- Investors have sued the team behind the Hawk Tuah meme coin crypto project after an alleged rug pull caused them to lose money

- The lawsuit names the company behind the coin Overhere Ltd, its executive Clinton So, and its promoter Alex Larson Schultz, but not Haliey Welch herself

- The lawsuit alleges that the defendants leveraged Welch’s celebrity status to enhance the token’s credibility and appeal, leading to a speculative frenzy before the value rapidly declined

The meme coin project led by Hawk Tuah girl, Haliey Welch, has reportedly been sued by investors following a dramatic decrease in the value of the token. This incident, often referred to as a “rug pull”, has raised significant concern among the crypto community.

Launch and Initial Success of Hawk Tuah Meme Coin

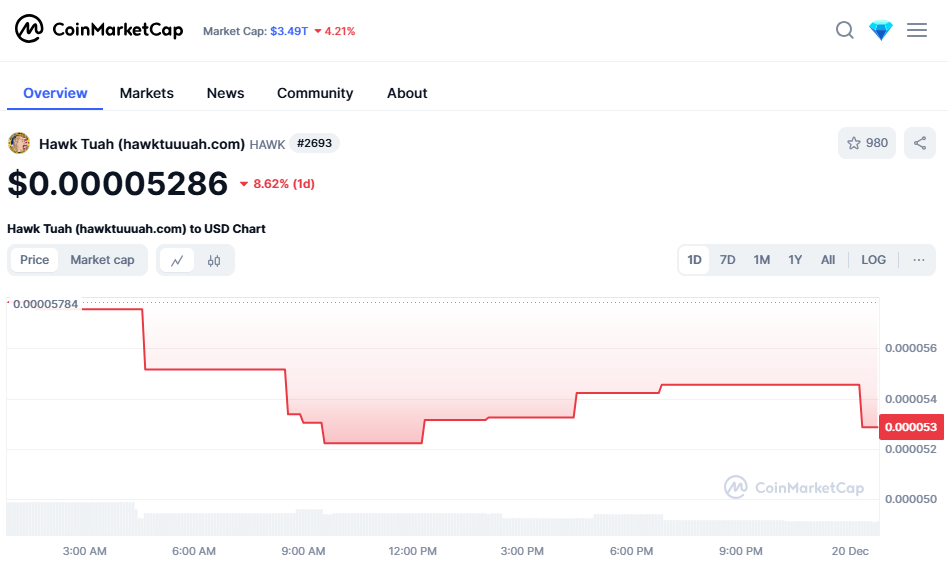

In the early days of December, Haliey Welch launched the Hawk crypto token. This move was met with widespread enthusiasm, leading fans across the globe to invest in the project. However, shortly after its launch, accusations started to surface on social media that Welch and her team had “rug-pulled” the project, resulting in a rapid loss of investment for backers. The launch was later described by YouTube crypto investigator Coffeezilla as one of the most disastrous he had ever seen.

Legal Action Against Hawk Tuah Meme Coin Project

Following the alleged rug pull incident, Newsweek reported on December 19 that a lawsuit had been filed against the individuals behind the Hawk Tuah meme coin project. According to the report, the lawsuit claimed that the promotion and sale of the Hawk Tuah cryptocurrency, also known as the HAWK token, was conducted unlawfully and without proper registration. Named in the lawsuit are Overhere Ltd, the company behind the coin, its executive Clinton So, and promoter Alex Larson Schultz. Interestingly, Haliey Welch herself was not directly named in the lawsuit.

Impact of the Lawsuit and Future Implications

The lawsuit alleges that the project created a speculative frenzy, causing the token’s market value to spike shortly after launch, which resulted in a significant market capitalization. The defendants reportedly used Welch’s celebrity status to boost the token’s credibility. Many investors, who were first-time participants in cryptocurrency, were allegedly drawn to the project due to Welch’s involvement. The swift devaluation of the token resulted in significant losses for these investors.

Conclusion

This incident isn’t the first of its kind, with a similar backlash experienced by Logan Paul‘s failed CryptoZoo project in 2022. The implications of these events continue to be a topic of hot debate within the crypto community, especially as more celebrities venture into the world of cryptocurrency.