- Ethereum (ETH) saw a 53% gain in 2024, trailing Bitcoin’s 113% surge, but rallied strongly after the U.S. election with a 39% climb.

- Key drivers of Ethereum’s resurgence include growing staking dynamics, steady transaction fees, increased institutional interest through ETFs, and its role in DeFi, NFTs, and Web3.

- Factors fueling Ethereum’s growth are the outperformance of Ether ETFs over Bitcoin ETFs, upcoming protocol upgrades, lucrative staking rewards, and the potential for an altcoin season.

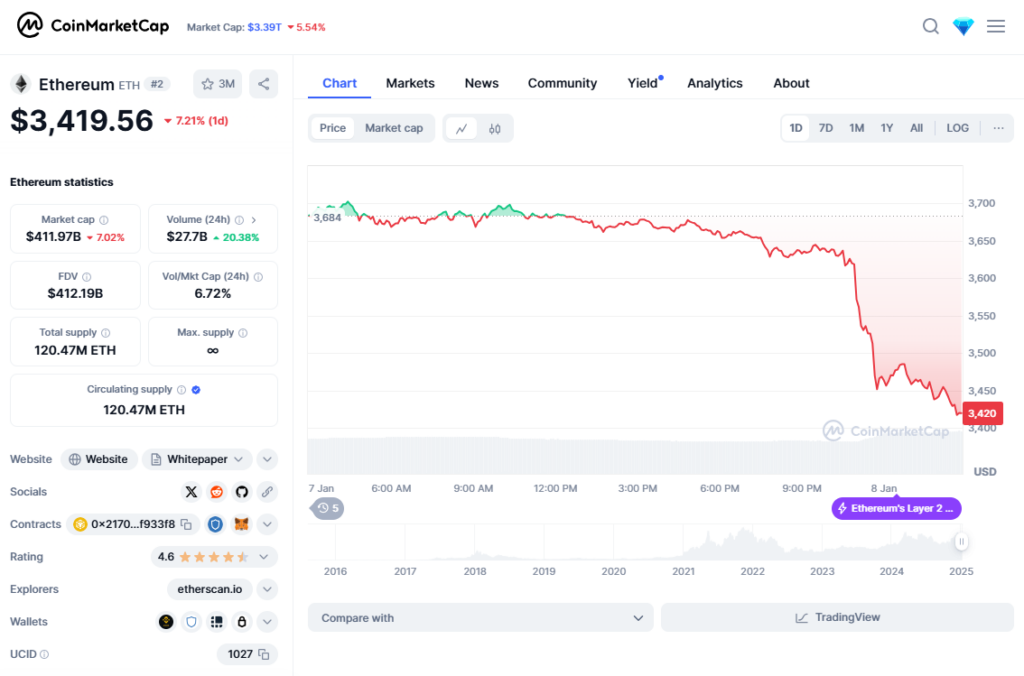

After trailing behind its crypto peers for most of 2024, Ethereum (ETH) is finally making waves. While Bitcoin stole the spotlight with its record-breaking highs, ETH quietly crossed the $4,000 mark in December—though it’s still a bit shy of its all-time high of $4,900.

Ethereum’s 2024 Performance: A Slow Start, but Strong Finish

Ethereum saw a modest 53% gain throughout 2024, compared to Bitcoin’s impressive 113% surge. However, things shifted after the U.S. election results. Since then, ETH has climbed 39%, slightly outpacing Bitcoin’s 35%. Investors are buzzing with optimism over president-elect Donald Trump’s rumored pro-crypto policies, and Ethereum seems ready to capitalize on the momentum.

Key Drivers Behind Ethereum’s Resurgence

Ethereum’s recent rally isn’t just riding on election hype. Several factors are contributing to its newfound strength, including growing staking dynamics, steady transaction fees, and increased institutional interest, especially through ETFs.

CME Ether Futures Show Growing Interest

Despite starting the year with relatively low activity, CME Ether Futures became a hot spot for risk management as volatility returned mid-year. With the launch of spot Ether ETFs, futures trading surged, hitting $256 billion in total value for 2024. The fourth quarter alone accounted for 39% of the trading volume, driven by market reactions to the election.

What’s more, large institutional players—dubbed large open interest holders—reached new records in December, showing a growing appetite for regulated ways to manage Ethereum’s price risks.

ETH-BTC Ratio: Bouncing Back from Lows

Ethereum’s performance relative to Bitcoin, measured by the ETH-BTC ratio, hit its lowest point in November at 0.032857. However, with improved regulatory clarity and rising institutional adoption, this could mark a turning point. Traders are eyeing a potential rotation from Bitcoin to Ethereum as confidence builds.

What’s Fueling Ethereum’s Growth?

1. Ether ETFs Outperforming Bitcoin ETFs

Since their launch in July 2024, U.S. spot ETH ETFs have pulled in $577 million in net inflows. At one point in late November, ETH ETFs even surpassed Bitcoin ETFs in daily inflows, with a staggering $428 million coming in a single day.

The approval of these ETFs marks a significant milestone for crypto adoption, and if Ethereum staking yields become part of these products, institutional interest could soar even higher.

2. Upcoming Upgrades

Ethereum’s March Dencun upgrade brought lower transaction fees and improved Layer 2 scalability. Looking ahead, the Pectra upgrade in early 2025 promises to enhance protocol efficiency, expand data capacity, and lay the groundwork for future scalability improvements.

3. DeFi, NFTs, and Beyond

Ethereum isn’t just a digital currency; it’s the backbone of DeFi, NFTs, and Web3. The total value locked (TVL) in Ethereum-based DeFi projects has climbed to $69.4 billion, reflecting growing confidence in its ecosystem.

4. Staking Rewards Sweeten the Deal

Ethereum’s staking rewards are another key draw. About 28% of ETH’s supply is locked in staking contracts, with annual rewards averaging 3%. As the Federal Reserve signals potential rate cuts, and with ongoing blockchain upgrades, staking yields could become even more attractive in the coming months.

5. Alt Season Is Heating Up

Traders are betting on an alt season, where altcoins like Ethereum gain momentum after Bitcoin’s initial rally. Bitcoin’s dominance has dropped from 61.7% in October to 56.5% in December, suggesting that altcoins are starting to catch up.

Conclusion: Eyes on 2025

The crypto world is watching closely to see how the Trump administration will influence the market. With growing institutional interest in ETH ETFs, lucrative staking opportunities, and Ethereum’s central role in DeFi and NFTs, 2025 could be a pivotal year for ETH. Whether you’re a seasoned investor or just getting into the game, Ethereum’s potential looks brighter than ever.