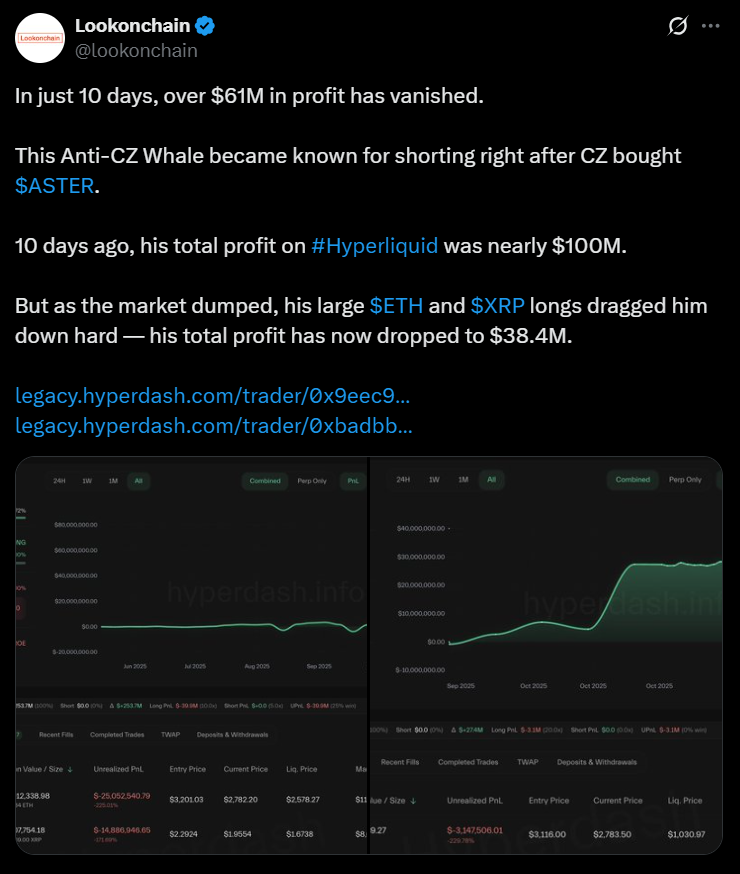

- A Hyperliquid whale’s profits collapsed from $100M to $38.4M in ten days.

- ETH long at $3,200 and XRP long at $2.30 are both deeply underwater.

- More than $61M in profit vanished as both assets fell over 18% in the same period.

A major whale on Hyperliquid just watched profits plunge from nearly $100 million to $38.4 million in only ten days, according to new data flagged by on-chain tracker Lookonchain. The sharp drawdown reflects the brutal selloff gripping the crypto market, with both Ethereum and XRP posting heavy losses that hit leveraged long positions hard.

ETH Long Turns Deep Red

Ethereum’s decline from $3,400 to around $2,800 has been the biggest drag on the trader’s portfolio. The whale opened a long at $3,200, and with ETH now well below that level, unrealized gains evaporated quickly. The move represents an extended 18% slide over ten days, mirroring broader risk-off sentiment.

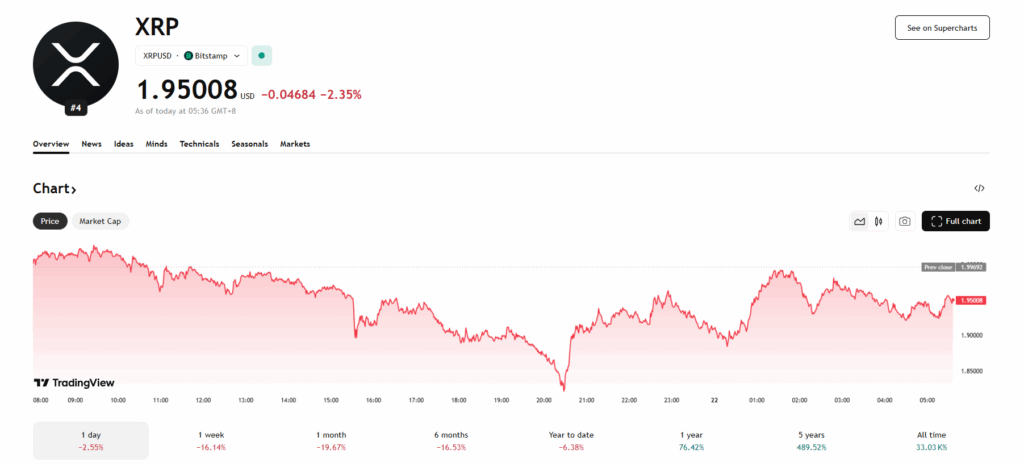

XRP Long Suffers Similar Fate

XRP also dropped sharply, falling from $2.50 down to $1.96 at the time of writing. The trader entered long at $2.30, leaving that position underwater as well. XRP’s double-digit correction contributed heavily to the profit wipeout, with the asset losing more than 18% over the same period.

High Leverage Meets Market Reversal

The whale remains profitable overall, sitting on $38.4 million, but the speed and scale of the drawdown underscore the risks tied to oversized directional bets on Hyperliquid. As the cryptocurrency market unwinds months of gains, leveraged long traders have been among the hardest hit, with sudden price swings accelerating unrealized losses.