- GameStop is adding Bitcoin to its treasury, marking a major step into digital assets.

- The company’s stock is up 69% over the past year, with strong financials backing its crypto move.

- GameStop also plans to sell its France and Canada operations and has partnered with Zip Co. for installment payments.

GameStop is doing… something a little unexpected. The old-school video game retailer, which has already seen its fair share of wild headlines in recent years, just announced it’s adding Bitcoin to its treasury reserves. Yep, GameStop is buying BTC.

The move was unanimously approved by the company’s board, and it marks a pretty major pivot from its traditional retail roots into the world of digital assets. No one knows exactly how much Bitcoin they’re buying (they’re keeping that part vague for now), but the company says it’s happening immediately.

And just to be clear—this isn’t a desperate gamble. GameStop’s financials are in solid shape right now. They’ve got more cash than debt, a strong balance sheet, and a current ratio of 5.11, which is… very healthy.

Another Company Betting on Bitcoin

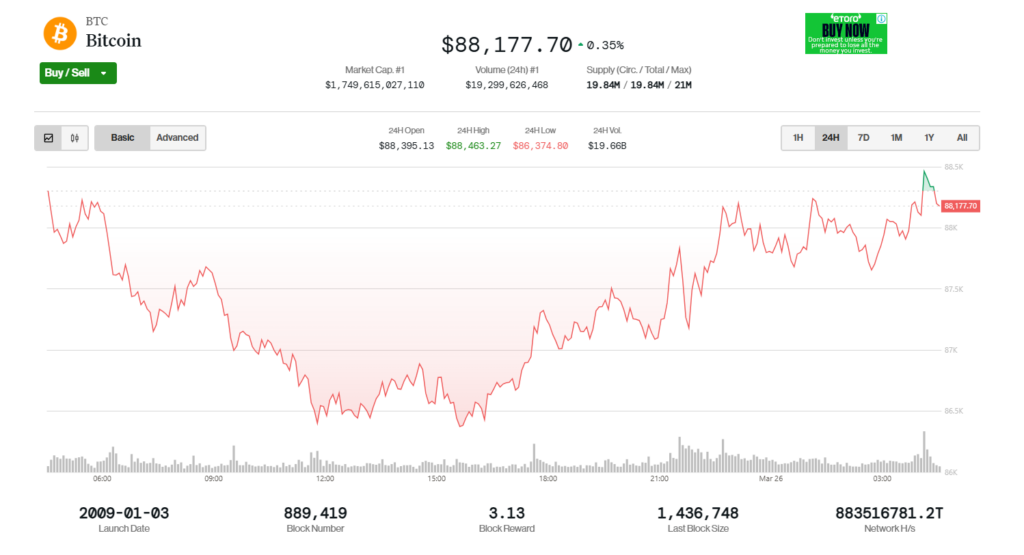

GameStop joins the growing list of companies looking at crypto as a hedge against inflation, a store of value, or maybe just a better long-term bet than holding piles of cash. This kind of move isn’t unheard of anymore—think Tesla, MicroStrategy, even Square.

But it is notable coming from a retail brand like GameStop. The company’s been trying to reinvent itself for a while now, and this seems to fit right in with that broader shake-up. Whether it’s trading cards, NFTs, or now Bitcoin—GameStop clearly wants to be seen as more than just a mall-era relic.

According to the company, the crypto purchase will use existing infrastructure, which likely means they’re not building anything new for now. No word yet on whether Bitcoin will be part of customer transactions or loyalty programs or whatever—but hey, never say never.

What’s the Market Saying?

Investors… seem interested. GameStop’s stock is already up nearly 10% this past week, and over 69% in the last year. The stock also carries a negative beta (-0.26), which basically means it tends to move opposite the overall market—something traders actually like during uncertain times.

Still, not everyone’s buying the hype.

Wedbush Securities isn’t convinced. They’ve stuck to their Underperform rating with a price target of $10, citing concerns about GameStop’s strategy and lack of clear advantages in newer ventures like crypto or collectibles. Meanwhile, Strive Asset Management has publicly pushed GameStop to go all-in and adopt the Bitcoin Standard—meaning, put a big chunk of its cash reserves into BTC for the long haul.

Other Stuff Going On at GameStop

This crypto news comes just ahead of GameStop’s Q4 earnings, scheduled for March 25, 2025. Analysts and investors will be watching closely to see how they did over the holiday shopping season—a make-or-break time for retail.

In the background, the company is also cleaning house internationally. It’s planning to sell off operations in France and Canada to streamline things and focus more on its core markets. Oh—and they’ve also teamed up with Zip Co. to offer buy-now-pay-later options in stores and online.

It’s a lot, honestly.

So… Is GameStop Really Back?

Time will tell. But one thing’s clear—they’re not sitting still. Bitcoin, strategic exits, partnerships—it feels like GameStop is betting hard on reinvention. Whether that turns into real growth or just more headlines, we’ll probably find out soon enough.