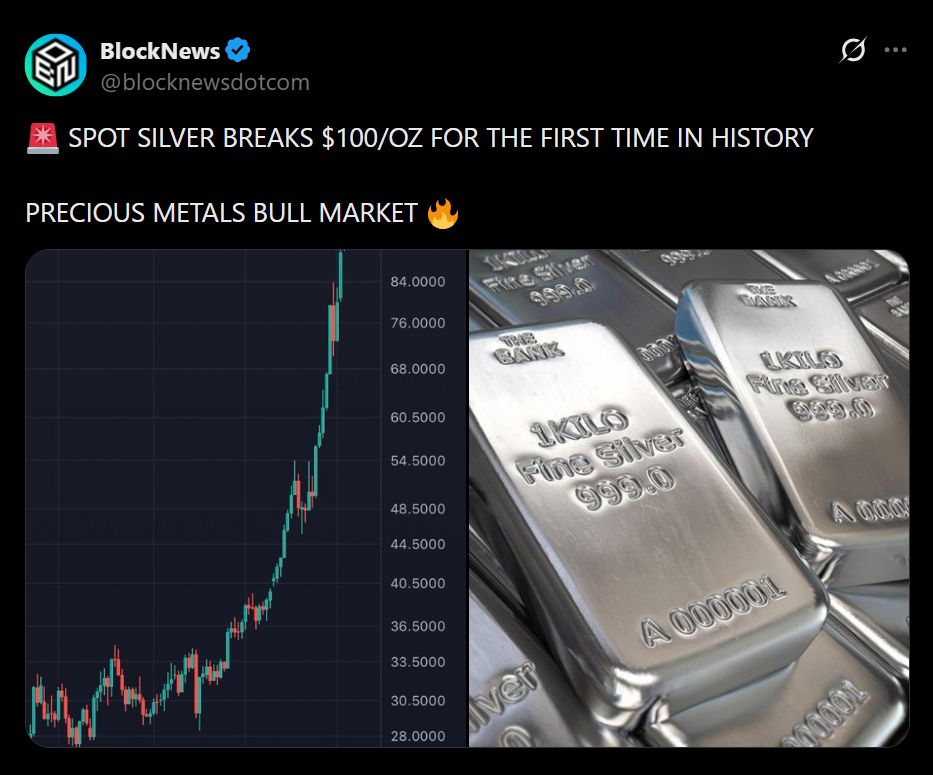

- Silver hit $100 per ounce for the first time, extending a historic rally

- Gold is approaching $5,000 as investors seek safety

- The metals surge signals a defensive market environment crypto is feeling

Precious metals are rewriting the record books, and markets are paying attention. Silver surged past the $100-per-ounce mark for the first time, while gold pushed closer to $5,000, extending one of the strongest rallies the sector has ever seen. The move isn’t happening in isolation. It reflects a broader shift in how investors are positioning amid geopolitical tension, policy uncertainty, and growing discomfort with risk assets.

Why Silver’s Move Is Turning Heads

Silver’s breakout is especially striking. The metal jumped more than 4% in a single session, adding to gains that now total roughly 40% in 2026 and more than 230% over the past year. That surge has pushed silver’s market capitalization into multi-trillion-dollar territory, putting it firmly back on the radar as both an industrial metal and a store of value.

Unlike gold, silver sits at the intersection of financial fear and real-world demand. When both forces align, price moves can accelerate quickly, and that’s exactly what markets are witnessing now.

Gold Continues to Price Uncertainty

Gold’s march toward $5,000 has been steadier but just as telling. Prices are up sharply this year and have nearly doubled over the past twelve months. Investors are leaning into traditional safe havens as trade tensions, unresolved global conflicts, and questions around monetary policy continue to stack up.

Concerns over central bank independence have also played a role. When confidence in policy neutrality wobbles, gold tends to benefit, and recent political signals have only reinforced that dynamic.

What This Means for Crypto Markets

Crypto traders are watching metals closely for a reason. When gold and silver outperform this decisively, it usually signals a defensive market regime. Capital is prioritizing preservation over growth. In those environments, liquidity tightens and speculative assets often struggle to gain traction.

This doesn’t invalidate the long-term crypto thesis, but it does explain why rallies can stall while safe havens run. Gold absorbs fear. Crypto reacts to liquidity. Right now, fear is clearly being priced first.

The Broader Commodities Picture

The strength isn’t limited to gold and silver. Palladium has rebounded toward key levels after years of weakness, platinum is up solidly this year, and even lithium has staged a sharp recovery. Together, these moves point to a market increasingly hedged against instability rather than chasing upside narratives.

Conclusion

Silver breaking $100 and gold nearing $5,000 aren’t just milestones, they’re signals. They show where capital is seeking safety as uncertainty dominates the macro backdrop. For crypto investors, watching metals isn’t optional right now. It’s context. And that context explains a lot about the current market mood.