- Analysts warn Solana could drop to $160 as whales reduce holdings and momentum cools.

- Technicals show key support at $160 near the 200-day EMA.

- Despite near-term weakness, analysts remain optimistic.

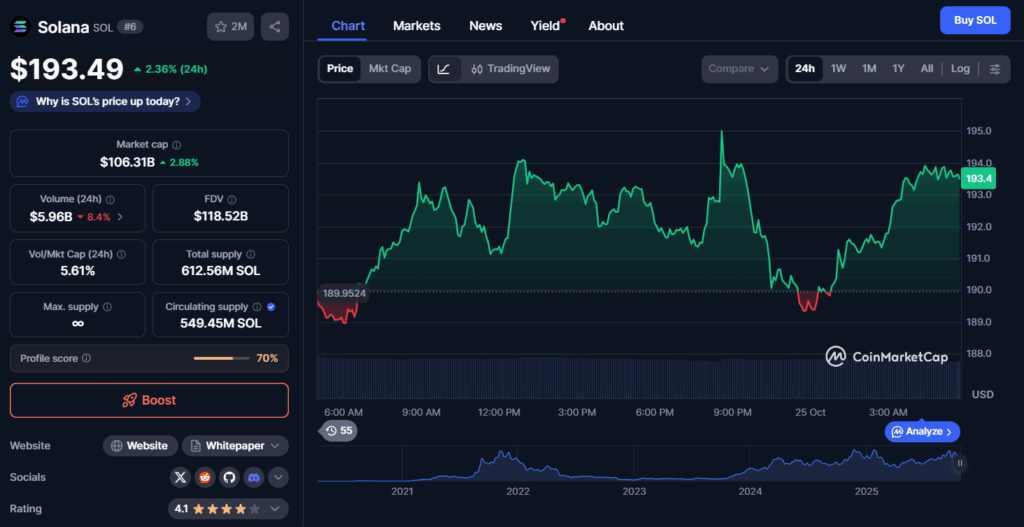

Solana’s recent price action has traders treading carefully again. After rebounding slightly from $175, analysts now warn the network’s native token, SOL, could be headed for a retest of $160. On-chain metrics show large holders are starting to take profits, with whale accumulation dropping off over the past week. This kind of repositioning often signals a cooling trend in bullish momentum, especially when combined with neutral readings across RSI and MACD indicators.

Key Support Levels and Technical Outlook

The $160 level is now emerging as a major line in the sand for Solana’s short-term stability. It aligns closely with the token’s 200-day exponential moving average (EMA), a zone that previously acted as a strong bounce point during earlier corrections. If SOL loses grip on the $175 area, traders warn a clean breakdown could trigger another leg down to $160. For now, buyers appear hesitant, with institutional inflows slowing as funds diversify across other high-utility assets.

Long-Term Outlook Still Intact

Despite near-term weakness, analysts remain optimistic about Solana’s broader trajectory. The ecosystem continues to expand, and upcoming ETF-related developments could reignite investor interest. Most see this pullback as a natural breather after an extended rally rather than a structural breakdown. If Solana manages to hold above $160, it could reestablish its bullish footing heading into the next cycle of institutional accumulation.