- FTX’s bankruptcy estate is pursuing $100 million from SkyBridge Capital and founder Anthony Scaramucci.

- FTX alleges funds used for sponsorships and investments lacked economic justification and breached contractual terms.

- This lawsuit is one of several FTX has filed recently to recover assets for creditors.

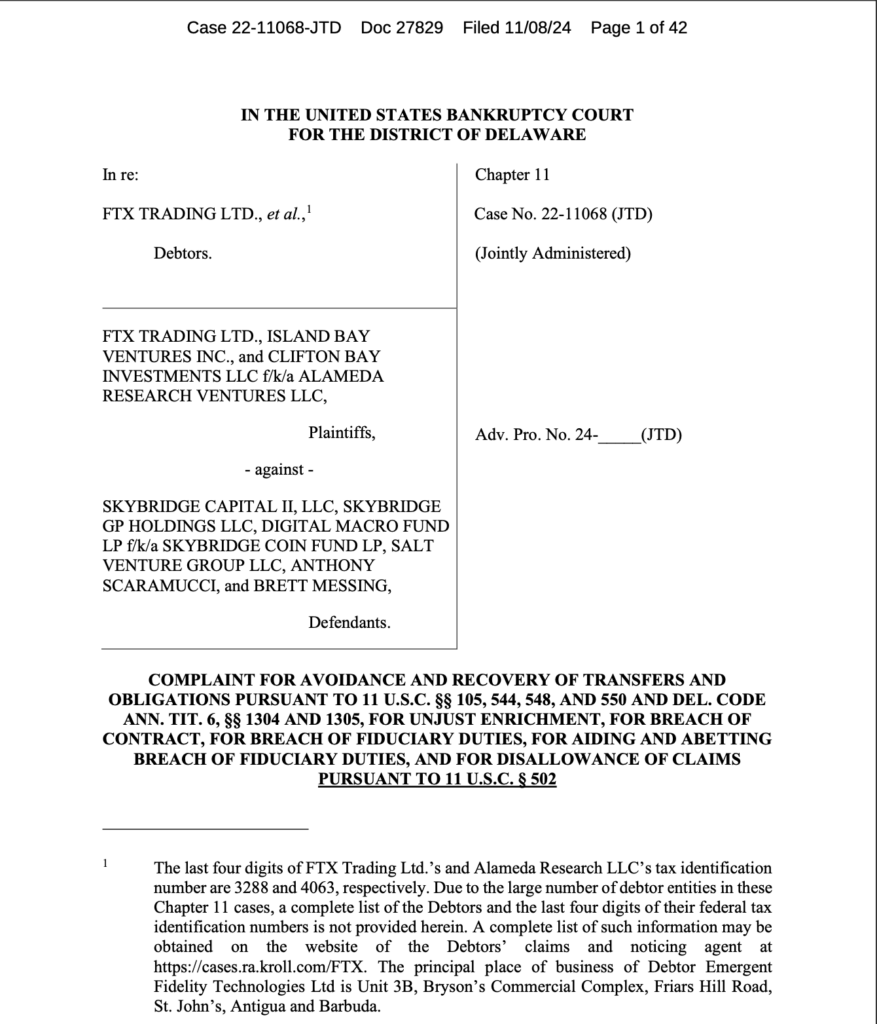

The FTX bankruptcy estate has filed a lawsuit against SkyBridge Capital and its founder, Anthony Scaramucci, aiming to recover over $100 million in funds linked to investments made by former FTX CEO Sam Bankman-Fried. These funds, reportedly used for sponsorships and investment deals, were deployed shortly before FTX’s collapse in late 2022, resulting in approximately $8 billion in customer losses.

Legal filings from Nov. 8 reveal that Bankman-Fried initially sponsored Scaramucci’s SALT conference with a $12 million investment in January 2022. Subsequently, Alameda Research invested $10 million in SkyBridge’s Coin Fund in March of the same year. Later, in September 2022, FTX acquired a 30% stake in SkyBridge’s management companies for $45 million, which FTX attorneys argue was an economically unjustified move. They noted that the funds could have been used more effectively within FTX’s own trading operations rather than with an external firm.

Contractual Breach Allegations

FTX attorneys allege that SkyBridge breached the terms of its agreement with FTX by selling a portion of the purchased assets, including Bitcoin and Solana, in 2023 without prior approval. At current market rates, these holdings are valued at around $120 million, while they were reportedly worth $60 million when SkyBridge conducted the sales.

Broader Legal Efforts by FTX

This case is part of a wider effort by FTX’s bankruptcy estate to reclaim assets. Recently, FTX also filed lawsuits against KuCoin and Crypto.com, seeking to recover $50 million and $11 million, respectively, as it continues to pursue recovery for creditors affected by the exchange’s collapse.