- HYPE surged 12% to $38.92 after Hyperliquid Strategies unveiled a $1B equity plan to accumulate more tokens.

- Trading volume and open interest jumped 20%, signaling growing bullish momentum and investor confidence.

- The $1B raise will fund treasury expansion and token acquisitions, with the firm set to list on Nasdaq later this year.

The crypto market might be cooling off, but Hyperliquid’s HYPE token is on fire. The token jumped 12% to $38.92 after Hyperliquid Strategies announced plans for a $1 billion equity offering to bulk up its treasury and accumulate more HYPE. The move sparked a wave of fresh optimism, helping the token bounce back from recent lows near $34 and test key resistance levels that could set up a major breakout toward its all-time highs.

Trading activity exploded alongside the rally, with daily volumes climbing 20% to around $690 million. Futures open interest also surged 20% to $1.55 billion, showing traders are betting on more upside. The recovery comes after weeks of volatility linked to token unlock fears, but the new billion-dollar treasury plan has flipped sentiment sharply bullish. After losing some spotlight to the ASTER token rally in September, HYPE finally looks ready to take the lead again.

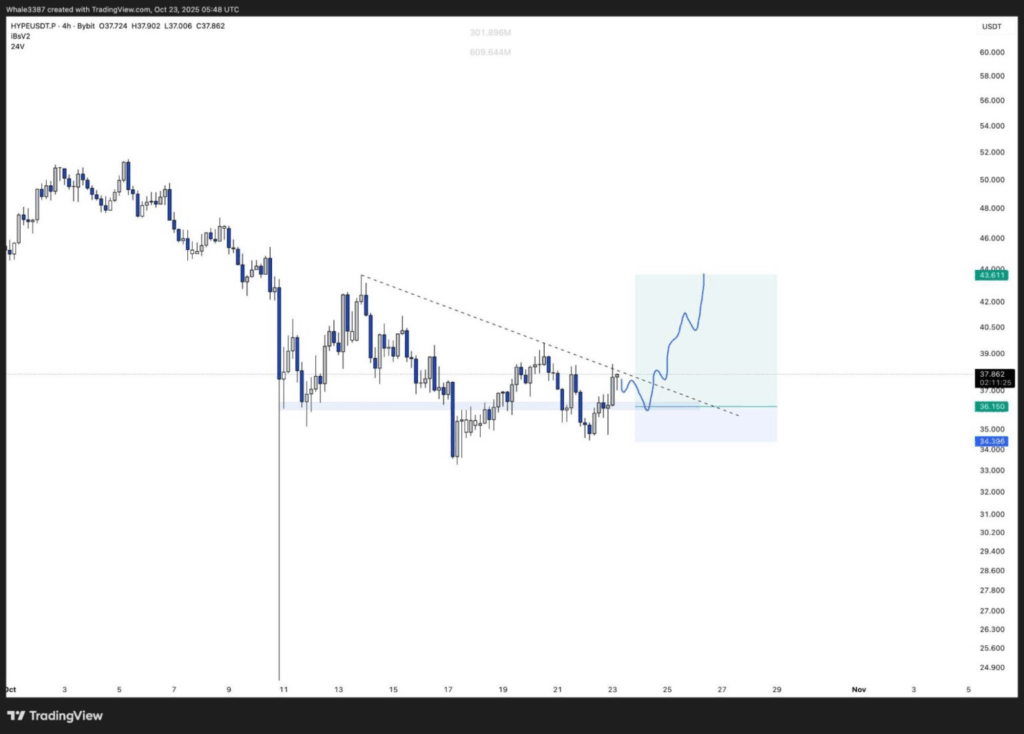

A technical setup hinting at a breakout

Charts show HYPE breaking out of a descending channel pattern — a formation that often precedes strong upward moves. If bulls manage to push past the current resistance zone, analysts believe the token could surge toward the $60 mark, revisiting its previous all-time high. The combination of strong trading volume, growing futures exposure, and renewed confidence in Hyperliquid’s expansion efforts makes this setup one to watch.

At the same time, Hyperliquid itself is evolving fast. The team is preparing to roll out HIP-3, the latest Hyperliquid Improvement Proposal, which will enhance the DEX’s infrastructure and improve execution efficiency across its perpetual trading markets. It’s another signal that the project is scaling up at a time when traders are looking for decentralized alternatives to centralized exchanges.

Hyperliquid Strategies’ billion-dollar play

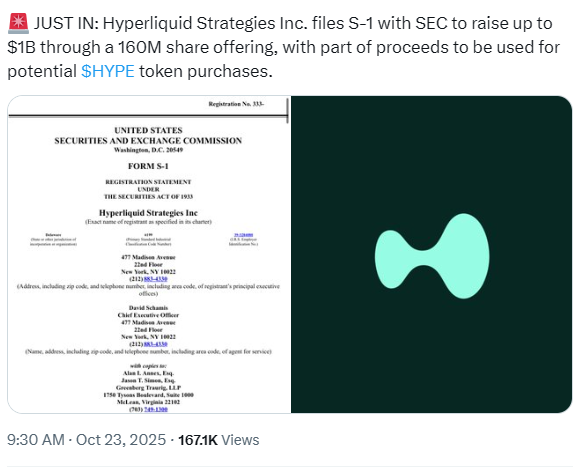

Hyperliquid Strategies officially filed with the U.S. SEC to raise up to $1 billion through a new equity offering. The company plans to issue roughly 160 million common shares under a committed equity facility with Chardan Capital Markets. Funds will be used to reinforce its balance sheet and fuel the HYPE token acquisition plan.

The firm is part of a larger merger between Nasdaq-listed Sonnet BioTherapeutics and Rorschach I LLC, a SPAC entity, with the combined group expected to trade later this year under a new ticker. The move marks one of the biggest equity-backed crypto treasury expansions of 2025 — and it’s clearly paying off in the markets already.