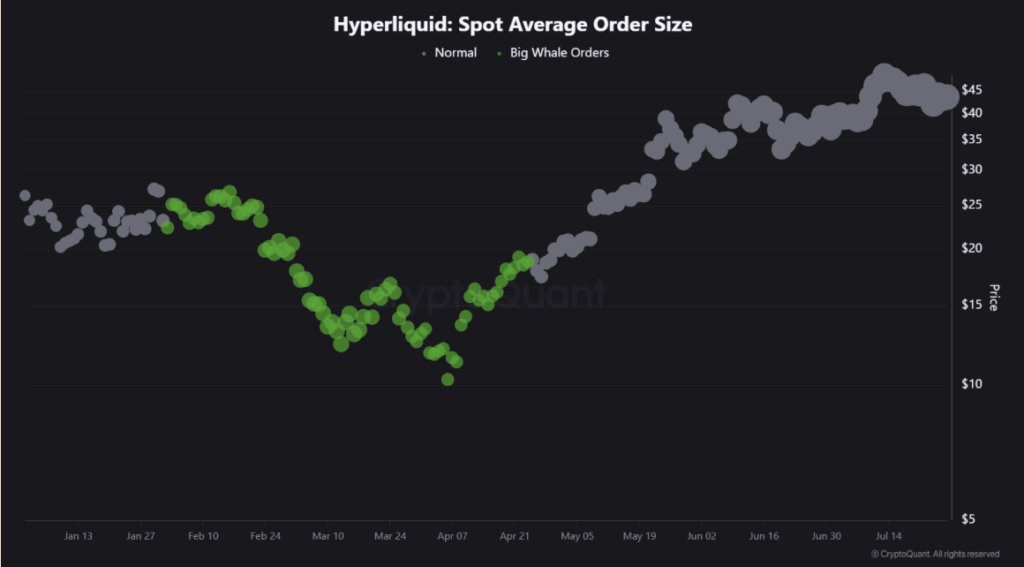

CryptoQuant’s latest data shows a major shift in the Spot Average Order Size for Hyperliquid since late April. Early-year activity? That was mostly smaller retail hands fumbling around. Lately though, the script’s flipped—whales are clearly stepping in.

And we’re not talkin’ pocket change here. These are serious-sized buys, not speculative sprays. That kind of volume from big players typically means one thing: conviction. When price rises and the order sizes swell? That’s not just buzz, that’s capital pushing the narrative forward.

The Zones the Smart Money’s Watching

Now, swing over to the derivatives side and things get spicy.

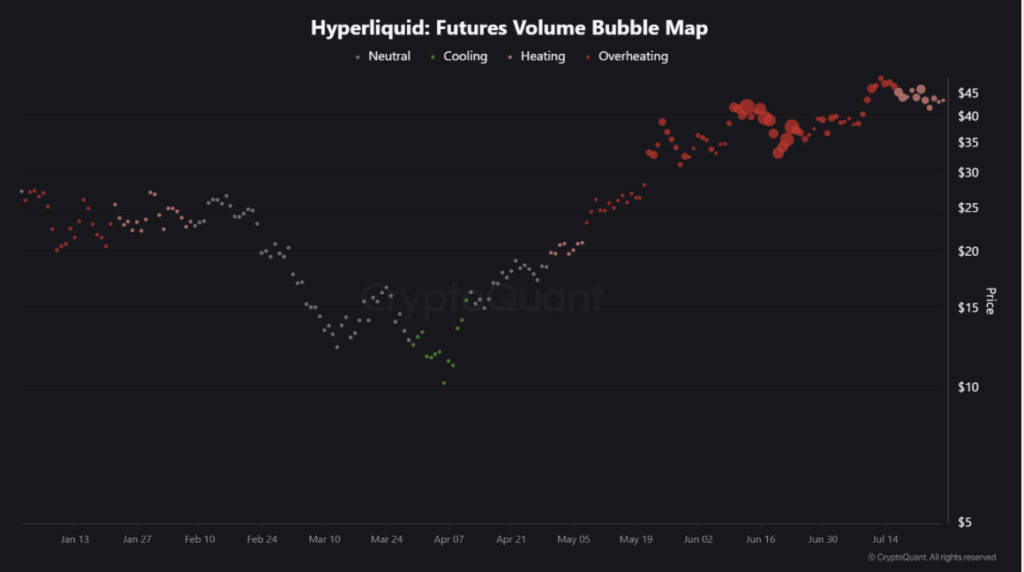

HYPE’s Futures Volume Bubble Map has been heating up hard between $35 and $45. These little red fireballs on the chart? That’s leverage. Big leverage. It’s the kind of concentration you’d expect when whales are betting heavy on current ranges.

What’s more interesting? There’s almost zero volume stacked under $30. Translation: the market’s saying, “Yeah, that was the floor. We’re done with that.”

If that $35–$45 range holds, the next stop could be higher than most expect.

All Eyes on the Breakout

As of now, HYPE’s hanging just above $44. The 50-day EMA is tracking close behind at $40.68, and the 100-day EMA’s chillin’ around $35.61—both pointing up. That slope? It’s momentum-friendly.

The RSI’s lounging at 54—neutral but with room to run. Meanwhile, MACD is still technically bearish, but the histogram’s flattening out. Could be a crossover coming… or not. But it ain’t screaming “crash” either.

What we’re looking at is a calm before something. Either a rocket or a retrace. But if bulls can punch through $45 with volume, especially on a daily close? This thing could finally push into uncharted territory and set a new ATH.