- Bitcoin investment products saw another $1.1B in inflows, with year-to-date flows hitting $12.7B — mostly from U.S. institutions.

- Price action is facing stiff resistance between $110K–$112K while bearish RSI signals and a double top form on the weekly chart.

- If BTC fails to hold $100K, a dip toward $96K is possible, especially with short liquidations piling up and analyst sentiment turning cautious.

Even with the market feeling shaky and whispers of capitulation spreading fast, big players haven’t backed off Bitcoin. Actually, it’s quite the opposite — institutional demand has stayed strong, maybe stronger than ever.

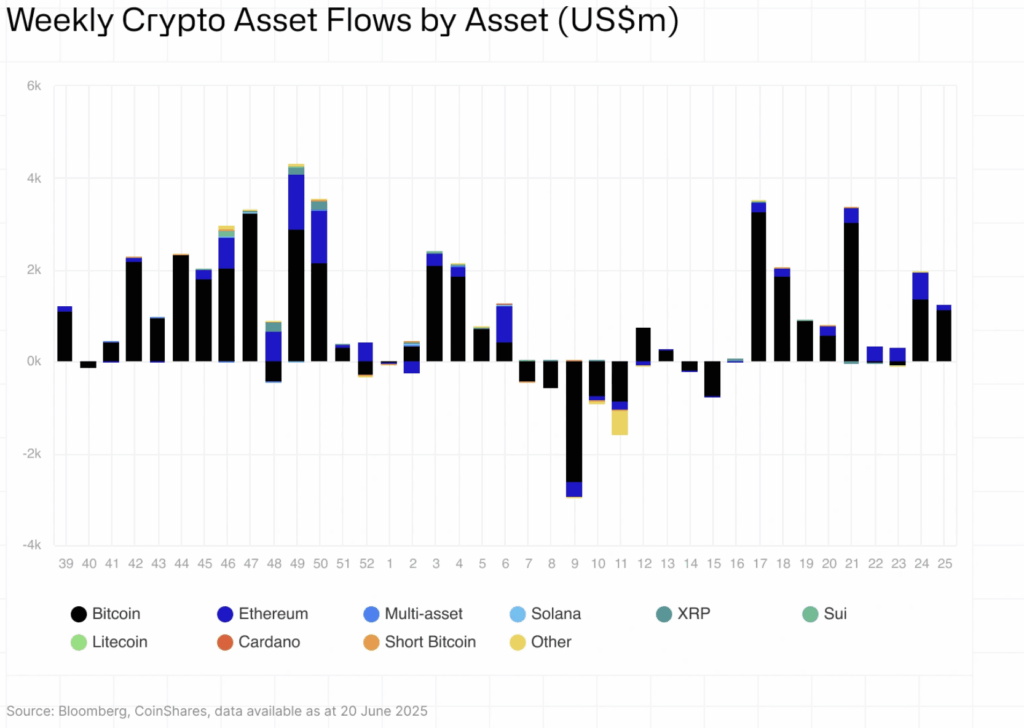

Data from CoinShares shows BTC investment products pulled in another $1.1 billion last week. That’s the second week in a row of fresh inflows. Altogether, the monthly total sits around $2.38 billion, and year-to-date inflows are now hovering near a massive $12.7 billion. Most of this cash is coming from the U.S., which clocked in a net $1.25B. On the flip side, Hong Kong and Switzerland saw outflows of $32.6M and $7.7M, respectively. Not huge, but still worth noting.

Can BTC Break Resistance or Nah?

Bitcoin managed a decent bounce — up a little over 3% — and is now trading near $104,100 as of Monday, June 24. That’s in the heart of the North American session. Still, it’s staring down some tough resistance ahead, with the $110K–$112K zone looking like a wall it hasn’t cracked yet.

Zooming out to the weekly chart, BTC’s setting up what looks like a possible double top pattern. And to make things worse, the RSI is showing some bearish divergence. That’s usually not a great combo if you’re hoping for a breakout.

Liquidations Mount as Analysts Turn Cautious

According to Coinglass, more than $12 billion worth of shorts have been liquidated — a pretty clear sign that the leveraged market’s in chaos mode. If you’re reading between the lines, that kind of unwinding suggests BTC could still have more downside ahead before things stabilize.

Benjamin Cowen, a well-followed crypto analyst, recently shared a grim take: he sees the whole crypto space (Bitcoin included) dipping into lower lows over the next few months. His call? A local bottom forming sometime in August or September 2025. Not exactly cheerful.

What If BTC Drops Below $100K?

From a chart perspective, the $100K mark is looking like a line in the sand. If BTC closes below that level consistently this week, there’s a good chance it slides further — maybe down to the $96K support range. At that point, all eyes would be on whether buyers step in or if the sell pressure just snowballs.