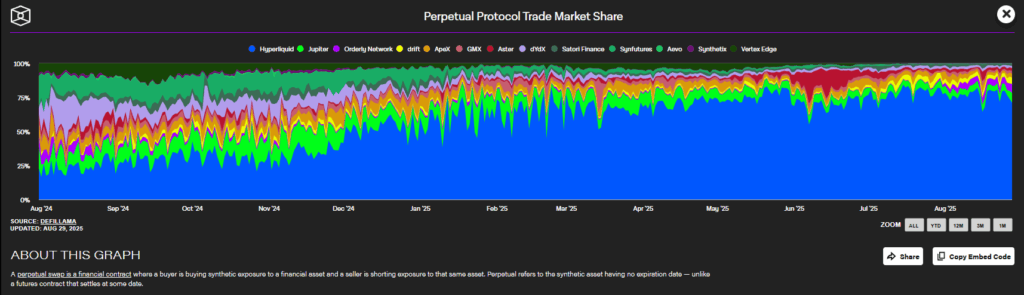

- Hyperliquid (HYPE) now holds nearly 80% of decentralized derivatives market share, with over $200B in recent trading volume.

- Its bold tokenomics skipped venture capital, launching $HYPE directly to public markets to ensure fair access and organic growth.

- Cross-chain deposits, including Bitcoin, and strong liquidity are fueling adoption as Hyperliquid chips away at Binance’s dominance.

Hyperliquid has quickly become one of the biggest stories of this crypto cycle, reshaping the decentralized derivatives market in ways few expected. The platform now commands nearly 80% of all perpetual protocol market share, placing it firmly in the spotlight as the decentralized rival traders are taking seriously against centralized heavyweights.

What makes Hyperliquid stand out is its tokenomics. Instead of leaning on venture capital, like most DeFi protocols do, the team launched the $HYPE token straight into public markets. No early VC discounts, no private rounds — everyone had to get in at market prices. It was a bold move that screamed confidence, while also keeping things fair for the community and proving the protocol was betting on organic growth rather than institutional handouts.

Hyperliquid Chips Away at Binance’s Grip

The shift is already showing up in data. The Hyperliquid-to-Binance volume ratio climbed to 13.6% in recent months, up from just 8% at the start of the year. For context, Binance has long dominated the derivatives market, but this kind of growth suggests traders are more than willing to explore decentralized alternatives if they deliver comparable speed, reliability, and liquidity.

And Hyperliquid hasn’t been playing small ball — the protocol has processed more than $200 billion in trading volume in just the last few months. That’s the kind of number that usually belongs to centralized exchanges, making it clear the gap between CEX and DEX offerings is narrowing fast.

Liquidity, Cross-Chain Access, and The Road Ahead

Part of this success comes from Hyperliquid solving pain points other decentralized protocols have struggled with. The platform’s cross-chain functionality lets users deposit assets from multiple chains — even Bitcoin — something that’s historically been a roadblock for other DEXs. That extra flexibility has made it easier for traders to stick around and shift more of their activity into decentralized markets.

Still, the big question now is sustainability. Can Hyperliquid keep its technical advantage as user demand scales up? Growth is great, but performance is what made traders leave centralized platforms in the first place. If Hyperliquid can hold that line while continuing to expand, it may just prove that decentralized derivatives aren’t a niche anymore — they’re the future.