- Hyperliquid grew to $1.8T annual volume without VC funding or CEX listings.

- All protocol fees go to the community, not developers or investors.

- With only 11 team members, the project thrives on focus, authenticity, and steady execution.

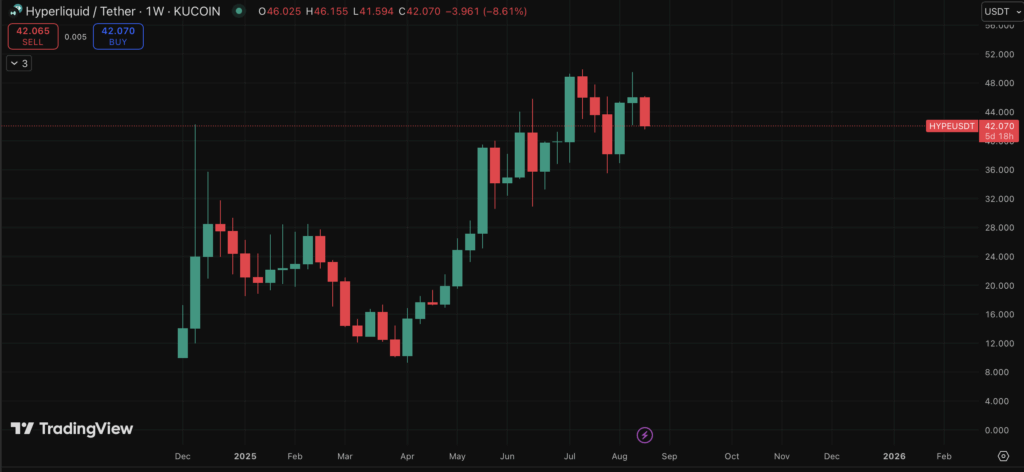

Jeff Yan, the founder of Hyperliquid, recently shared the philosophy that shaped one of the most surprising success stories in crypto. Unlike most major projects, Hyperliquid never raised venture capital, never paid for exchange listings, and never relied on market-making partnerships. Instead, it quietly grew into a decentralized exchange that now processes over $1.8 trillion annually—with just 11 full-time employees.

A Community-First Philosophy

Yan explained that money was never the main driver. From day one, Hyperliquid was self-funded, avoiding the hype machine of inflated VC valuations. He believes big investors often chase optics, not utility, while real projects should focus on users. That’s why every fee generated on the platform goes back to liquidity providers and insurance funds—developers take nothing. To him, that’s decentralization in practice, not just marketing spin.

Staying Off the Big Exchanges

While most protocols scramble for a centralized exchange listing to gain exposure, Yan chose the opposite route. Hyperliquid stayed away from big exchanges, letting users discover it naturally. That decision, though unconventional, built authenticity and kept the project true to its ethos of openness. Even without the “normal” route, the platform reached daily volumes of $10 billion, proving substance can outshine hype when executed with discipline.

Just 11 People, One Clear Vision

Despite its massive scale, Hyperliquid runs on a tiny team of 11—split between engineering and operations. Yan says success comes from keeping culture tight, avoiding bad hires, and moving fast with upgrades like HLP3. The vision isn’t just another DEX; it’s about building a blockchain that can handle all financial applications. Scalable, performant, and open. In his words, “focus on real substance, not surface-level appeal.” That’s what he believes will restore credibility to crypto after cycles of overhyped crashes.