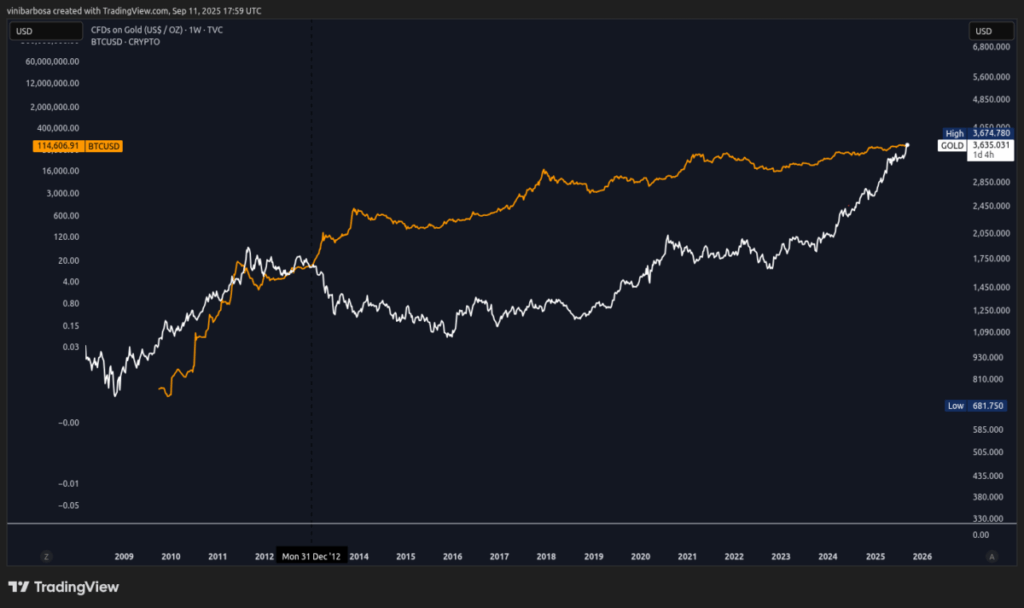

- Gold just smashed an inflation-adjusted record above $3,635 per ounce, driven by rising inflation, weak USD, and central bank reserve buys.

- Bitcoin is holding near $114,600, historically moving in sync with gold, and could be setting up for its own breakout.

- With the Fed eyeing rate cuts and Tether minting $2B USDT, liquidity may fuel BTC’s next big rally.

Gold just pulled off something it hasn’t done since the 1980s—hit an inflation-adjusted record above $3,635 an ounce. The timing is uncanny too, with inflation still biting and whispers of Federal Reserve rate cuts on the horizon. Meanwhile, Bitcoin is cruising around $114,600, and many are wondering if the so-called “digital gold” might be ready to follow the same trajectory.

Gold’s Dream Setup

So how did we get here? Inflation-adjusted pricing is basically a way to measure gold’s real value against today’s dollar. And right now, it’s at levels not seen in over four decades. The latest CPI numbers came in hotter than expected—2.9% in August compared to 2.7% in July. That uptick, mixed with stubbornly high core inflation, has turned gold into every central bank’s favorite hedge.

Emerging market giants like China, India, Russia, and Turkey are scooping up gold reserves, all trying to cut down reliance on the US dollar. Add in a weaker dollar index and ongoing geopolitical messes—trade wars, Middle East flare-ups, even election-year drama—and you’ve got the perfect storm for gold’s run.

Bitcoin’s Shadow Play

Now, here’s where Bitcoin slides into the picture. Historically, BTC and gold move in sync during these cycles, both pitched as hedges against inflation and uncertainty. The kicker is, Bitcoin doesn’t just shadow gold—it tends to overshoot once it gets momentum. Right now, BTC sits at $114,600, consolidating while gold rips higher, but some analysts think the lag is temporary.

Tether just minted $2 billion in USDT, a move not seen since late 2024, and that kind of liquidity injection often precedes a crypto surge. Market watchers say Bitcoin looks like it’s gearing up for its own breakout moment, especially if rate cuts arrive and risk assets catch another bid.

For now, gold is clearly wearing the crown, but Bitcoin’s still waiting in the wings. And if history’s any guide, the handoff might not be far away.