- FTX CEO refuses increasing demand to remove law firm as general counsel for the company’s bankruptcy case.

- John Ray hopes to revive FTX.com, the company’s exchange platform.

- A lawyer at Sullivan & Cromwell is revealed to be the chairman of the Board of Directors at Apollo Global.

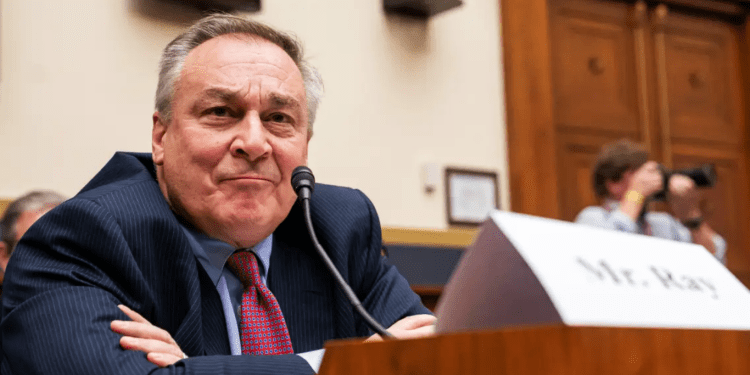

The new CEO of FTX, John Ray, has been struggling to retain his lawyers as lead counsel during the bankruptcy case as calls for the removal of the lawyers increase.

John J. Ray III, who became the next CEO of the crashed and scandalous cryptocurrency exchange FTX, filed a court motion on January 17, declaring his stance on the removal of his law firm—Sullivan & Cromwell—stating that their contribution in gaining control over the “dumpster fire” given to him was essential hence he would be retaining them.

In the court motion, Ray explained that retaining the law firm was in favor of FTX, and they were being chased by legal authorities primarily because of the information they possessed.

“The advisors working at my direction tirelessly and nonstop for the last seventy days to take control over what can only be described as a ‘dumpster fire’ to stop assets from being depleted and to take action to realize value related to ten Debtors’ assets. The advisors are not the villains in these cases,” the court document reads.

U.S. Trustee files an objection

On January 14, the U.S. Trustee, Andrew R. Vara, filed an objection to the retention of the Sullivan & Cromwell law firm, stating two reasons for this action.

He mentioned that S&C’s disclosure needs to be revised to understand whether the law firm is fit or sufficient to fulfill the Bankruptcy Code. He also added that due to the publicly available information, an ex-partner of Sullivan & Cromwell became the general counsel to FTX 14 months before the company’s collapse.

Secondly, he argued that the retention of the law firm could not be accepted because the Bankruptcy Code prevents debtors (John Ray and FTX) in possession from investigating themselves, which was precisely what the Debtors drafted in the law firm’s application. Also, S&C’s close relationship with an insider of the Debtors renders the law firm too conflicted to investigate the Debtors’ fall.

Twitter user calls out Apollo Global for quietly purchasing FTX creditor claims.

In another vein, James A. Murphy, a lawyer who goes by MetaLawMan on the popular social media app, Twitter, posted on his page that the law firm’s past relationship with FTX was none of its many conflicts of interest in the case.

“Much has been written about Sullivan & Cromwell’s conflict due to its prior legal work for FTX and Alameda, but no one, to my knowledge, has mentioned S&C’s other conflict,” he said on Twitter.

James further accused Apollo Global, a private equity company, of purchasing creditor claims from FTX clients for “pennies on the dollar.” According to James, Jay Clayton, the Chairman of the Board of Directors of Apollo Global, is also a lawyer at Sullivan & Cromwell. This law firm is privy to confidential information.

FTX CEO hopes to revive its exchange

According to a report by The Wall Street Journal on January 19, FTX CEO, John Ray, expressed his decision to revive and reboot FTX’s exchange. He stated that all was on the surface with FTX.com. He claimed to have commissioned a task force to explore reviving FTX.com.

In his first interview, since he took the mantle of FTX’s CEO, John Ray positively mentioned that he was looking forward to restarting the exchange as he was working towards returning funds to the company’s clients and creditors. FTX reported discovering $5.5 billion of liquid assets in its ongoing investigation, although more than half of it was owed to the company’s top 50 creditors.

However, the crypto community is still determining the revival of FTX.com due to its fraudulent activities and how it was poorly managed by its founder and previous CEO, Sam Bankman-Fried.

SBF took to Twitter to celebrate the news of FTX’s possible revival. He commended John Ray’s effort at the company, but his tweet only generated backlash and retorts from the crypto community.

“I’m glad Mr. Ray is finally paying lip service to turn the exchange back on after months of squashing such efforts!” SBF tweeted.

Conclusion

John Ray, the CEO of FTX, filed a motion to retain his law firm, citing their relevance in the bankruptcy case amidst requests to remove them. A U.S. Trustee has, however, filed a countermotion, objecting to his proposal, stating that Sullivan & Cromwell’s prior relationship with the company is suspicious and should not be given a stay at FTX.