- GameStop may use a $1.75B note offering to expand its bitcoin holdings, despite a 17% revenue drop.

- Treasury Secretary Bessent projects the U.S. stablecoin market could surpass $2T by 2028 with the GENIUS Act.

- Ethereum ETFs outpaced Bitcoin for daily inflows, while USDC launched natively on XRP Ledger.

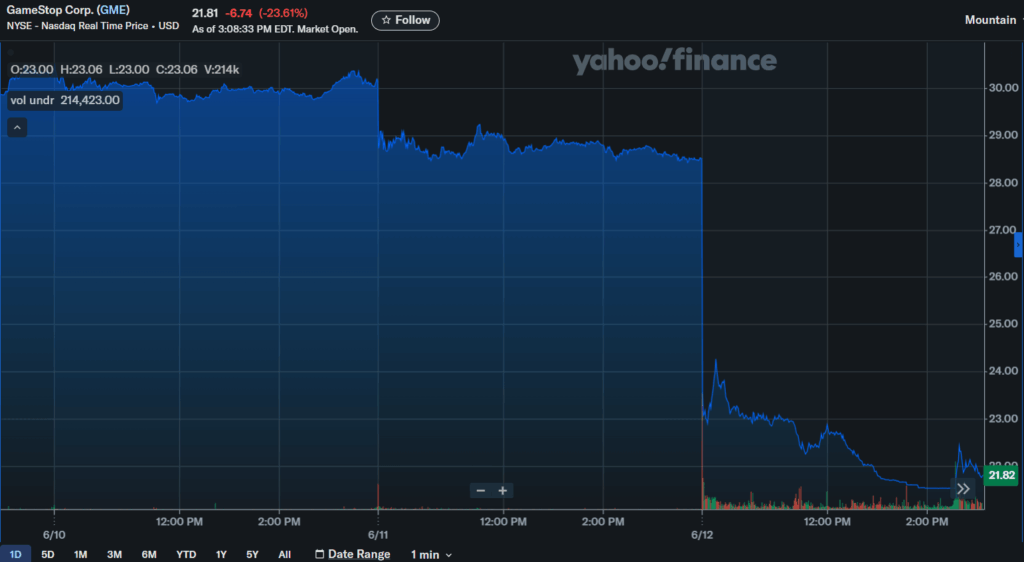

GameStop has filed to issue $1.75 billion in zero-coupon convertible notes, with an option to add $250 million more. The funds may support its bitcoin treasury strategy announced earlier this year. In March, GameStop declared BTC as a treasury reserve asset and later purchased 4,710 BTC using proceeds from a $1.5 billion note sale. However, Q1 revenue fell 17% year-over-year, and GME stock tumbled nearly 25% following the announcement.

U.S. Stablecoin Market Could Top $2 Trillion by 2028, Says Bessent

Treasury Secretary Scott Bessent told Congress that the U.S. dollar stablecoin market could surpass $2 trillion by 2028 — contingent on passing supportive legislation like the GENIUS Act. The Senate advanced the bill Wednesday, requiring full dollar backing and audits for major issuers. Bessent emphasized stablecoins’ potential to solidify the U.S. dollar’s reserve status, with President Trump pushing to sign the act into law before August.

Ethereum ETFs Overtake Bitcoin for a Day

On Wednesday, U.S. spot Ethereum ETFs posted $240.3 million in inflows, beating Bitcoin ETFs’ $164.6 million. This marked 18 straight days of net ETH ETF inflows totaling $1.3 billion. BlackRock’s ETHA led with $163.6 million, followed by Fidelity’s FETH. While daily flows favored Ethereum, Bitcoin ETFs still dominate in total with $45.5 billion in inflows since launch versus Ethereum’s $3.8 billion.

Plasma Sidechain Doubles Deposit Cap to $1B

Plasma, an EVM-compatible Bitcoin sidechain, doubled its stablecoin deposit cap to $1 billion after overwhelming demand for its XPL token sale. The original $500 million cap was filled in under an hour earlier this week. Deposits in USDT, USDC, USDS, and Dai grant users access to the XPL public sale, which remains capped at $50 million. Plasma reiterated that deposits are not part of the token sale and remain user-owned.

USDC Launches on XRP Ledger

USDC is now natively available on the XRP Ledger, expanding access to the stablecoin without needing bridges. The integration, just a week after Circle’s IPO, enables real-time payments and DeFi applications on XRPL. Circle Mint and APIs now fully support this rollout. The XRPL network, supported by Ripple, has processed over 3.3 billion transactions since 2012.