- Hedera’s utility and transaction volume continue to grow while price remains muted

- Institutional structures, ETFs, and governance are reshaping HBAR supply and demand

- Long-term valuation depends on infrastructure adoption, not speculative hype

The crypto market has a habit of rewarding noise over substance. Loud stories dominate timelines, while quieter infrastructure work often goes unnoticed. That contrast sits at the heart of a recent breakdown from Cheeky Crypto News, where analyst Nick takes a closer look at Hedera and why the long-term math behind HBAR keeps pulling serious attention, even without hype.

Hedera doesn’t behave like most crypto projects. There are no meme cycles or constant promotional pushes. Instead, the network moves deliberately, building in the background while much of the market chases short-term momentum. That’s exactly why talk of a $5 HBAR price sounds unrealistic at first, until the numbers start to add up.

Hashgraph and Why Hedera Scales Differently

Hedera runs on Hashgraph rather than a traditional blockchain, and that design choice shapes everything else. Hashgraph allows thousands of transactions per second without congestion or unpredictable fees. These aren’t lab results either. As 2026 unfolds, the network is already processing millions, and at times billions, of real-world transactions.

For large organizations, reliability and predictability matter more than hype. Hedera offers both, which explains why global companies are willing to associate their reputations with the network. It may not generate retail excitement, but it builds infrastructure institutions can trust.

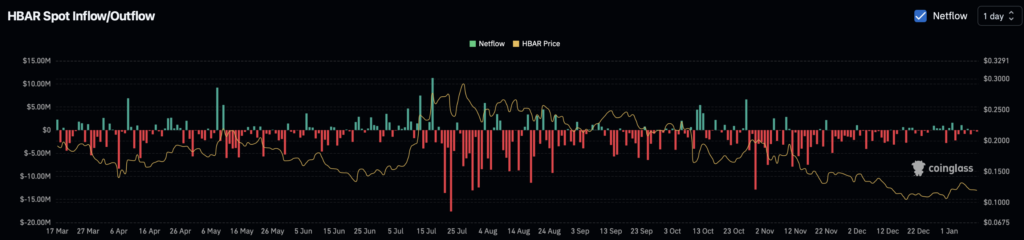

HBAR Price Looks Quiet Because Utility Leads Speculation

HBAR trading around $0.13 has frustrated many traders. With a market cap near $5.6 billion, the valuation looks small compared to the scale of activity happening on the network. Nick frames this as utility outpacing speculation.

High transaction volume without explosive price action often signals accumulation rather than disinterest. Institutions tend to move quietly, especially when infrastructure is involved. One example highlighted by Cheeky Crypto News is Hedera’s integration into Bitget’s global markets, which opened deep liquidity channels into Asia and Southeast Asia.

HBAR USDT pairs frequently saw daily volume above $250 million, with sharp spikes during active market periods. That depth matters. Large buyers need markets that can absorb size without distorting price.

Governance Built for Institutions, Not Hype Cycles

Governance is where Hedera really separates itself. The Hedera Governing Council is made up of major global organizations spanning finance, technology, energy, law, and academia. Companies like Google, IBM, Boeing, and Repsol participate as equal members, with nodes distributed across continents.

This structure reduces regulatory uncertainty, which is critical for institutions deploying large amounts of capital. Stability often matters more than speed when trillions are involved, and Hedera appears designed for that reality.

Breaking Down the Math Behind a $5 HBAR Price

The math becomes clearer when broken down. Circulating supply sits near 43 billion HBAR, roughly 86% of the maximum supply. At around $0.13, that places market cap near $5.6 billion. A $5 HBAR price implies a valuation of roughly $215 billion, about 40% of Ethereum’s current market cap.

According to Nick, this doesn’t require Hedera to replace Ethereum or Solana. Capturing a meaningful slice of enterprise settlement and tokenization flows could be enough. Tokenizing just 1% of global equities, estimated near $100 trillion, already supports that scale.

How the HBAR ETF Changed Supply and Demand

A major structural shift arrived with the Canary Capital spot HBAR ETF, trading under the ticker HBR. Filed in late 2025, the ETF opened access for pension funds, family offices, and wealth managers. Within its first week, net inflows exceeded $70 million, and by early 2026 it absorbed more than 1% of circulating HBAR supply.

Each dollar entering the ETF removes tokens from open markets and locks them into custody. Cheeky Crypto News describes this as a Bitcoin-style institutionalization moment, where price discovery gradually shifts away from retail speculation.

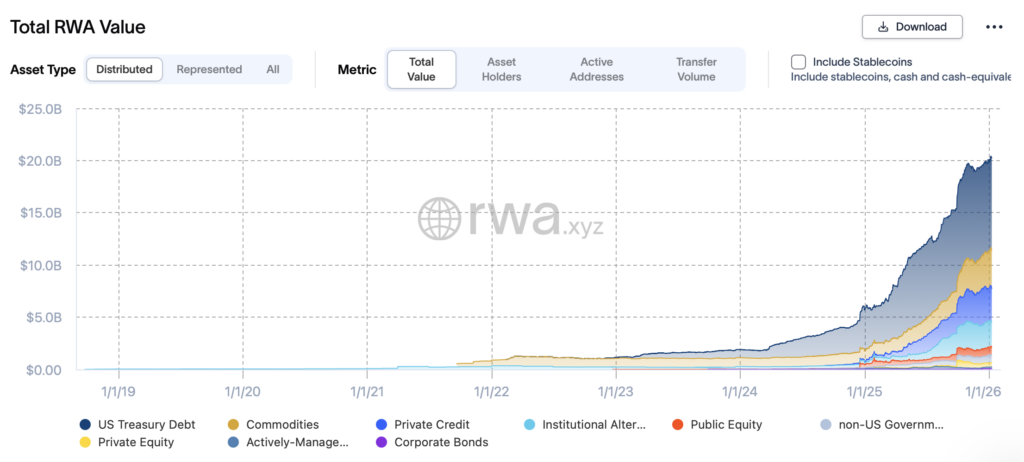

Real-World Tokenization and AI Create Non-Speculative Demand

Real-world asset tokenization remains one of Hedera’s strongest narratives. RedSwan has already tokenized more than $5 billion in institutional-grade real estate on the network, including landmark properties in New York. Tokenization compresses months of legal and settlement work into near-instant digital transactions, and every transaction consumes HBAR.

Regulatory alignment adds another layer. Hedera was built with ISO 20022 compliance in mind, helping explain its role in CBDC pilots and banking integrations worldwide. Collaboration with Nvidia and Accenture introduces AI auditability, where machine actions are recorded on Hedera for verification at scale. Each verification step creates additional functional demand.

A Quiet Network With Loud Math

Critics often point to supply size or corporate governance, but most supply is already circulating and inflation pressure has eased. Governance may move slower than developer-driven chains, yet institutions prioritize predictability over rapid experimentation.

A $5 HBAR price sounds extreme until infrastructure adoption, ETF flows, real-world tokenization, regulatory alignment, and AI verification demand are viewed together. None of these rely on hype cycles. Hedera continues to build quietly, and the arithmetic behind it is becoming harder to ignore.