- Ether’s open interest in the futures market hit an all-time high of 132 million ETH on November 11th, indicating increased interest and liquidity.

- Demand for Ether has increased, as shown by a 26% rise in the number of daily active addresses on the Ethereum blockchain after Donald Trump’s election win.

- US spot Ether ETFs recorded inflows of over $295 million on November 11th, the biggest single-day inflow since their launch in July, suggesting growing institutional demand.

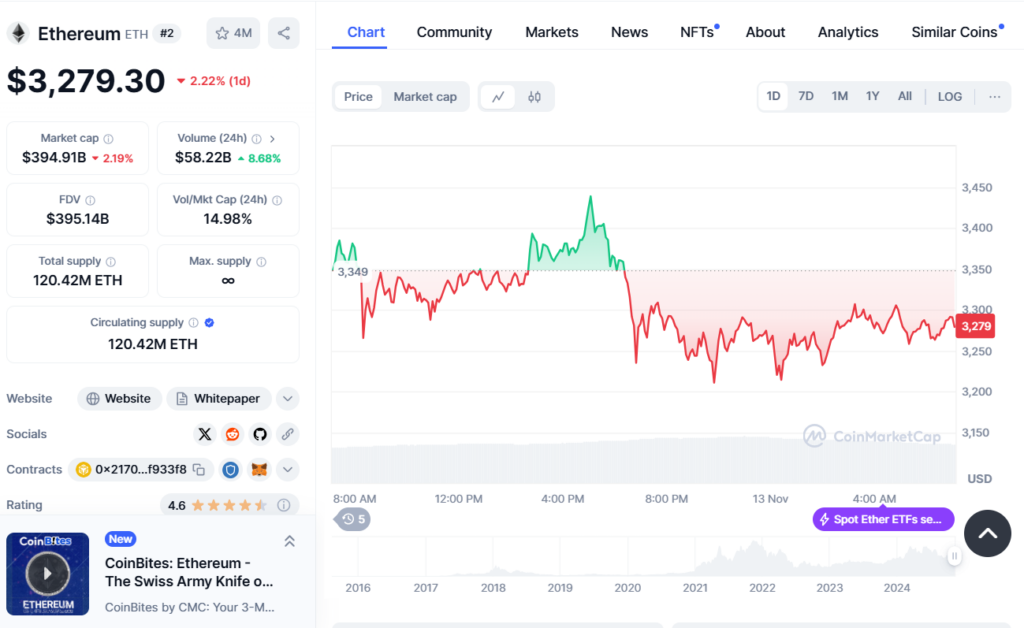

The price of Ethereum has surged over 37% in the past week, reaching highs not seen since July. Multiple metrics suggest Ethereum’s uptrend remains strong with the potential to push toward $4,000 soon. This article explores the factors driving Ether’s bullish momentum.

Futures Market Signals Increasing Demand

Ethereum’s recent rally followed a spike in open long positions on ETH futures contracts. According to data from CryptoQuant, Ethereum’s total open interest hit an all-time high of 132 million ETH on November 11, up from 98 million on November 5. This surge in futures activity signals rising trader engagement and liquidity in the ETH derivatives market.

On-Chain Activity Picks Up

Increased on-chain activity also suggests growing demand for ETH amid greater network usage. The number of daily active addresses on Ethereum climbed to 388,350 on November 12, a 26% increase from 306,751 on November 5, based on CryptoQuant data. Higher user interaction with Ethereum suggests more token transactions.

DappRadar data likewise shows an 8% rise in active addresses for Ethereum dApps over the past week. Sustained growth in network activity should drive further ETH demand.

Spot ETF Inflows Turn Positive

The recovery in ETH price after the U.S. election coincided with a flip to positive inflows for spot Ethereum ETFs following $73 million in outflows prior. According to SoSoValue, ETH spot ETFs saw record inflows of over $295 million on November 11.

The Fidelity Ethereum Fund led with $155 million inflows, followed by the iShares Ethereum Trust ETF at $101 million. Continued institutional inflows into Ether investment products could propel ETH back toward its March highs above $4,000.

Conclusion

Multiple metrics point to strengthening bullish momentum for Ethereum. Increased futures interest, on-chain activity, and spot ETF demand suggest the potential for Ether to rally toward the $4,000 level soon. However, every investment involves risk and readers should conduct their own research before making decisions.