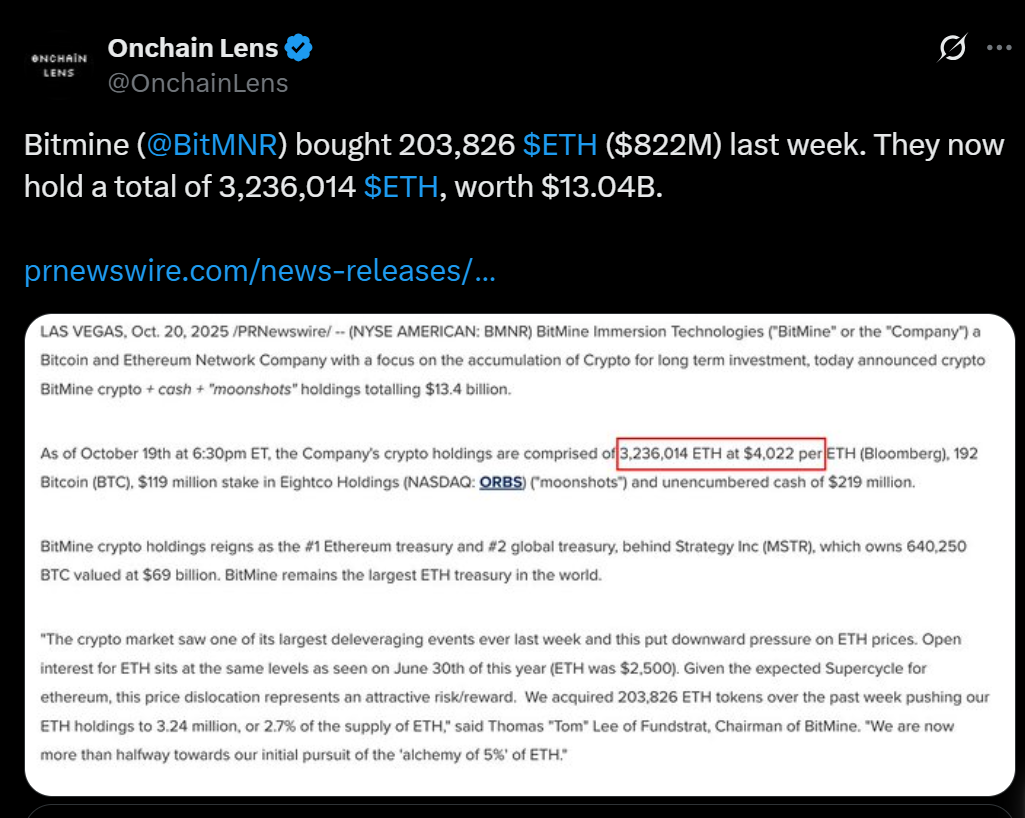

• BitMine Immersion purchased 77,055 ETH ($320M), bringing its total to over 3.31M ETH.

• The firm now holds 2.8% of Ethereum’s total supply and $14.2B in total assets.

• CEO Tom Lee cites market stabilization and macro tailwinds as reasons for the timing.

Tom Lee’s BitMine Immersion Technologies is making another big bet on Ethereum. The digital asset treasury firm announced it had purchased 77,055 ETH worth about $320 million, bringing its total Ethereum holdings to more than 3.31 million coins. At current prices around $4,150 per ETH, that stack is now valued at over $13.7 billion, with BitMine’s combined portfolio — including Bitcoin, equity stakes, and cash reserves — topping $14.2 billion overall.

Closing in on 5% of Ethereum’s Supply

With this latest buy, BitMine now controls roughly 2.8% of Ethereum’s circulating supply, inching closer to its stated goal of reaching 5%. That would make the company one of the most influential ETH holders globally — second only to Strategy (MSTR) in total crypto treasury value. The firm’s stock jumped 4.5% following the announcement, while ETH itself gained roughly 5% over the weekend, reflecting renewed market optimism.

Strategic Timing and Market Sentiment

Thomas Lee, who also co-founded Fundstrat Global Advisors, said the purchase followed signs of stabilization in crypto markets after a recent deleveraging phase. He pointed to easing U.S.–China trade tensions and positive momentum in equities as reasons for the timing, noting that crypto tends to perform well during risk-on phases. Historically, Ethereum has mirrored such macro recoveries, with institutional flows often accelerating once volatility subsides.

BitMine’s Expanding Role in Crypto Finance

Beyond Ethereum, BitMine’s treasury includes small allocations of Bitcoin, shares in Worldcoin-related Eightco (ORBS), and other equity positions across the blockchain sector. The company’s consistent accumulation of ETH highlights its conviction in Ethereum’s long-term dominance in decentralized infrastructure. As Lee continues to project Bitcoin at $250,000 and Ethereum at $15,000 in the next cycle, BitMine’s aggressive strategy signals growing institutional faith in crypto’s next major bull phase.