- Franklin Templeton is expanding its OnChain U.S. Government Money Fund (FOBXX) to Solana, after previously integrating with Base, Aptos, Avalanche, and Stellar.

- FOBXX holds U.S. government securities and repurchase agreements, functioning similarly to a stablecoin with a $1 share price.

- Tokenized Treasuries are booming, with $3.6 billion in circulation, and Franklin Templeton now managing $594 million as it embraces Solana’s fast blockchain.

Franklin Templeton—the asset management giant that’s been making some pretty bold strides into the crypto space—is taking its Franklin OnChain U.S. Government Money Fund (FOBXX) to Solana. Yeah, that Solana. The one that had a massive breakout in 2024, thanks in part to memecoins running wild.

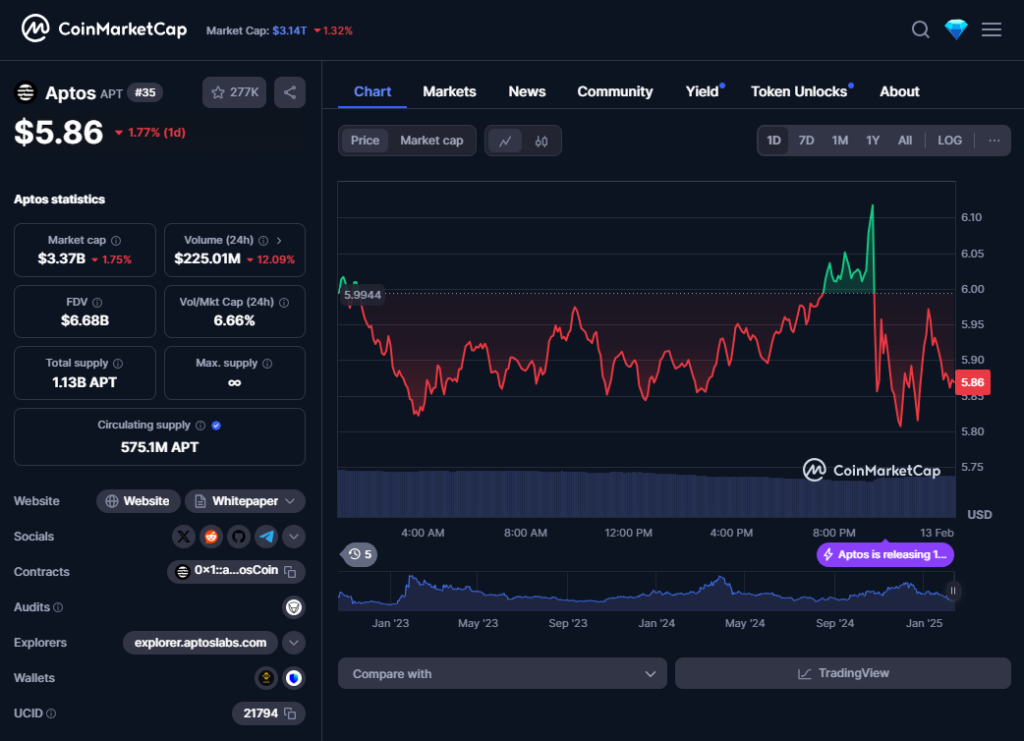

Now, if you’re unfamiliar, FOBXX operates kinda like a stablecoin—it aims to keep its price locked at $1 per share. It’s already playing the field on Coinbase’s Base, Aptos, and Avalanche, and way back, about four years ago, its first taste of blockchain action was with Stellar. So, this isn’t exactly its first rodeoSo, what’s in this fund, anyway?

FOBXX is stacked with U.S. government securities—fixed-rate, floating-rate, and variable-rate bonds—plus repurchase agreements that are fully backed by either U.S. Treasuries or straight-up cash. Basically, it’s got a solid backbone.Tokenization: The Next Big Wave?

Tokenization is on fire right now. A growing list of asset management heavyweights—BlackRock, Fidelity, and WisdomTree, to name a few—are diving in, touting onchain investment products as smoother, more efficient, and easier to trade.

According to RWA.xyz, there’s about $3.6 billion worth of tokenized Treasuries floating around, with a staggering chunk—$2.5 billion, at least when you don’t count Layer 2s—living on Ethereum.

But here’s the kicker: Franklin Templeton isn’t just dabbling. It’s managing $594 million in tokenized Treasuries alone. And now? It’s stepping onto Solana’s fast, scalable blockchain, making a play in a space that’s only heating up.

The shift to Solana might raise some eyebrows, especially given its rocky history, but in 2024, it proved itself. If Franklin Templeton is betting on it, maybe it’s time to start paying closer attention.