- GameStop raised $1.5 billion through convertible notes, with $1.48B in net proceeds.

- The board has approved a new policy allowing Bitcoin to be added to GameStop’s balance sheet.

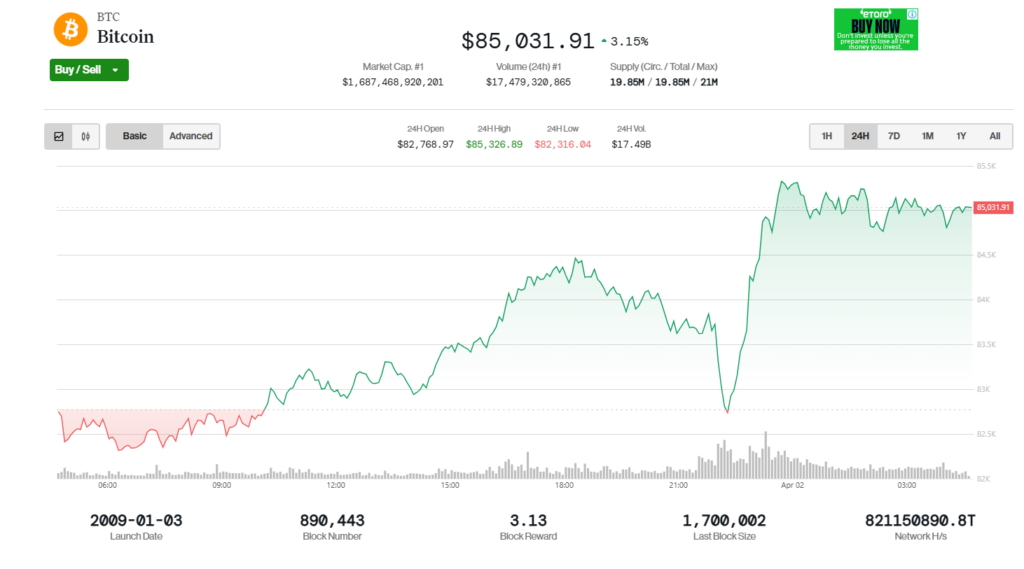

- GME shares rose slightly as Bitcoin hovered near $85K, hinting at a potential crypto move.

Could GameStop be loading up on Bitcoin right now? Honestly… it’s looking pretty likely. Or, at the very least, the wheels are in motion.

The company just closed a $1.5 billion convertible note sale, and that cash might already be heading toward crypto—if it hasn’t started flowing already.

Big Raise, Big Moves

Last week, GameStop wrapped up a $1.3 billion offering of five-year convertible notes. Then the greenshoe option (extra $200 million) got fully exercised, pushing the total deal size up to $1.5 billion. After fees and all the usual cuts, the company ended up with $1.48 billion in net proceeds, per Monday’s filing.

And that’s where things get interesting.

Right alongside its Q4 earnings report, GameStop—under the leadership of CEO Ryan Cohen—revealed that the board has signed off on an updated investment policy. That new policy? It allows for adding Bitcoin (BTC) to the company’s balance sheet.

So yeah, this isn’t just a casual idea anymore. It’s board-approved, and they’ve got the cash.

Markets React (Sort Of)

GME shares didn’t go wild on the news, but they did tick up—1.35% during regular trading Monday, with another 0.8% gain after hours.

As for Bitcoin, it’s hovering just under $85,000, modestly up in the last 24 hours. No fireworks yet… but if GameStop starts buying big, that could change real quick.