- Grayscale has filed for a Spot XRP ETF on the NYSE, signaling major progress for crypto investment in the U.S.

- The firm’s XRP Trust surged 300% in January amid speculation of ETF approval within the next year.

- Grayscale also filed for a Spot Solana ETF and launched a Bitcoin Miners ETF, expanding its crypto offerings.

In a major shake-up for the crypto world, Grayscale has filed to launch a Spot XRP ETF on the New York Stock Exchange (NYSE). Yep, it’s official—a filing with the U.S. Securities and Exchange Commission (SEC) confirmed the move, marking another step toward bringing new crypto investment vehicles to market.

Grayscale isn’t alone in this race, either. They’ve joined forces with five other asset managers, including Bitwise and WisdomTree, all vying to push their own spot ETFs forward. And if that wasn’t enough, Grayscale is also looking to roll out a Spot Solana ETF, a move that could change the game entirely for crypto investors in the U.S., especially with the recent policy shifts we’ve been seeing.

A Massive Shift in Crypto Regulation

It’s wild to think how much has changed in such a short time. Not long ago, Ripple was locked in a grueling legal battle with the SEC, which seemed hell-bent on keeping XRP under its thumb. The SEC was determined to control the sector through constant enforcement, challenging XRP’s very legitimacy at every opportunity.

Fast forward to today, and it’s like a completely different world. With Donald Trump back in the White House and a pro-crypto stance taking root, the SEC has done a full 180. Gary Gensler has resigned, and Mark Uyeda has stepped in as the new chairman, signaling a friendlier approach toward digital assets. On the heels of these changes, Grayscale has now officially submitted its Spot XRP ETF application to the NYSE.

Ripple’s Comeback and Grayscale’s Expansion

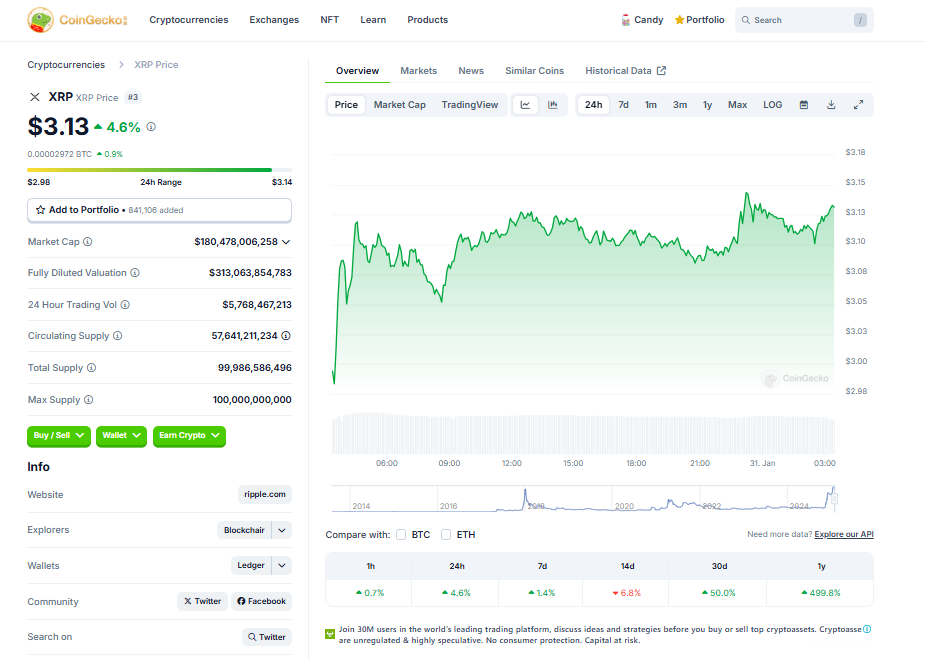

Grayscale’s timing couldn’t be better. Their existing XRP Trust has been crushing it lately, surging 300% just at the start of January, thanks to speculation about the ETF’s approval. According to Nasdaq reports, investors have been piling in, anticipating that XRP could finally get its ETF in the next 12 months.

This isn’t Grayscale’s first foray into the ETF arena either. In 2024, the U.S. approved its first two crypto-based ETFs for Bitcoin and Ethereum. Those launches were huge—the Bitcoin ETF was even hailed as the greatest ETF debut in history. With that success in mind, there’s now mounting anticipation for altcoin ETFs, including XRP and Solana.

On top of their XRP ambitions, Grayscale filed for a Spot Solana ETF late last year and recently launched a Bitcoin Miners ETF this past Thursday. Clearly, they’re making serious moves to expand crypto investment opportunities.

The takeaway? Crypto ETFs are quickly becoming a cornerstone of the U.S. market, and Grayscale is right at the center of it all. With policy shifts and new investment products on the horizon, the next few months could be pivotal for digital assets in America. Stay tuned.