- Bitcoin price volatility is expected ahead of the US presidential election results on November 5th.

- The key support level for Bitcoin is around $65,000-$66,000, which could lead to a V-shaped reversal after the election results.

- Over $300 million in leverage positions are at risk of liquidation around the $62,000 level if Bitcoin’s price drops sharply after the election.

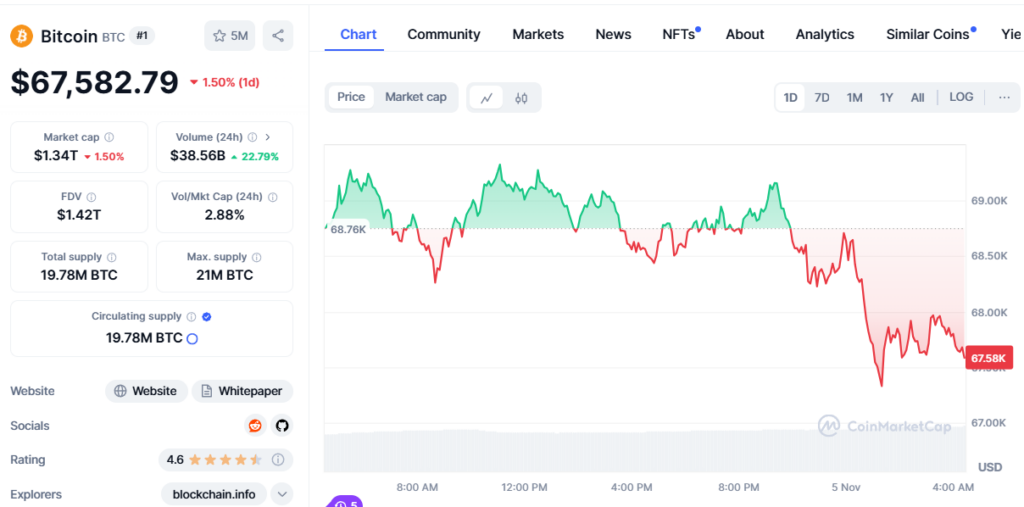

The Bitcoin price has seen increased volatility in the lead up to the US presidential election. Analysts are exploring the potential upside and downside price levels traders should watch around the election results.

Bitcoin’s Recent Price Action

Bitcoin’s price witnessed a sharp 8% correction between October 29th and November 3rd, briefly dropping below $67,500 over the weekend. While the higher timeframe market structure remains bullish, volatility is expected around the election results on November 5th.

Bitcoin’s current uptrend began after it formed lows around $52,500 on September 6th. Since then, each correction has retested the key Fibonacci support level between 0.5 and 0.618. The weekend drop found support here again, indicating the bullish structure remains intact.

The Key Support Levels

The $66,000 to $67,000 range has emerged as an important area of buyer demand and order book depth during Bitcoin’s recent rally above $69,000. This area could act as support again if prices drop after the election results.

A drop to retest the 50-day, 100-day and 200-day moving averages around $62,000 is also possible if leverage longs are liquidated. Over $300 million in leveraged positions sit around this level, posing a liquidation risk.

The Long Term Outlook

While short term volatility is expected, most analysts believe Bitcoin’s long-term trajectory remains bullish regardless of the election outcome. The accelerating institutional adoption of Bitcoin and crypto remains the key driving narrative.

Conclusion

In summary, traders should watch the $66,000 to $67,000 zone for potential support if volatility spikes after the US election results. A drop to retest the key moving averages around $62,000 is also possible if overleveraged longs are liquidated. But the prevailing bullish sentiment around accelerating institutional adoption points to upside over the long term.