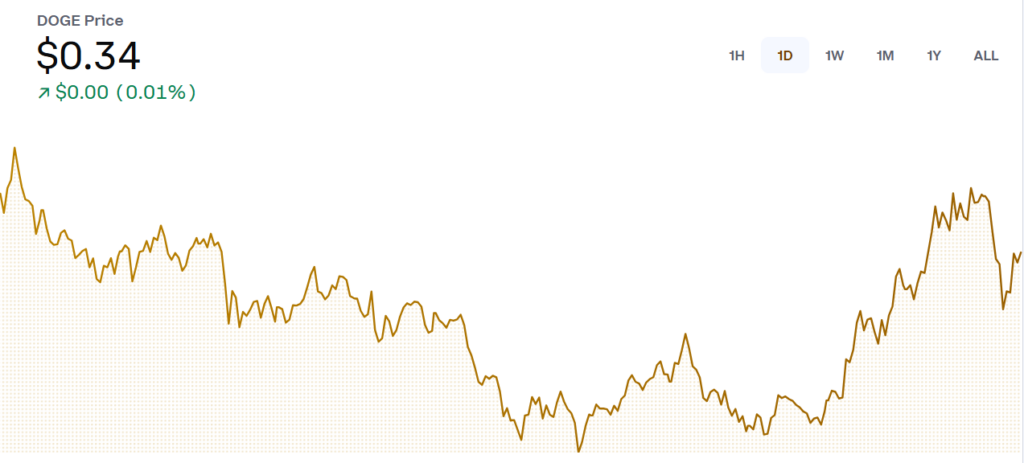

- DOGE hovers at $0.34, showing stability despite broader market swings.

- Minimal price movement suggests consolidation before the next big shift.

- Trading volume remains steady, indicating neither strong accumulation nor sell-offs.

Dogecoin is often seen as the king of meme coins, and right now, it’s holding its position at $0.34 without much movement. Unlike other meme coins that tend to see wild spikes and crashes, DOGE has been relatively stable, which might be a sign that traders are waiting for a bigger catalyst before making moves. While it’s not the kind of action that excites short-term speculators, long-term holders may see this as a period of accumulation.

Bull Trap or Real Rally?

The lack of dramatic price swings suggests that DOGE is in a consolidation phase, which usually means that a larger move is on the horizon. Whether that move is up or down depends on broader market sentiment. Historically, DOGE has reacted strongly to news-driven catalysts, particularly from high-profile figures like Elon Musk. If a fresh wave of hype or mainstream adoption hits, DOGE could easily break out of this range. On the flip side, if market sentiment weakens, it might retest lower support levels before regaining traction.

Outlook of DOGE in 2025

For now, the Coinbase data shows that DOGE is holding its ground, with no clear signals of an immediate breakout or breakdown. The fact that it hasn’t lost key support levels is a good sign for bulls, but it also needs fresh momentum to push higher. If Bitcoin and Ethereum rally, DOGE could follow suit, as it often mirrors broader crypto trends. However, if the overall market remains sluggish, DOGE might stay in its current range a little longer.

Dogecoin remains one of the most recognizable cryptocurrencies, and while it’s not making headlines right now, it has a history of surprising investors when least expected. Whether this is just a period of calm before a breakout or a sign of slowing interest will depend on the next major market moves.