- HBAR dropped after the recent market crash but holds above key support.

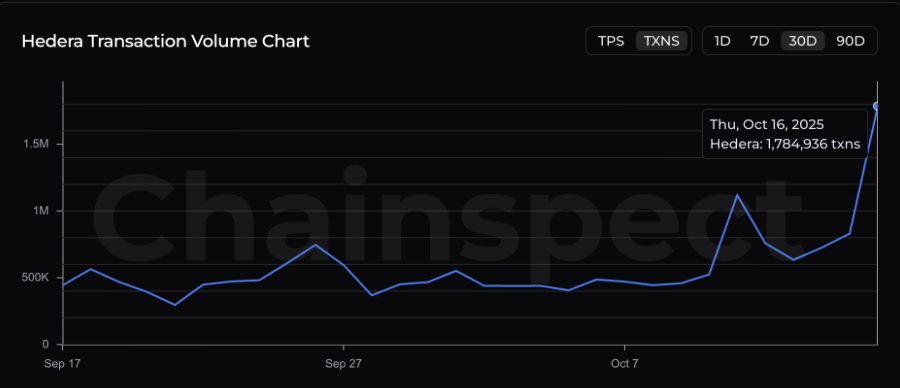

- Hedera network records over 1.78M daily transactions, signaling strong adoption.

- New UAE partnership launches decentralized digital IDs, expanding Hedera’s reach in Asia.

Hedera Hashgraph (HBAR) is pushing deeper into Asia with its newest collaboration — a partnership with the UAE to deploy decentralized digital identities. The move strengthens Hedera’s real-world adoption narrative, though its token hasn’t escaped the wider crypto market downturn. HBAR has slipped over the past two days, echoing broader market volatility that’s left traders cautious but watchful.

HBAR Price Action: Bearish, But a Potential Setup in Play

Looking at the 3-day chart, HBAR is trading midway through a falling trend channel, a range that has contained price action since the last big bull run that wrapped up in late 2024. After reaching its December highs again earlier this year, HBAR entered what looks like an accumulation phase.

During last week’s flash crash, HBAR briefly touched $0.075, only to rebound sharply and close back above $0.20 — a strong rejection that shows buyers are still active at lower levels. Since then, though, price has drifted down to around $0.15, stabilizing near the midline of the channel. This same zone has acted as a key support level, with three notable bounces in recent weeks.

If that support gives way, analysts warn HBAR could slide to $0.10 before finding another solid floor. But if it manages to hold, a move toward the upper band of the channel might spark a breakout attempt — potentially pushing HBAR toward $0.75 or even higher, especially if the broader crypto market regains strength.

While the short-term outlook leans bearish, the flag pattern forming on higher timeframes is typically viewed as a bullish continuation structure. That suggests Hedera’s long-term trajectory could remain upward — assuming its network activity and partnerships continue to scale.

Network Activity Surges as On-Chain Adoption Grows

Despite the price turbulence, Hedera’s on-chain activity is booming. The network processed a daily record of over 1.78 million transactions on October 16, a sign that real adoption is kicking in beyond speculative use.

Even more impressive, transaction volume across Hedera’s crypto services jumped nearly 20x compared to its normal levels. Fresh data shows an hourly transaction count above 20,000, representing a 9% increase over previous periods.

Current daily activity sits around 826,000 transactions, up 8% week-over-week. The weekly and monthly totals reached roughly 3.2 million and 15.3 million respectively. Over the past three months, the network has handled nearly 53 million transactions, underscoring its expanding utility in enterprise and decentralized applications.

The strong spikes in usage suggest that Hedera’s infrastructure — especially its low-cost, high-speed framework — continues to attract serious projects and partners, even while markets correct.

Hedera Partners With UAE on Decentralized Digital IDs

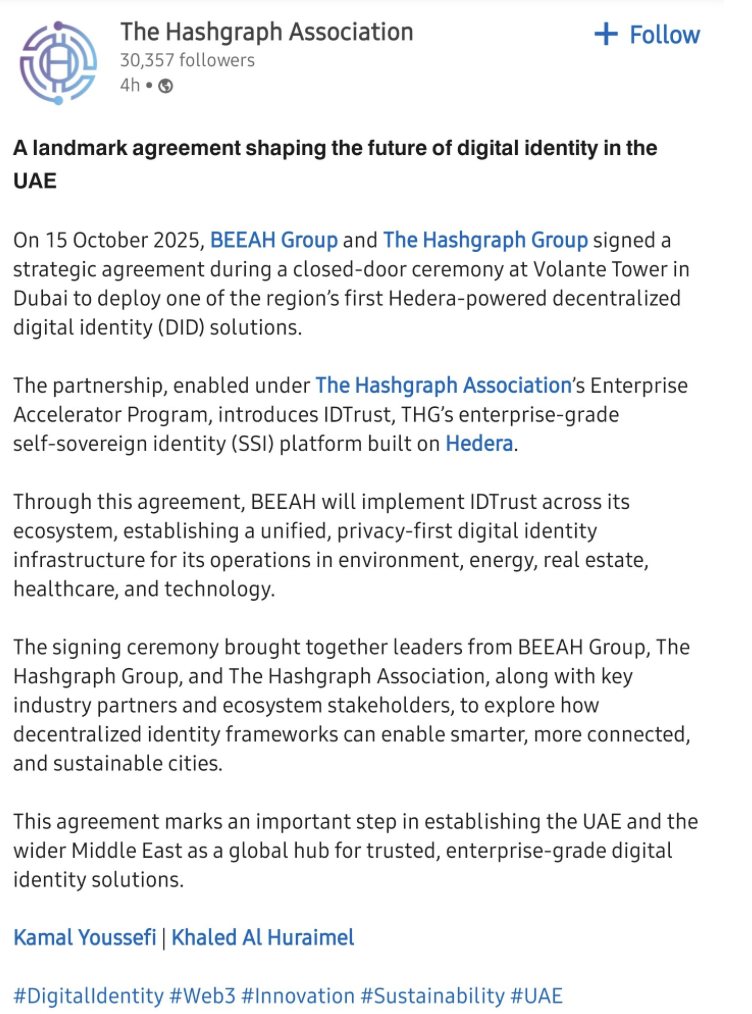

One of the biggest headlines this month came from Hedera’s partnership with BEEAH Group and The Hashgraph Group to launch IDTrust, a decentralized digital identity (DID) platform built on Hedera’s distributed ledger technology.

The initiative, revealed during an event at Volante Tower in Dubai, marks one of the UAE’s first enterprise-level DID solutions. IDTrust falls under The Hashgraph Association’s Enterprise Accelerator Program, and it’s designed to offer secure, self-sovereign identity management for businesses and citizens alike.

BEEAH plans to integrate the platform across its operations in energy, real estate, environment, and healthcare, building a privacy-first ecosystem for managing data. This partnership positions the UAE as a leader in digital identity innovation, backed by Hedera’s secure infrastructure.

More broadly, it highlights Hedera’s growing role in the Web3 and enterprise blockchain scene — particularly in regions prioritizing digital transformation and trust-based systems.

Final Thoughts

While HBAR’s short-term chart looks shaky, its fundamentals keep getting stronger. The network’s expanding utility, record-breaking on-chain activity, and growing list of enterprise partnerships — especially in the Middle East — give long-term investors plenty to stay optimistic about.

If the crypto market stabilizes and HBAR maintains its structure above key supports, this consolidation phase might just be setting up for the next big leg upward.