• Ripple finalizes its $1.25B Hidden Road acquisition, rebranding it as Ripple Prime.

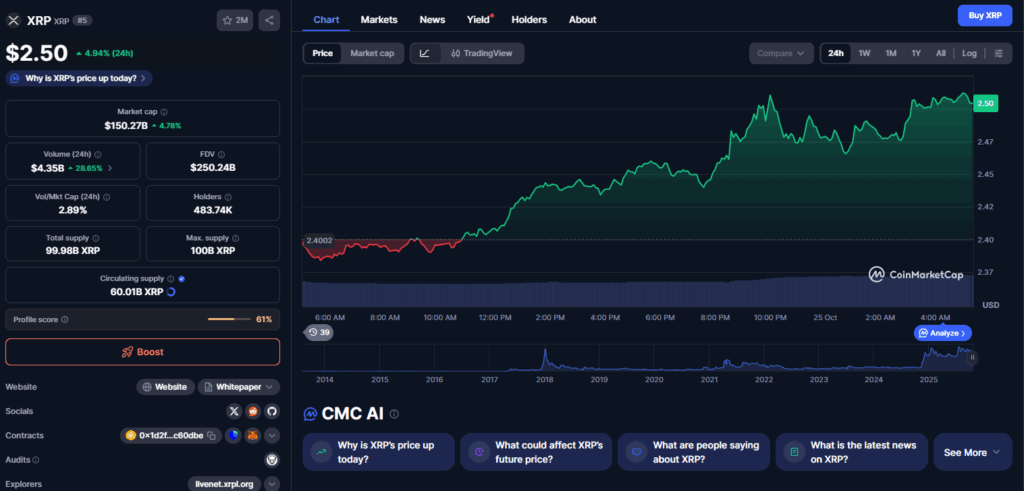

• XRP jumps 5% to $2.50 as Ripple expands from payments to institutional finance.

• Ripple Prime integrates XRP and RLUSD to power next-gen blockchain-based brokerage services.

Ripple just pulled off one of its biggest moves yet — completing its acquisition of global prime broker Hidden Road in a $1.25 billion deal. Now rebranded as Ripple Prime, the acquisition marks a major shift for Ripple as it steps deeper into institutional finance. Following the announcement, XRP surged to around $2.50, gaining 5% on the day and 8% over the week, bouncing back from last week’s broader market dip. With a market cap north of $148 billion, XRP remains the fifth-largest cryptocurrency globally, showing renewed investor confidence.

Ripple Prime: A First in the Industry

According to Ripple, this marks the first time a crypto firm has owned and operated a global, multi-asset prime brokerage platform. Ripple Prime’s business has reportedly tripled in size since the deal was first announced earlier this year. Ripple also revealed that its stablecoin, RLUSD — currently holding a market cap near $899 million — will increasingly serve as collateral on the platform as more institutions adopt it. The company believes Ripple Prime’s infrastructure, combined with XRP and RLUSD, will help streamline institutional operations through blockchain technology.

Expanding Beyond Payments

This acquisition underscores Ripple’s ongoing pivot beyond payments and into broader financial services. The company’s infrastructure — which spans payments, crypto custody, and stablecoin management — is now evolving into a full-service financial ecosystem. Ripple says it aims to use blockchain to cut operational costs and increase efficiency across institutional finance. The move also strengthens the real-world utility of XRP, integrating it directly into the backbone of Ripple Prime’s ecosystem.

A String of Strategic Acquisitions

Ripple Prime isn’t an isolated expansion — it follows a series of major acquisitions. In just over a year, Ripple has acquired GTreasury (October 2025), Rail (August 2025), Standard Custody (June 2024), and Metaco (May 2023). CEO Brad Garlinghouse recently emphasized that these moves reaffirm Ripple’s focus on payments as crypto’s strongest real-world use case. With Ripple’s legal battles with the SEC finally over, the company appears poised to cement itself as a dominant institutional player — one that’s building a bridge between traditional finance and blockchain.