- Chipmaker Intel is cutting 15% of its workforce, around 15,000 jobs, as it tries to revive its business and compete with rivals like Nvidia and AMD.

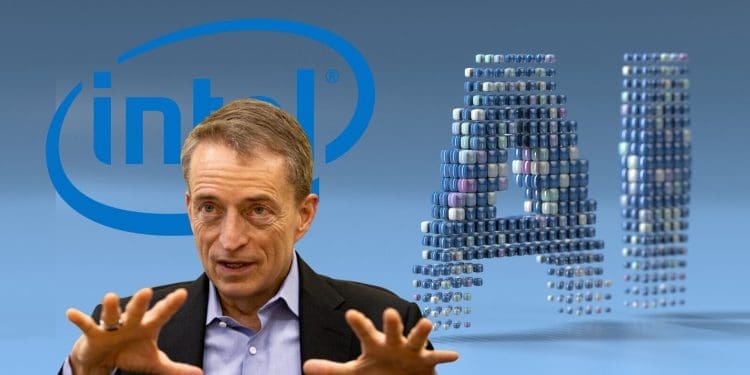

- Intel CEO Pat Gelsinger said the company plans to save $10 billion in 2025 and will announce an “enhanced retirement offering” and voluntary departure program.

- Intel reported a loss for its second quarter, forecasted lower-than-expected third-quarter revenues, and its stock plunged 19% in after-hours trading.

Intel announced it is cutting 15% of its workforce, around 15,000 jobs, in an attempt to revive the company’s business and compete with rivals like Nvidia and AMD.

Company Faces Declining Revenue and Profits

In an internal memo, Intel CEO Pat Gelsinger said the company must align its costs with its new operating model. He stated Intel’s revenue is not growing as expected and it has yet to benefit from technology trends like AI.

Gelsinger said the job cuts come after disappointing financial results. Intel reported a loss and a slight revenue decline in its most recent quarter. It also forecast third-quarter revenue below expectations, leading to a 19% stock plunge after hours.

For the second quarter, Intel posted a $1.6 billion loss on $12.8 billion in revenue. That’s down from a $1.5 billion profit on $12.9 billion in revenue a year ago.

Cost-Cutting Measures Announced

Along with job cuts to be completed this year, Intel said it is offering an enhanced retirement package and voluntary departure program.

Gelsinger called the layoffs the hardest decision of his career. The company is suspending stock dividends as part of broader cost-cutting efforts.

Intel Struggles to Compete in Evolving Chip Market

Analysts say the job cuts may improve Intel’s finances in the near term but are likely insufficient to redefine its market position.

Unlike rivals, Intel both manufactures and designs chips. It aims to build up its domestic foundry business but faces intense competition.

While Intel has benefited from U.S. policies like the CHIPS Act to boost domestic chip manufacturing, fully ramping up new plants takes time. The company must now leverage its opportunities in AI chips and manufacturing expansion.

Outlook Remains Challenging

Intel has invested heavily in AI PCs, hurting profitability temporarily but with expected long-term gains. However, the overall business faces considerable challenges.

The layoffs represent a major course correction as Intel contends with declining revenues and growing competition. But the company must still execute on plans to revitalize its business.