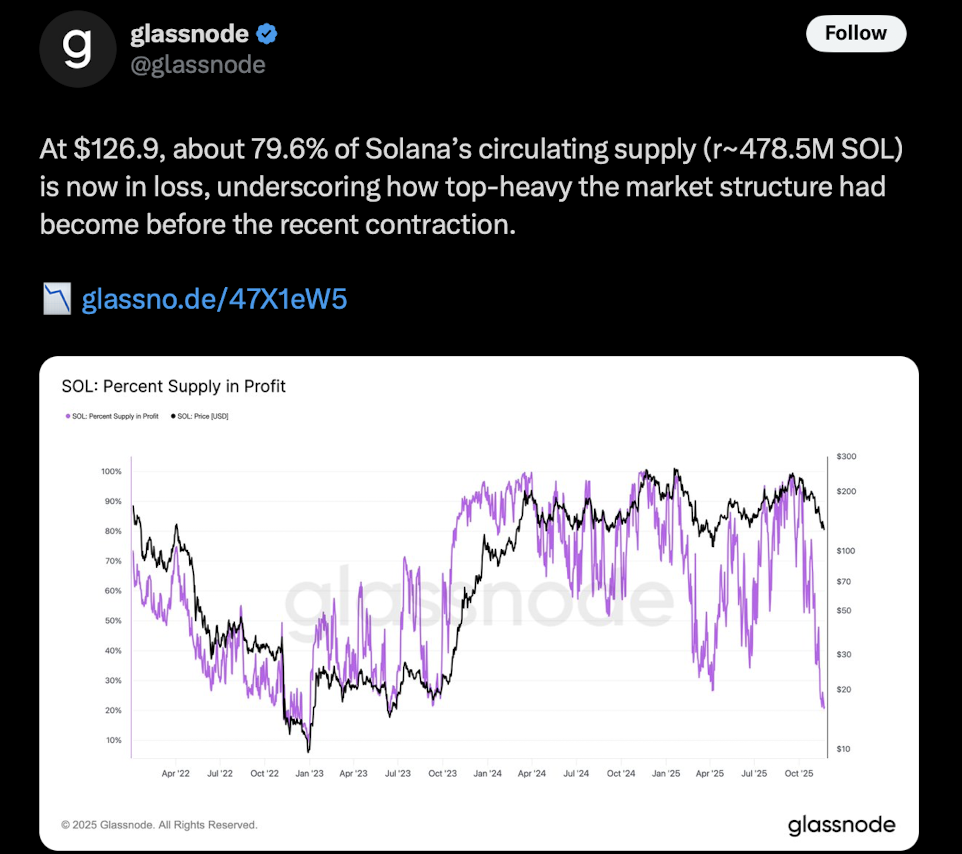

- Forward Industries holds 6.91M SOL but now sits on $668M in unrealized losses as Solana trades far below their $230 buy-in.

- Nearly 80% of all circulating SOL is underwater, showing widespread market pain after a 50%+ drawdown from the 2024 highs.

- Despite the crash, FWDI has not sold, continues staking, and appears committed to its long-term Solana strategy amid cautious market sentiment.

Solana’s brutal downturn is hitting everyone, but it’s hitting Forward Industries harder than almost anyone else. The company — now the largest institutional holder of SOL — is staring at a staggering $668 million in unrealized losses, and the pain doesn’t stop there. Nearly 80% of all circulating SOL is now underwater, painting an ugly picture for Digital Asset Treasury firms that went heavy on Solana during the hype cycles of late 2024 and early 2025.

It’s one of those moments where you can practically feel the stress radiating off the charts.

Forward Industries’ SOL Bet Is Deep in the Red

Forward Industries (NASDAQ: FWDI) holds 6,910,568 SOL, or about 1.12% of the entire supply. At today’s prices, that stash is worth roughly $917 million, down massively from the $1.59 billion they spent acquiring it. Their average buy? Around $230 per SOL — which, in hindsight, looks painfully mistimed.

The company started building its Solana treasury in September 2025, buying more than 6.8 million SOL at $232 each, and later topped up their holdings. Even worse, FWDI’s own stock hasn’t escaped the fallout… it’s crashed from $40 to $8.17, erasing billions in value. Their market cap today? Just $706 million, which is actually lower than the value of their SOL holdings.

It’s a tough combo: the asset’s down bad, and the stock tied to the asset is down even worse.

A Market-Wide Bleedout for Solana Holders

The deeper story here is that Forward Industries isn’t alone in this mess. Glassnode data shows 79.6% of Solana’s supply is now held at a loss — that’s almost 478.5 million SOL underwater. This confirms what everyone already suspected: the market was top-heavy, with too many buyers piling in near the highs.

The irony? Fundamentals were strong just months ago.

Solana hit:

- $263 ATH in November 2024

- 171% spike in fees to $200M

- 73% jump in TVL, making it the #2 chain globally

Now, prices have retraced more than 50%, and the sentiment has flipped completely.

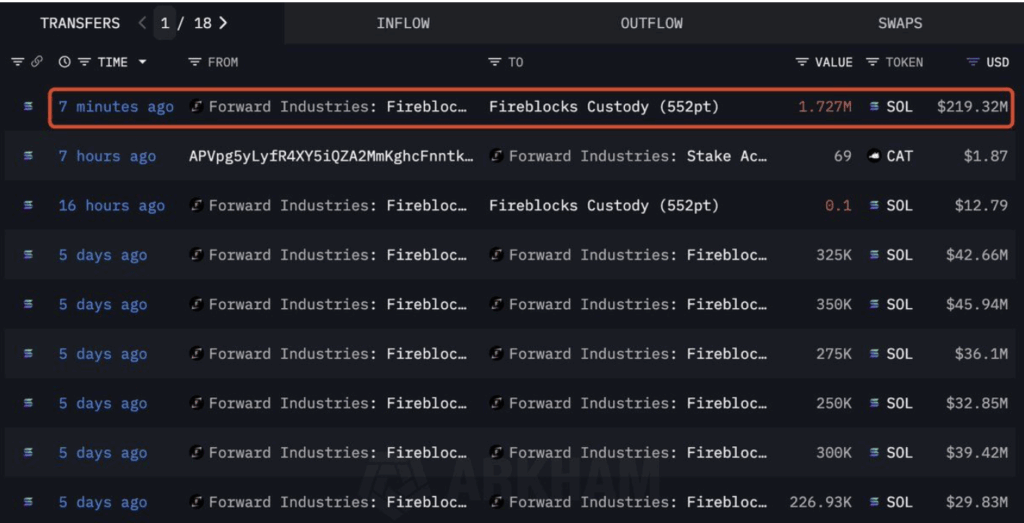

Big Transfers, No Panic Selling

On-chain watchers spotted a massive move: Forward Industries shifted 1.727 million SOL (worth $219M) to another wallet. This triggered panic… until the funds moved right back into the company’s staking wallet.

Meaning?

No dumping. No fire sale. Just internal restructuring.

It fits the pattern: FWDI continues to hold, continues to stake, and even added a small amount of SOL recently. Their entire strategy seems to revolve around long-term conviction, even if that means surviving a nasty drawdown.

Other Treasury Giants Tell a Very Different Story

Not every Digital Asset Treasury company is feeling the same level of pain.

- Strategy’s 649,870 BTC (avg buy: $74,433)

→ Unrealized profit: $6.15B (+12.7%) - Bitmine’s 3,559,879 ETH (avg buy: $4,010)

→ Unrealized loss: $4.52B (-31.6%)

Solana-focused treasury firms are suffering the most right now, while Bitcoin-focused ones remain firmly in the green. It’s a pretty brutal reminder of how different the risk profiles really are.

Futures Market Shows Caution, Not Capitulation

SOL open interest has flattened near 8 million contracts, signaling consolidation rather than panic. But when OI stabilizes during a price drop, it usually means conviction is thinning out and liquidations could be on the horizon. Traders are basically sitting on their hands, waiting for a clearer direction.

What Happens Next?

Forward Industries isn’t backing out. Led by chairman Kyle Samani, they’re sticking to their Solana treasury play — but their future now hinges entirely on Solana’s ability to:

- Stop the bleeding,

- Build new support, and

- Prove that the fundamentals still matter.

Right now, the market is cold, sentiment is weak, and institutions are learning the painful lesson that big bets on volatile assets can cut both ways.

If Solana stages a strong rebound, Forward Industries could look visionary.

If not… the losses could deepen fast.