- HBAR is trading at $0.30, with key resistance at $0.31 and support at $0.29.

- Hedera’s hashgraph technology provides speed, scalability, and energy efficiency for enterprise solutions.

- Expanding adoption in decentralized finance and partnerships with global organizations boost its market position.

Hedera (HBAR), known for its unique consensus algorithm, has gained attention for its efficiency and enterprise-level use cases. The cryptocurrency has consistently been a focus for businesses seeking reliable blockchain solutions for various applications, including supply chain, tokenization, and decentralized finance.

Recent Price Movements and Growth

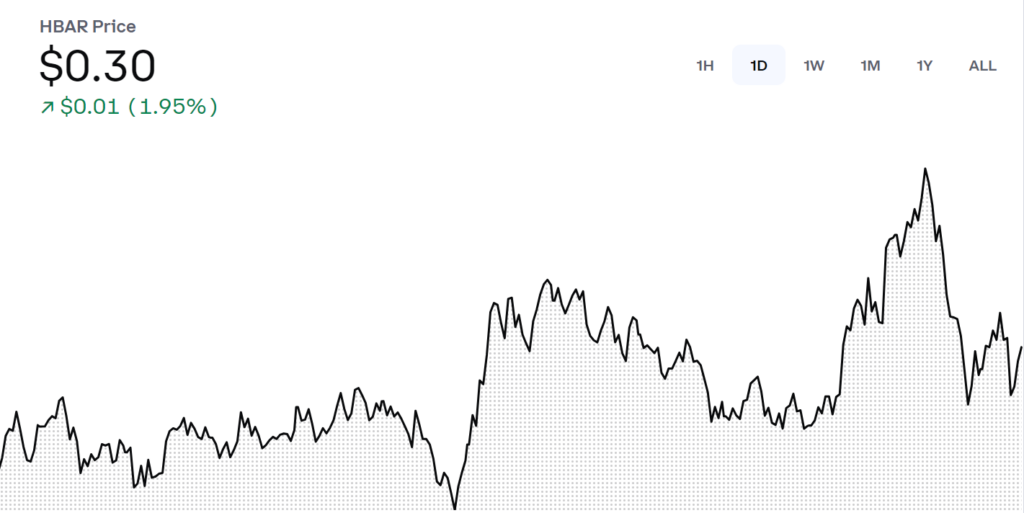

HBAR is currently trading at $0.30, reflecting a 1.95 percent increase over the last 24 hours. The token has been building on its recent upward trajectory, testing resistance levels near $0.31 while holding firm support around $0.29. This price activity is supported by increased trading volume, suggesting growing investor interest in the asset.

Over the past week in the Coinbase chart, HBAR has shown steady gains as market sentiment improves, aligning with a broader crypto market recovery. The price chart reveals a series of higher highs and higher lows, indicating a bullish trend for the token. This momentum positions HBAR as a promising asset in the near term.

Technological Edge and Adoption

Hedera’s core advantage lies in its hashgraph consensus mechanism, which provides faster transactions, scalability, and lower energy consumption compared to traditional blockchains. These attributes make it appealing to enterprises looking to leverage blockchain technology for real-world applications.

The network has witnessed growing adoption across industries, with several major partnerships established in recent months. Hedera’s governing council includes globally recognized organizations such as Google, IBM, and Boeing, which oversee its development and ensure decentralization. This governance model has reinforced Hedera’s reputation as a trusted platform for institutional use.

In addition to enterprise solutions, HBAR is gaining traction in the decentralized finance ecosystem, with new dApps and projects leveraging its efficient infrastructure. This expansion of use cases further solidifies its position as a versatile digital asset.

Market Sentiment and Future Outlook

The sentiment around HBAR remains optimistic, bolstered by its consistent network performance and ongoing integration with enterprise systems. A break above the $0.31 resistance level could pave the way for further price appreciation, with targets set at $0.33 and beyond.

HBAR’s focus on sustainability, combined with its ability to handle high transaction throughput, positions it as a leader in blockchain innovation. Its alignment with institutional needs and the growing interest in decentralized applications indicate long-term growth potential.