- As the US presidential election nears, altcoins face an uncertain future, while Bitcoin remains steady around $70,000

- A Kamala Harris win could lead to heightened regulatory scrutiny on altcoins, while a Donald Trump victory might drive an “explosive upside” for the crypto market

- While some traders are hedging against potential challenges under a Harris administration, others anticipate a market lift if Trump wins

The US presidential election is nearing its conclusion, bringing increased focus on how the outcome could impact the altcoin market.

Altcoins Experience Heightened Volatility

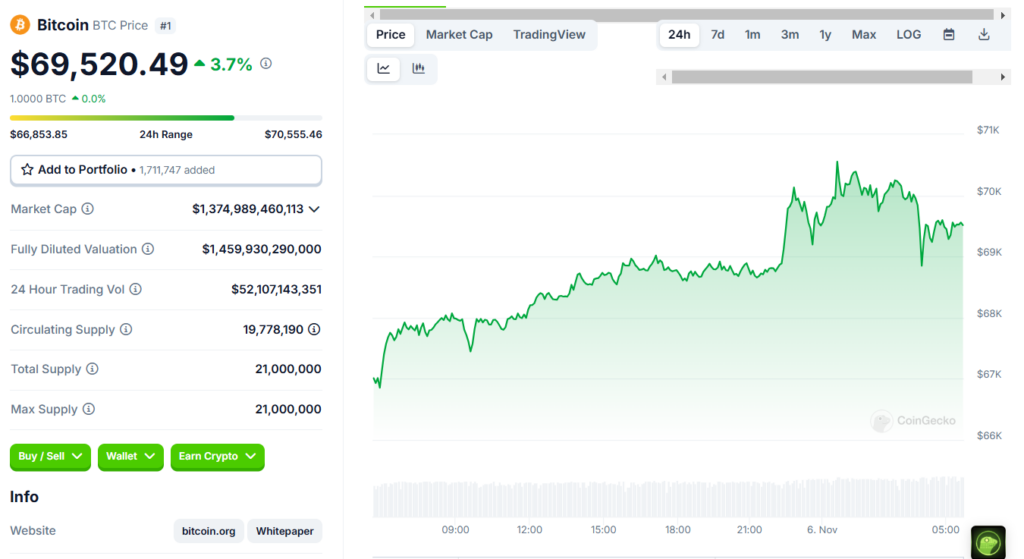

While Bitcoin has remained relatively steady, hovering around $70,000, altcoins like Dogecoin and Solana have seen amplified volatility in anticipation of potential shifts in US crypto regulations and policy depending on the election result.

In a notable move, Dogecoin surged 18% after Elon Musk hinted at a hypothetical Department of Government Efficiency (DOGE) if former President Donald Trump is victorious. The token, now trading at approximately 17 cents, has doubled in value since the start of the year.

Bitcoin Poised For Upside Regardless of Outcome

Zaheer Ebtikar, the founder of Split Capital, said Bitcoin would thrive in this bull cycle regardless of who wins the election. However, Vice President Kamala Harris‘ win might create an environment where altcoins struggle due to increased regulatory scrutiny.

Historically, altcoins tend to surge during bull markets as investors move into these smaller-cap assets after Bitcoin rallies. However, this past year has been challenging for altcoins, which have generally underperformed compared to Bitcoin.

Options Trading Reflects Mixed Sentiment

Options activity on Deribit, the largest crypto options exchange, indicates a divided perspective among traders. Increased interest in protective puts and bullish calls suggests some are hedging against potential regulatory hurdles under a Harris administration, while others are betting on an upside if Trump wins.

Bitcoin Remains Key Bellwether

At the time of writing, Bitcoin is ranked #1 by market capitalization, with a 24-hour trading volume of $451 billion. Bitcoin has a dominant position in the crypto market, and its price action often leads overall market momentum.

The election outcome may pose challenges for altcoins, but Bitcoin appears poised to continue its upward trajectory regardless of the results. Its steady technical strength highlights why many view it as the most important bellwether for gauging the crypto market’s direction.