- JPMorgan warned Strategy could face up to $8.8B in index-related outflows, sparking community backlash.

- Grant Cardone, Max Keiser, and others accuse the bank of targeting MSTR and fueling panic.

- Some traders say a GameStop-style retail squeeze could emerge if sentiment escalates.

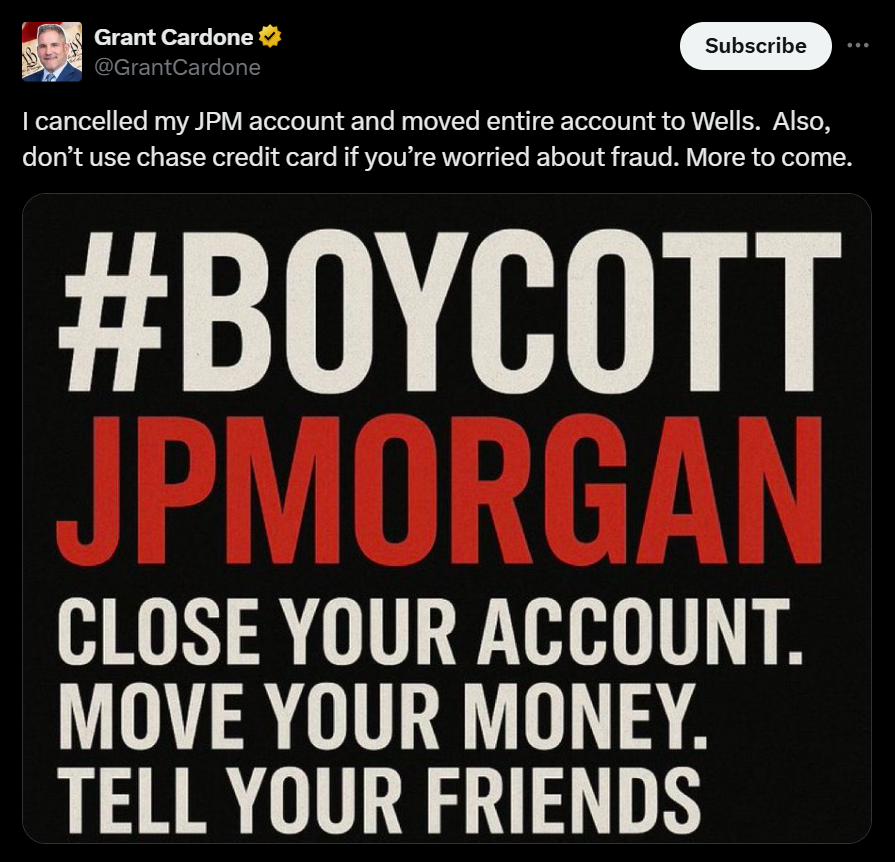

Prominent real estate investor Grant Cardone has joined a growing chorus of crypto community members calling for a boycott of JPMorgan. The backlash erupted after the banking giant warned that Strategy could face up to $2.8 billion in forced outflows if removed from MSCI indices. JPMorgan analysts also said total withdrawals could reach as high as $8.8 billion if other index providers take similar action, a scenario that rattled Strategy shareholders and crypto advocates.

Strategy Stock Falls Sharply After MSCI Outflow Estimates

Following JPMorgan’s report, Strategy stock dropped below $200 on Wednesday and continued sliding into the week’s close, hitting a new yearly low near $170. This marks a dramatic reversal from mid-July when MSTR traded above $450. Once one of the S&P 500’s standout performers, MSTR is now down 41 percent year-to-date and roughly 57 percent over the last twelve months, amplifying fears that forced index selling could deepen the decline.

Crypto Advocates Accuse JPMorgan of Targeting Strategy

Bitcoin supporters argue that JPMorgan’s note was not simply analysis but an intentional hit on Strategy shareholders. Cardone, Max Keiser, and pro-XRP attorney John Deaton all claim the bank is deliberately provoking panic. Some in the community even allege JPMorgan is shorting MSTR, though no public evidence has surfaced. The criticism intensified as JPMorgan faced renewed scrutiny over its historic ties to Jeffrey Epstein, fueling distrust among crypto-aligned retail traders.

Rumblings of a GameStop-Style Retail Uprising

As tensions rise, some believe the situation could morph into another GameStop-style revolt. Deaton said that if retail traders become convinced JPMorgan is betting against MSTR, they may rally around the stock in an effort to squeeze out short sellers. The dynamic mirrors the early days of the GME frenzy, with traders framing the narrative as a battle between Wall Street institutions and a grassroots community determined to defend a high-conviction asset.

A Growing Divide Between Banks and Crypto Holders

The conflict highlights a widening cultural and financial rift between the crypto community and traditional banking giants. Supporters see JPMorgan’s warnings as an attack on Bitcoin-aligned companies, while critics insist the market risks outlined by the bank are legitimate. With Strategy’s stock now under severe pressure and Bitcoin itself trading far below its peak, the possibility of a retail-driven counterattack remains firmly on the table.