- Hyperliquid airdropped 310 million HYPE tokens worth $1.2 billion during its genesis event on Nov. 29.

- The HYPE token surged 63% in value within 12 hours, reaching $6.16.

- No allocations were made for private investors or centralized exchanges, prioritizing community and ecosystem growth.

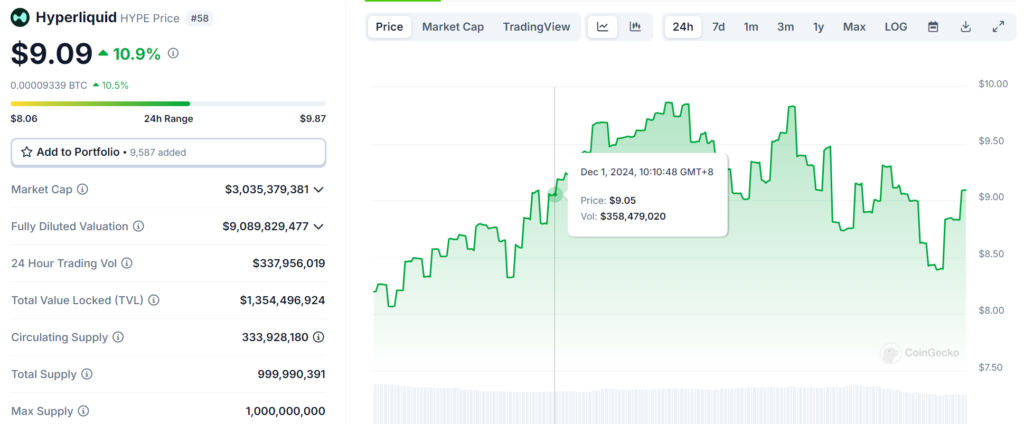

Hyperliquid, a decentralized finance (DeFi) protocol, executed one of the largest token airdrops to date, distributing 310 million HYPE tokens to its community on Nov. 29. Initially valued at $3.90 per token, the total airdrop was worth approximately $1.2 billion, data from CoinGecko confirmed.

Following the launch, HYPE’s value rose by 63% in just 12 hours, trading at $6.16 and pushing its market capitalization to nearly $2 billion. The token functions as both the staking asset for Hyperliquid’s proof-of-stake consensus and the gas token for its Ethereum-compatible HyperEVM layer.

Community-Centric Tokenomics

Hyperliquid’s genesis event distributed 31% of its total 1 billion HYPE tokens. The remaining supply is earmarked for emissions and community rewards (38.8%), the Hyper Foundation treasury (6%), and grants (0.3%). Core contributors are allocated 23.8% under a lockup period lasting until 2028.

Unlike many airdrops, Hyperliquid excluded private investors, centralized exchanges, and market makers, focusing instead on fostering its community and ecosystem.

Airdrop Comparisons in DeFi History

Hyperliquid’s airdrop ranks among the largest in DeFi history, joining notable distributions like Uniswap’s 2020 event and Arbitrum’s 2023 airdrop. Uniswap distributed 400 UNI tokens per recipient, initially valued at $3.40, with its total value surging during the 2021 DeFi boom. Similarly, Arbitrum allocated ARB tokens worth $812,500 to over 625,000 wallets.

Airdrops have become a significant method for blockchain protocols to reward early users and incentivize adoption. According to CoinGecko, airdrops have collectively distributed over $26.6 billion worth of tokens, measured at their peak market values.