It’s not often you see a crypto project pull off a buyback that actually works. Hyperliquid, the perpetuals DEX, just did — spending around $780 million to buy back 34.41 million HYPE tokens, and somehow turning that into a 65% gain. Meanwhile, six other projects that tried the same play? They lost big. The difference wasn’t luck — it came down to real demand, utility, and timing.

Only One Winner in a Billion-Dollar Experiment

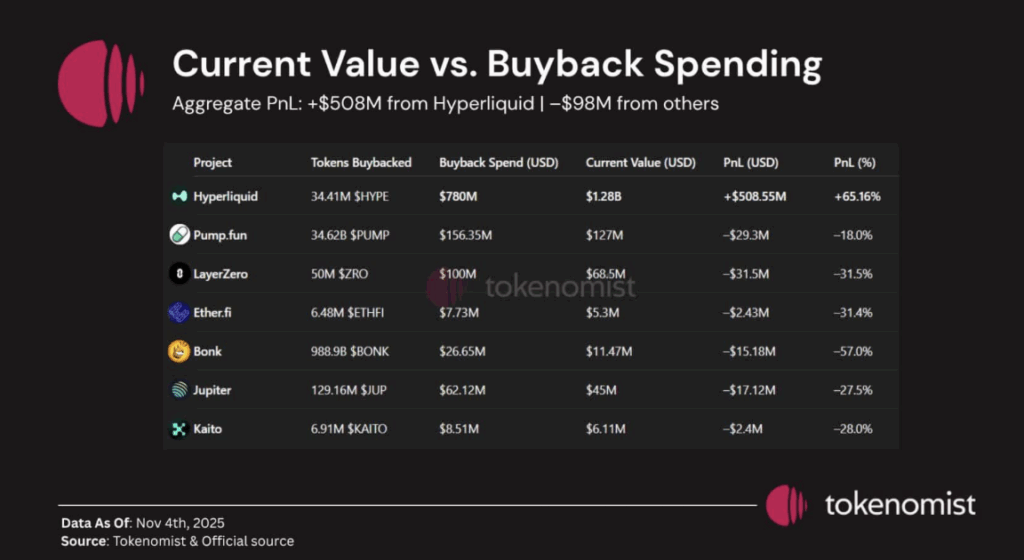

According to Tokenomist data, seven crypto projects collectively spent $1.1 billion on token buybacks. Out of all of them, only Hyperliquid managed to end up in profit. The DEX’s buyback strategy paid off with $1.28 billion in token value post-purchase — a net profit of roughly $508.55 million, or a margin north of 65%.

The rest of the field? Brutal. Bonk led the losses, falling 57% despite sinking $26.65 million into its buyback. LayerZero and Ether.fi each dropped more than 31%, while Jupiter fell 27.5% even after spending over $62 million. Add Kaito and Pump.fun into the mix, and the total combined loss across all six losers hit nearly $100 million.

Buybacks, as it turns out, don’t create value — they just magnify whatever was already there.

Why Hyperliquid’s Strategy Worked

Hyperliquid isn’t a hype coin pretending to be something more. It’s a revenue-generating DEX with real usage — traders pay fees, and HYPE tokens offer tangible perks like discounted trading costs and platform benefits. That creates organic demand, not just speculation.

So when Hyperliquid launched its massive $780M buyback, it wasn’t trying to artificially inflate price — it was reinforcing real demand that already existed. The move also introduced a supply shock, since HYPE’s circulating supply is still relatively limited. Add in the fact that the buybacks happened while the platform was still growing, not at the top, and it’s easy to see why it worked.

At the time of writing, HYPE trades around $38.43, down slightly on the day but still holding up strong after bouncing from $35 lows in late October. On-chain indicators show steady accumulation, suggesting buyers are still confident.

Why Everyone Else Lost

The failures paint a clear picture. Projects like Bonk or LayerZero tried to buy demand that didn’t exist. Bonk, for example, doesn’t have any meaningful revenue stream or real-world token utility — its $26M buyback was just smoke and mirrors. The result? A 56% price collapse, with nearly 30 trillion tokens dumped by holders.

Jupiter ran into the same problem — even as Solana’s leading DEX, its token didn’t carry the kind of functional value that inspires long-term holding. LayerZero’s $100M buyback didn’t help either; with little clarity around what the token actually does, investors had no reason to stick around.

In short, you can’t fake fundamentals. Projects that tried to manufacture demand through flashy buybacks ended up accelerating their decline. Hyperliquid succeeded because it amplified genuine traction — the others failed because they had nothing solid to amplify.