- Bitcoin could hit $80,000-$90,000 if Donald Trump wins the US election, according to Bernstein analysts, due to his support for Bitcoin and cryptocurrencies.

- A Kamala Harris win could cause an instant dump in the Bitcoin market due to fears of increased regulatory scrutiny on crypto under her administration.

- Bitcoin is anticipated to reach $100,000 by the end of November, considering its historically strong performance in that month and a potential Fed rate cut.

The US presidential election between Donald Trump and Kamala Harris is coming down to the wire. With the race projected to be close, analysts have made bold predictions on how the outcome could impact Bitcoin’s price.

Trump Win Could Send Bitcoin to $80k-90k

According to analysts at Bernstein, Bitcoin’s price will likely reach $80,000-90,000 if Trump wins the election. Trump has publicly advocated for cryptocurrencies during his campaign. Key proposals include appointing a crypto-friendly SEC chair, establishing a national Bitcoin reserve, and making the US a hub for mining.

Bernstein’s bullish prediction aligns with historical trends showing Bitcoin reaching new highs after US elections, especially following its quadrennial halving events. For example, after the 2012 halving, Bitcoin surged from $12 to $1,150 in 2013. Similarly after the 2016 halving, Bitcoin rose from $650 to $20,000 by end of 2017. With the 2020 halving completed in April 2024, another upward move seems likely.

Harris Win Could Cause an Instant Bitcoin Price Dump

Analyst Miles Deutscher argues Bitcoin will likely reach $100,000 or higher regardless of the winner, but the path and timing differs based on the outcome. He says a Harris win will likely cause an instant Bitcoin price dump, as her administration may maintain or strengthen crypto regulations.

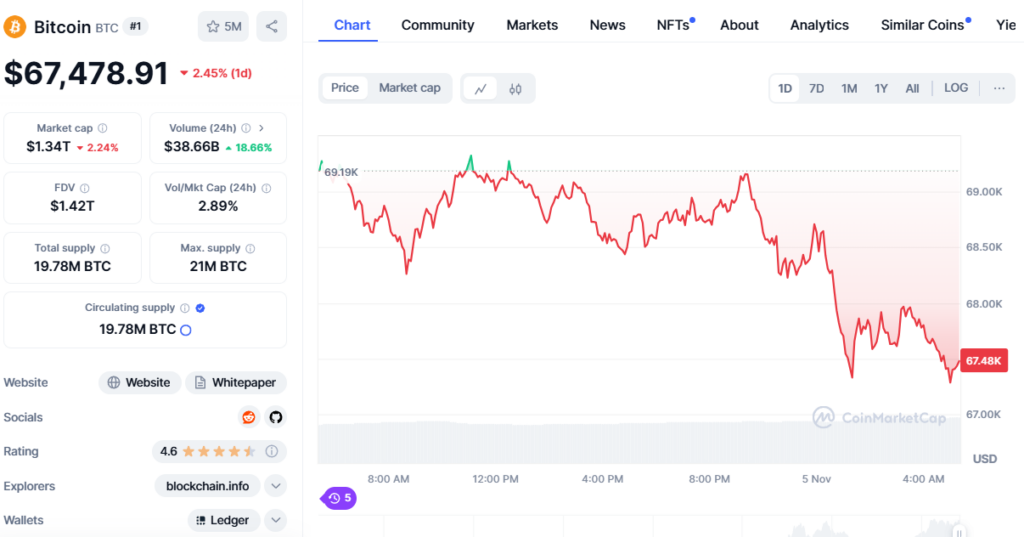

Bets on Polymarket support this prediction, with the strongest bets on a November drop to $65,000. This aligns with growing fears that Harris could bring increased regulatory scrutiny.

Bitcoin Could Hit $100k by November’s End

Historically, November has been Bitcoin’s most profitable month since 2013, with average returns of 46%. Analyst Lark Davis anticipates similar gains this November, which could take Bitcoin to $104,000 from current levels.

The upcoming Fed meeting on Nov 7, with potential for a rate cut, could also boost Bitcoin’s price. The combination of strong seasonal performance, possible Fed easing, and Trump’s crypto-friendly narrative, point to an optimistic outlook for Bitcoin this month.